Wall Street rebounded sharply after the Bank of England said it would begin temporarily buying long-dated bonds, despite Fed officials’ reiteration of their hawkish stances. The measure of the BOE offered a broad-based relief rally in equity markets as rates retreated from their decades-highs, hammering the US dollar down, and boosting risk assets, with the US small Cap index, Russel 2000, jumping 3.4%. The US 10-year bond yield fell to 3.7% after it hit 4%, which is the biggest one-day drop since 2009, while the UK 10-year gilt sharply pulled back to 4% from 4.5% a day ago. It is worth knowing that the short-dated US bond yields fell more than their long-dated peers, steepening the yield curve, which also added the rebounding optimism, especially in growth stocks.

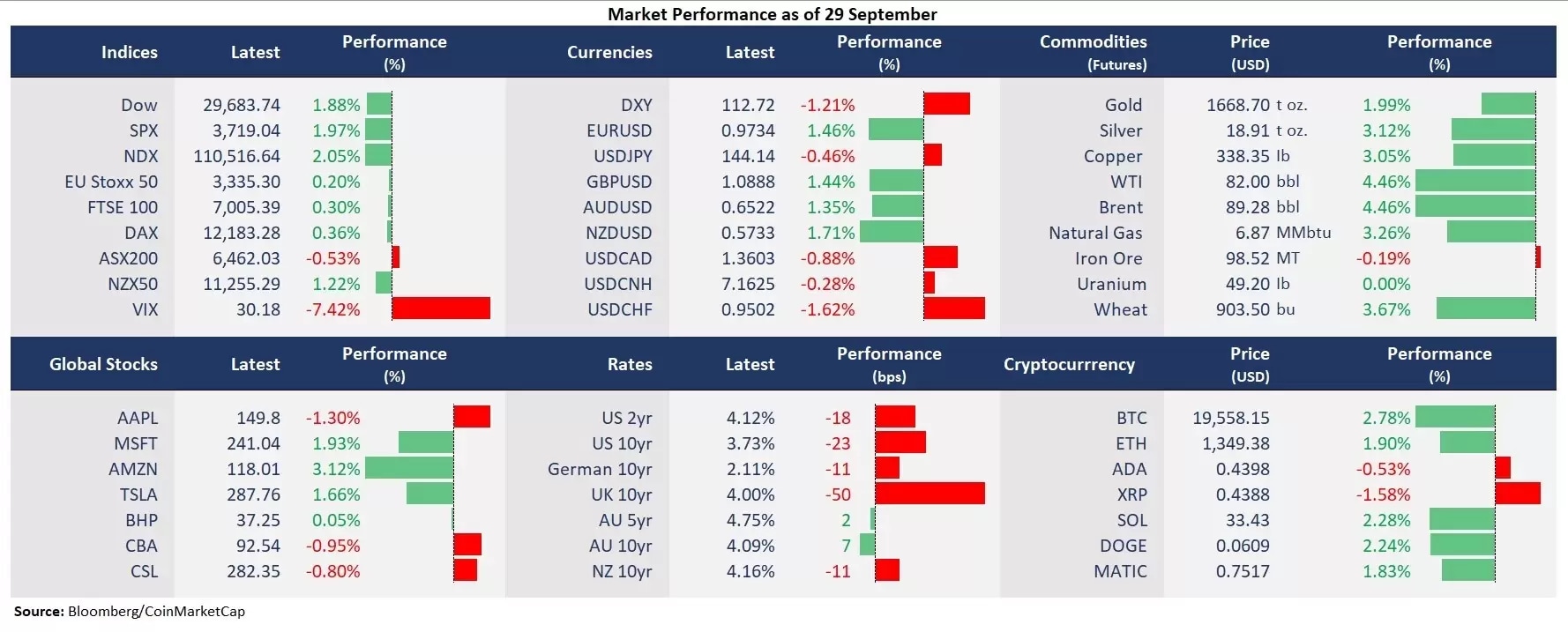

- Dow was up 1.88%, S&P 500 advanced 1.96%, and Nasdaq jumped 2.05%. All 11 sectors in the S&P 500 finished higher, with the energy (+4.4%) and communication services (+3.2%) leading gains. All the major oil producers’ shares, including Occidental, Devon Energy, and Exxon Mobil, were all up between 3-7%. Social media stocks, such as Meta Platforms and Pinterest, both rose more than 5%.

- Apple, however, fell 1% after the iPhone maker ditched its production increase plan as the anticipated demand surge failed to materialize. The company is reportedly to drop the plan to increase the production of iPhone 14 series units by 6 million for the second half of the year.

- Netflix shares surged 9% after the liver streamer announced to open a gaming studio in Finland after purchasing three studios in 2021, aiming to seek new growth apart from its ad-supported tier program that was newly developed this year.

- The offshore Chinese Yuan bounced from an all-time low against the US dollar amid a slump in US bond yields. The USD/CNH pulled back from the day-high of 7.2668 to just above 7.16. The British Pound swung widely from a day low of just above 1.05 to close to 1.09 amid the BOE’s bond-buying plan.

- Asian markets are set to take the rebounding tailwind following the broad relief rally. ASX futures were up 1.52%. Nikkei225 futures rose 2.12% and Hang Seng Index futures jumped 2.41%. The New Zealand dollar took the biggest ride of the slide in USD, with NZD/USD up 1.71% overnight.

- WTI futures jumped 4%, back to above 80 on an unexpected draw in the US inventories, along with a softened US dollar and improved risk appetite, while suspected sabotage of the Nord Stream pipeline intensified the geopolitical tension.

- Bitcoin continued to consolidate above 18,000, up 2.8% in the last 24 hours.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.