Wall Street pared early gains and finished lower for the second straight trading day as risk-off sentiment prevails ahead of the key US CPI data and major company earnings reports. According to Factset, the earnings growth for the S&P 500 is projected at 4.3% in the second quarter, the slowest since April 2020. The US June CPI data is expected to top the previous figure at 8.7% year on year, highlighting sticky inflation despite aggressive rate hikes by the Fed. Delta Airlines, JP Morgan Chase, and Morgan Stanley are to report earnings before the US markets open tonight.

Crude oil prices tumbled more than 8% as commodity futures continued to price in a foreseeable economic recession, while the 10-year and 2-year treasury yields stayed inverted. USD, Japanese Yen and bonds climbed further on mounting haven demands, with EUR/USD briefly hitting parity level.

Most Asian equity markets are set to open higher as indicated in the futures pricing despite losses in the overnight US session. However, China’s renewed Covid outbreak and the upcoming US data may continue to pressure sentiment.

AU and NZ day ahead

The RBNZ rate decision will be in focus today, with a high expectation that the bank will keep the pace of a 50-basis point rate hike to rein in inflation, which printed at 6.9% in the first quarter. Both Australian and New Zealand dollars were slightly higher against the USD in the overnight session as the deteriorated US economic outlook restrained the dollar’s strength. AUD/USD and NZD/USD were at 0.6757 and 0.6133 at EAST 7:20 am this morning.

The ASX 200 is set to open flat as the SPI futures were little changed. The local equity markets are expected to be under pressure as the energy stocks tumbled in the US session due to a plunge in oil prices. But the recent outperformance of defensive sectors, including utilities, consumer staples, and healthcare may offset some losses.

The S&P/NZX 50 rose 0.7% in the first half-hour of trading, with Air NZ leading gains, up 2.4%, at NZ$0.63, suggesting airline stocks may continue to benefit from the stumbled fuel prices and positive outlooks on traveling demands.

US

The Dow Jones Industrial Average was down 0.62%, the S&P 500 fell 0.92%, and Nasdaq declined 0.95%.

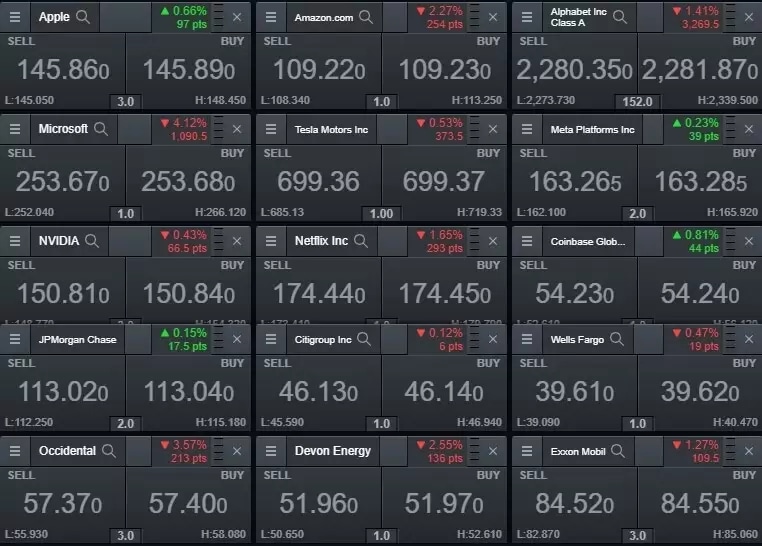

All the 11 sectors in the S&P 500 closed lower, with energy stocks leading losses, down 2% as crude oil tumbles below $100 per barrel. Big tech shares were mixed. Apple and Meta Platforms were up, while the rest of the mega-caps, including Alphabet, Amazon, Microsoft, and Tesla Motors were lower.

Airline stocks jumped on positive earnings expectations, along with a plunge in oil prices. Delta Airlines, United Airlines, and American Airlines were all up between 6-10%.

The major companies’ performance overnight (13 July 2022)

More dramas emerged between Tesla CEO Elon Musk and Twitter on the stalled acquisition deal. The social media giant suits Elon Musk over breaching his obligation to complete the merger. Twitter’s shares rose 4.3% overnight and 1% in after-hours trading.

Europe

The Europe major indices were mostly higher as the regional stocks tried to rebound from lows. The Stoxx 50 (+0.44%), FTSE 100 (+0.18%), DAX (+0.57%), CAC 40 (+0.80%). Read more

Commodities

The weakening demands outlook on recession fears continued to drag on the commodity markets, with oil prices plunging 8% and copper down 4%. The API data shows that US crude inventories jumped 4.8 million for the week ended 1 July, more than expected of a 1.9 million draw. Precious metals also fell further due to a strong dollar, while agriculture products tumbled on demand concerns.

WTI: US$95.84 per barrel (-7.93%), Brent: US$99.24 per barrel (-7.34%), Natural Gas per MMBtu: US$6.16 (-4.09%)

COMEX Gold futures: US$1, 724.80 per ounce (-0.40%), COMEX Silver futures: US$18.96 per ounce (-0.88%), Copper futures: US$328.80 per Ib. (-4.15%)

Wheat: US$814.25 per bushel (-4.93%), Soybean: US$1,343.00 per bushel (-4.41%), Corn: US$586.50 per bushel (-6.76%).

Currencies

The US dollar index was slightly down to 107.98. EUR/USD briefly fell to a parity level before bouncing back to 1.0036, while USD/JPY fell 0.4% to 136. 86 at AEST 8:00 am. All the other major currencies but the Canadian dollar were slightly up against the greenback. However, the falling US bond yields and the bonce of EUR/USD may suggest that the dollar’s strength may start fading off on the back of growing “Fed pause” after July.

Treasuries

The global bond yields continued to slide on risk-off sentiment.

US 10-year: 2.98%, US 2-year: 3.05%.

Germany bund 10-year:1.13%, UK gilt 10-year: 2.07%.

Australia 10-year: 3.41%, NZ 10-year: 3.67%.

Cryptocurrencies

The cryptocurrencies fell further on weak sentiment and bad news. A slew of major crypto brokers, including FTX, 3AC, and Voyager Digital are in pain of losses and bankruptcy due to a collapse of the stable coins and a plunge in the leading digital coins. The global crypto market cap dropped 4.29%, to US$871.44 billion in the last 24 hours according to Coinmarketcap.com.

(See below prices at AEST 8:19 am)

Bitcoin: US$19,439 (-4.74%)

Ethereum: US$1,045 (-8.09%)

Cardano: US$0.4289 (-3.85%)

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.