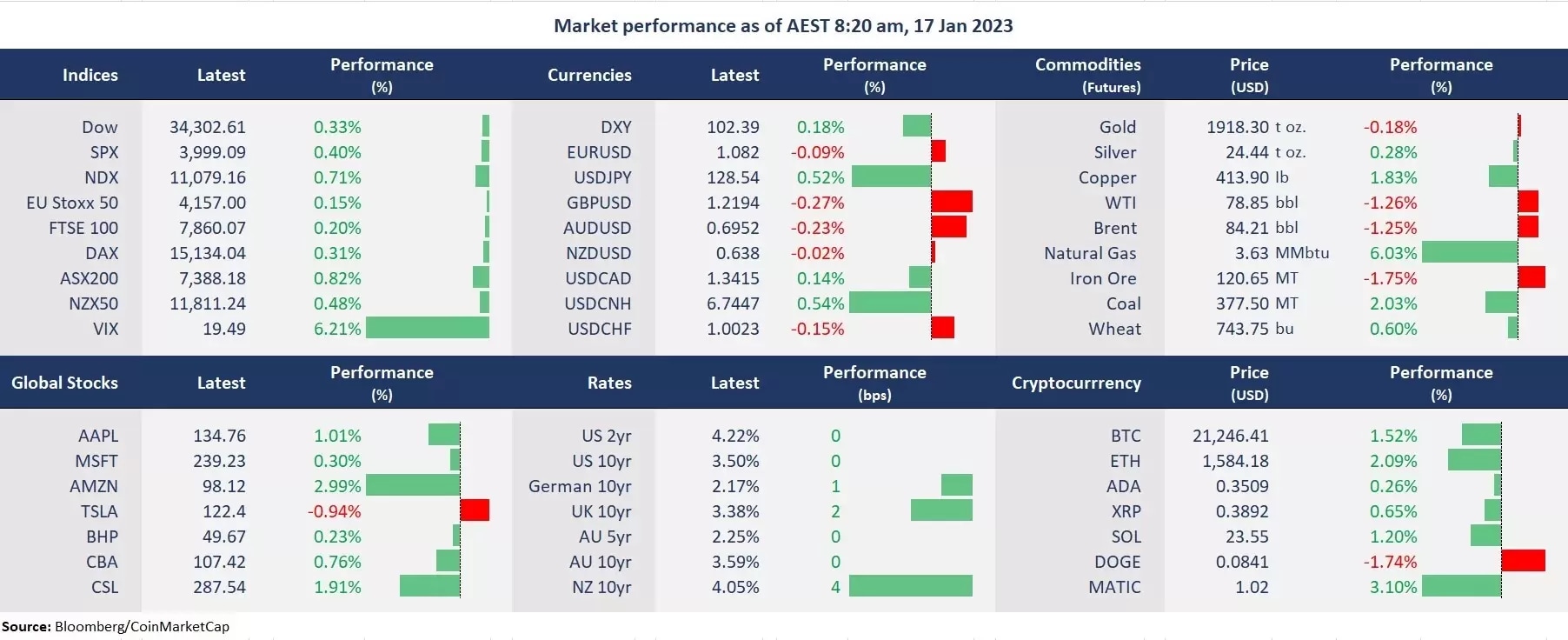

It was a quiet session for the global markets due to the absence of US exchanges on a public holiday. The European markets were mostly higher following the one-week rally on Wall Street. However, the US equity futures retreated from their one-month highs, while the US dollar rebounded against most of the other major currencies, with both the Japanese Yen and the Chinese Yuan lower ahead of the BOJ meeting tomorrow when the central bank is expected to give up its YCC control after a major twist in its monetary policy last month.

In Asia, the Nikkei 225 underperformed global markets since December amid a potential BOJ’s abandonment of its ultra-loss policy. Futures point to a lower open in most APAC exchanges. The ASX futures were down 0.29%, Nikkei 225 futures rose 0.35% and Hang Seng Index futures fell 0.27%.

A slew of influential Chinese economic data may steer the market movements in today’s Asian session. China’s final quarter GDP is due for release at 1 pm Australian AEST, along with the December retail sales, industrial output, and fixed assets investment.

- Both oil and metal retreated due to a rebound in the US dollar. Profit-taking may have also caused the price drop in broad commodities. However, both crude and gold prices still face upside pressure at the back of a downturn in the USD and bets on a slowing pace of the Fed’s rate hikes.

- Major iron ore producers’ shares dropped on the news that China would tighten the price supervision on the base metal, with Fortescue Metals down 2.7%. Though the ASX finished higher on Monday, buoyed by the broad optimism and the strong price action in commodities. The price pullbacks in metals may point to a down for the Australian markets.

- Base metals continued to soar amid China’s reopening, with copper futures up 2. 6% and Iron ore up 1.25%. A softened US dollar has also helped the surge in commodities lately, buoying Australian miners, such as BHP, Rio Tinto, Pilbara minerals and Core Lithium were all up between 1-2% on Wednesday.

- Cryptocurrencies continued to rise amid the broad rally in the global markets in January. Both Bitcoin and Ethereum were up about 2% to above 21,300 and 1,580, respectively, both of which consolidated at their 3-month highs.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.