There are many ways to determine if a market is overbought or oversold, writes independent financial analyst Helene Meisler.

Some traders use oscillators, while others devise their own models. There are those who use time, those who use price and some who use both.

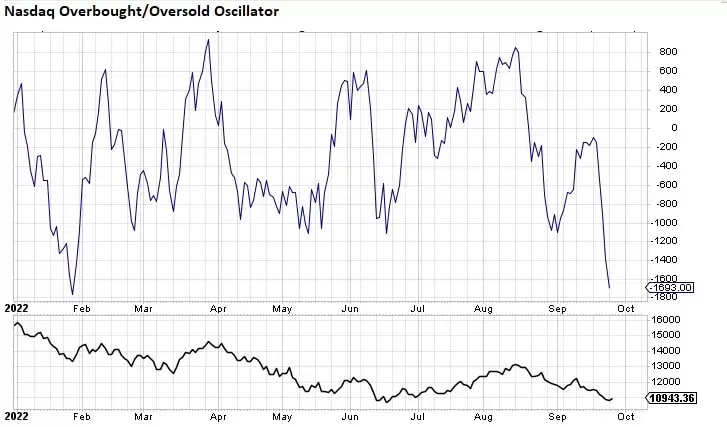

I generate my own overbought-oversold oscillator. It is based on the breadth of the market, by which I mean the advance-decline line. I use a 10-day moving average of net breadth. The theory is that a long string of negative breadth readings indicates that a market is oversold, and vice versa for overbought readings.

The below chart of the Nasdaq Composite’s overbought-oversold oscillator indicates how oversold the market is. The index is back to where it was in late January of this year. While the rally might not look large, it amounted to a sizeable 10% gain.

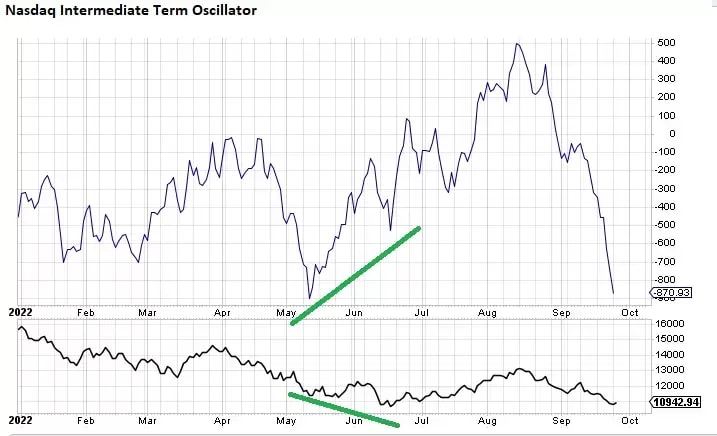

Even the 30-day moving average of net breadth for the Nasdaq indicates that the market is oversold – it is within the same range that it was in when it was oversold in May. While this once again might not look large on the chart, this rally had also seen a 10% rise. Moreover, when the Nasdaq hit a lower low in June, this oscillator made a higher low. That is to say, a positive divergence.

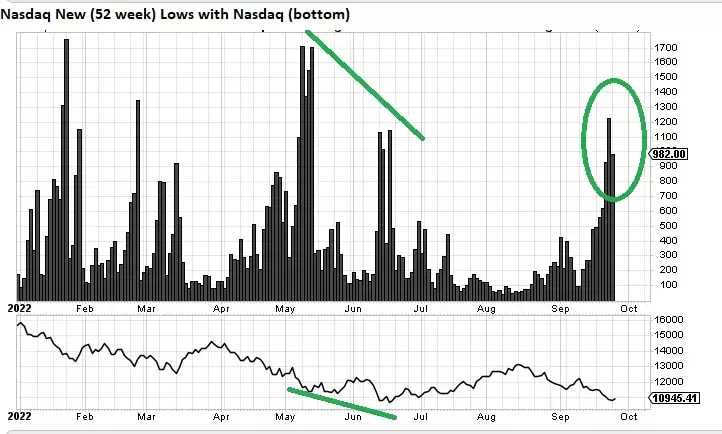

A positive divergence in the market, like what occurred in June, can in itself be a helpful indicator. In June, there were fewer stocks making new lows when the Nasdaq hit a lower low.

On Friday 23 September we saw more new lows than in June, but fewer than in May. Following this, the Monday 26 September decline showed almost 250 fewer new lows (as indicated by the green circle in the chart below) than we saw on Friday.

Why sentiment is an important indicator

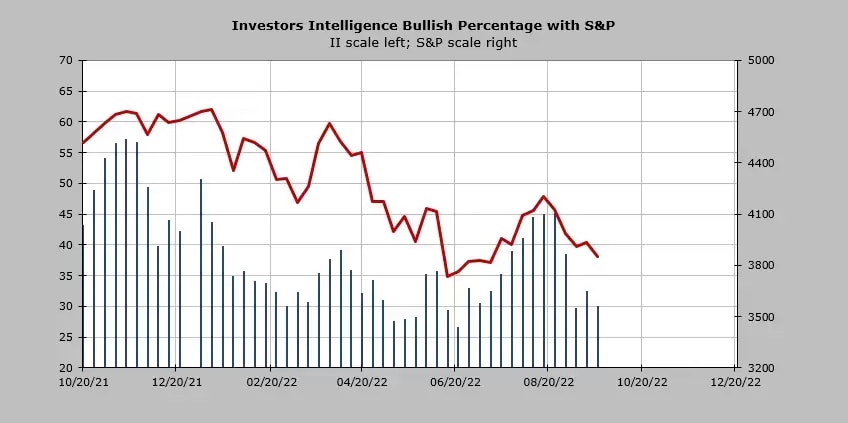

Sentiment is also a very useful indicator. Recent surveys show that sentiment is extremely tilted towards the bearish side. My favourite gauge of sentiment is the uncommonly used Investors’ Intelligence survey [US Advisors’ sentiment report].

I like it because it has been around since the 1960s and its methodology is scientific in its approach. It aggregates approximately 100 newsletters and tallies their authors’ views on the market. Importantly, there are newsletter writers who sell subscriptions, where readers pay for their insights.

It is not a matter of pointing to bulls or bears, or clicking up or down. Notice that the direction of the bulls rises as the price rises, and falls as the price falls. In mid-August, as indexes were peaking, this survey showed that 45% of respondents were bulls. At the spring lows, the survey revealed that bullish sentiment had dropped to 26%. The current reading is just under 30% again. I have never seen a reading below the 22% mark which occurred at the depths of the 2008 market.

Finally, I like to use the Daily Sentiment Index (DSI). This is another subscription-based service that is not widely used. On a scale of 0-100, readings under 10 or over 90 are considered extreme. It takes an awful lot of price action to get to that point. At the time of writing, the DSI is at five for both the S&P and the Nasdaq Composite.

I think we can all agree that we are currently in a bear market. As demonstrated above, there are trading opportunities on the long side, even in bear markets. I expect to see an oversold rally in early October, if not before.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.