How to invest in stocks: a beginner's guide to investing

Investing in stocks can be daunting, but it doesn't have to be. Learn the steps required to start investing in the stock market, whether it be through individual stocks or ETFs. We outline the steps for setting your investment goals, coming up with a strategy, how to place trades, and knowing when to invest and when to sell. All these steps can be customised to your own goals and personal risk tolerance.

How to get started investing in stocks

Read through all the steps to get a sense of the general investment approach. Then, think about how you’ll implement them, creating your own personalised investment approach.

1. Set your investment goal

This is a step many people skip, but it is important as it sets the stage for the investing steps that follow. Write down why you want to invest and what you hope to achieve with that investing. What is the end goal?

“Making money” isn’t specific enough. What is that money for? How much do you need? When do you need it? Do you want to trade often or seldom? How much time do you have for research?

Think not only of monetary goals but how much time investing will take up and how much time it may free up if done well (for example, more investment income from dividends or share price gains, could mean working fewer hours).

Consider what type of investor you want to be. If you don’t know yet, read through the rest of the article for ideas, and you can always come back to this step later.

These questions allow you to create an investment plan to meet those goals.

2. Decide how much to invest

Consider how much capital you are willing to invest as well as how much of your weekly or monthly income you’re willing to contribute to your investment account.

If you’re contributing money to your investments each month, a percentage can work well. This way, if the income fluctuates, the dollar amount of contributions moves up or down as well.

A fixed dollar amount can also work well. This too may require adjusting if the income rises or falls.

Investing as much as possible is tempting as your money is put to work instead of just sitting in your savings account, but make a budget and see how much is affordable. It may be worth keeping money aside for emergencies, as well as planned expenses over the next year. You may wish to redo this budget yearly, or as often as required, to ensure the contributions are still a good fit.

3. Understand your risk tolerance

Each investor has a different risk tolerance, and each asset has its own risk profile. Some people are fine investing in stocks that swing around wildly, while others have a hard time stomaching a 10% drop in their investments. This defines your risk tolerance.

Do you prefer assets that are more stable: smaller potential profits, but also smaller declines? Do you prefer to try to make as much as possible in the short-term? Possibly investing in riskier stocks and ETFs that could have large price swings or drawdowns.

Sometimes, investors don’t know their risk tolerance until they have a bit of experience. They think they want to own volatile stocks and ETFs with high returns, but when a price drop or correction arrives, they find it hard to sleep at night. They worry about their positions and may potentially sell too early at a loss.

When considering risk tolerance, the sleep rule is often used: never invest in anything that negatively affects your sleep. If it does, it means the position is risking too much for your personal tolerance.

4. Understand stocks vs the stock market

Investing in stocks means buying shares in individual companies or ETFs that contain a basket of stocks. The performance of individual stocks is mostly reliant on how that company performs, and to a lesser extent, how the stock market performs.

The “stock market” is measured by benchmark indexes. Indexes track a basket of stocks and, therefore, provide a barometer of how most stocks are performing. There are many indexes tracking different segments of the stock market, such as large companies, small companies, oil and gas stocks, gold stocks and so on.

Popular indexes include the FTSE 100 for UK stocks and the S&P 500 for US stocks. These indexes can’t be purchased directly, but there are exchange-traded funds (ETFs) that track these various indices. These ETFs can be purchased as investments. Investors need to choose whether they’ll invest in ETFs, individual stocks, or both.

Index ETFs rise and fall based on the movement of many stocks. Therefore, their movement isn’t reliant on the performance of only one company.

Each stock and ETF has its own risk profile. To see how risky an asset is, look at its beta. Above one typically means the asset is more volatile than the broader market, while under one is considered less volatile.

5. Choose an investment strategy

This is where people often get stuck, as there are many different investment strategies. This is why step 1 – set your investment goal – of this article is important. It helps define what you want out of our investments and gets you thinking about how you want to trade. Here are some ideas for how to do that:

Passive investing involves little activity. Invest a lump sum or make regular contributions to some chosen investments and hold on to them.

Active investing is being more involved in the process, deciding when to buy and when to sell.

Value investing is buying stocks that are a bargain based on their financial position and prospects. This is more of an active approach.

Growth investing is where you buy stocks or companies that have the potential to grow their business going forward. This is an active approach.

Fundamental investing is buying stocks based on whether they have a solid financial position.

Technical investing is purchasing stocks based on how the price of the asset has performed.

Portfolio diversification and allocation decide how the funds in the account are distributed. It could involve buying a diversified basket of individual stocks or a selection of ETFs that provide exposure to potentially thousands of stocks. This portfolio could also include bonds, precious metals, and even real estate, which can all be purchased via ETFs (or individually, but that is more work). This could be passive or active.

6. Learn how to choose stocks or ETFs

Once a strategy has been defined, it is now time to learn how to pick stocks or ETFs that align with that strategy. For more detail on stock picking, read our full guide on how to pick stocks.

With investing, every trade taken is a compromise because that money could be invested elsewhere. Therefore, typically, investors opt for only selecting the best candidates according to their strategy.

While there is not one single best stock or ETF for everyone, there is for each strategy. Take a growth investor, for example. If there are at least 10 stocks at a given time, which are forecasted to grow earnings by 50% per year over the next five years, then there is little reason to buy a stock with only 5% growth. If an investor wanted more than 10 stocks to buy, they choose the next strongest and then next.

Similarly, with a value strategy, an investor may look for stocks that are stable or growing but that are trading at a low valuation based on discounted cash flows or P/E. They opt for the best stocks that combine these factors.

Technical traders may look for breakouts in the strongest stocks, or fundamental traders may look for companies in the best financial position (strong cash position, low debt, high cash flow and so on).

For passive investors, their only job is to select a few funds that match their long-term goals. For most, this will be diversified index funds, typically tracking the S&P 500, FTSE 100, Nasdaq 100, or popular indexes from other countries. More niche exposure can be gained by purchasing an ETF in the desired sector.

With this step, also consider asset allocation – this is how many stocks or ETFs are to be held in the account and how much capital is allocated to each one.

One common way that an investor might find new individual stocks to invest in, is by using a stock screener to filter for companies that match the parameters of their chosen strategy.

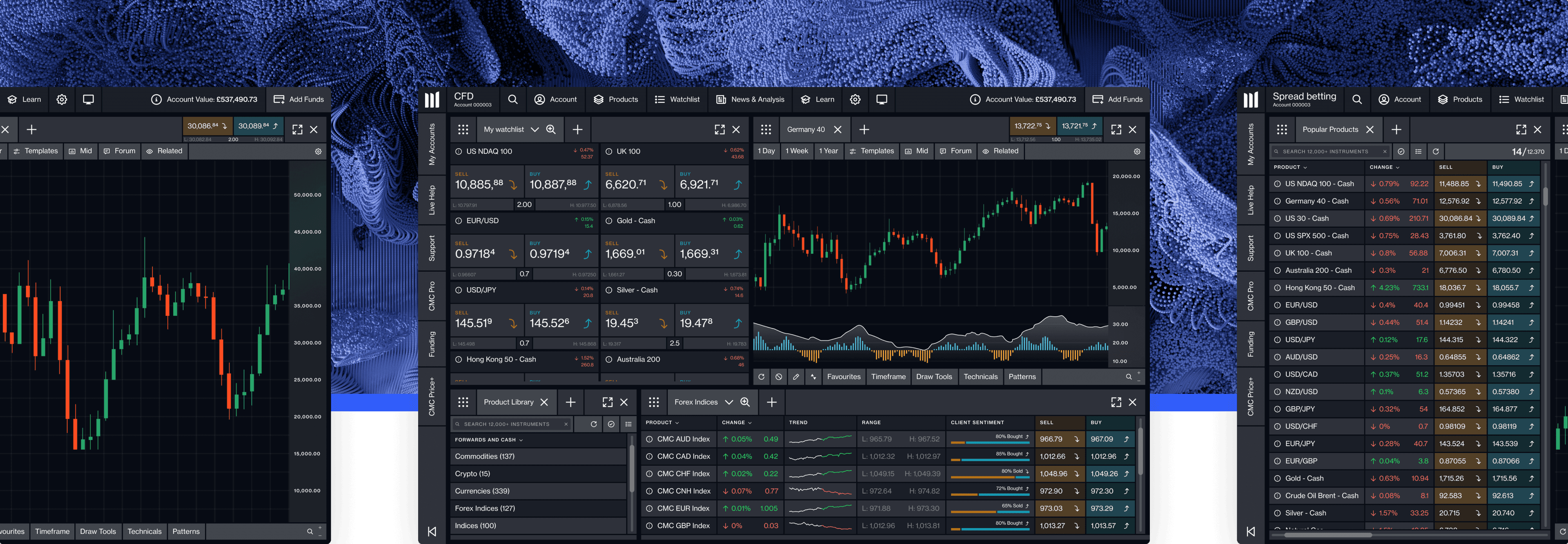

7. Sign up to an investing platform

An investing platform is where trades are placed. The platform sends the trades to the exchange for execution, then the trades can be monitored and altered within the platform. Depositing funds is required to start investing.

Before picking an investing platform, figure out what you want from it:

Do you want a standard account where gains will be taxed* (depending on the jurisdiction)? Do you want a shared ISA account where gains are protected from taxes (but some limitations are imposed)? Do you need a joint account or a corporate account? Make sure the investing platform and broker offers the right account type for your needs.

How much research do you plan on doing for your strategy and to find stocks to invest in? Ideally, the platform provides most of the tools you need for this. This saves time and money because if the platform doesn’t have the research tools required, then you may need to use other sites, possibly paying for the service.

8. Understand fees before you buy

There are several fees to be aware of when investing, including:

A commission is the cost of making a trade. It is often a flat fee but may also be a small percentage of the trade value. For example, it may be a £9.99 flat fee, or 0.1% of the value of the trade (£30,000 trade is £30), for example. Some brokers will wave the traditional commission fee but may have other fees such as a “spread” or “FX transaction fee” which can unwittingly eat into your capital.

ETFs charge a fee each year. This is called the expense ratio. This is not paid out of pocket but rather is taken out of the ETF each year. The fees range from 0.04% to about 1%. For example, if the fund’s expense ratio is 1%, and the ETF returned 10% in the year, the 1% is deducted, so investors who held the fund the entire year would make 9%.

Some platforms will have a yearly platform fee where they charge you a percentage of the value of the account, this is typically capped charge.

9. Buy your stocks or ETFs

There are a few things to understand before making an investment.

For every investment, there is a bid/ask spread. The bid price is where others are willing to purchase the asset right now, and the ask or offer price is where people are willing to sell it. You have a choice. You can buy right now at the offer – called a market order – and get into that trade as there is someone willing to sell to you at that price. Or you can place a limit order and try to get a better price.

Set a limit order at any price you want, but someone must be willing to sell to you at that price. The price will need to move to your order price, so there is no guarantee the order will get you into the trade. One order type isn’t better than another; market order types get you in, but limit orders can be used to get a better price, but there is no guarantee you will get into the trade at a price selected.

With that in mind, here is how to place a trade on a typical investing platform:

Open the trading platform.

Use the search box to type in the stock or ETF name, then select it.

This will typically bring up a chart or trade box with buy or sell buttons. These buttons may appear above the chart or somewhere else around the platform.

Click ‘buy’. This will bring up a trade box where you will verify the stock/ETF you want to buy is correct (if not, input the correct stock/ETF). Buying a stock in a different currency than the account is funded with will result in a currency exchange, which may involve fees.

Input the number of shares you wish to buy. Some platforms also have the option to select the amount you wish to invest (the number of shares is then calculated for you).

Input whether the order will be a limit or market order (see paragraph above).

If using a limit order, input the price you want to buy at.

Set how long the order is good for. Usually, it is good till cancelled (GTC), but you can set an actual date that the order will be cancelled if you wish. If the order has not been filled by the specified date, it is cancelled.

Double-check all your trade details, and then click ‘Confirm’ or ‘Submit’.

10. Monitor your position

Your investment positions will appear inside your trading account, along with details such as entry price, entry date, current price, and current profit/loss. Check on these positions at any time you wish, but how often you check on them should depend on your strategy. An active investor may want to regularly monitor these positions or at chosen intervals.

Passive investors don’t need to actively monitor their positions, especially if they have chosen a buy-and-hold.

It is easy to get addicted to watching the investments move. Try to set parameters around when you check performance. For passive investors, this would be infrequently, such as once a month or even every several months or more. For active investors, define when you’ll monitor your holdings, in alignment with the requirements of your strategy.

11. Know when you will sell

Define guidelines for when you should sell your holdings, such as:

Will you sell when you reach your goal (Step 1)? Or will you hold on to the trades but set stop-loss orders to get you out of trades so that even if the prices declines, you have still achieved your goal?

Will you get out if the price of your investments declines by a certain amount?

Will you sell when your investments have moved up a certain amount?

Will you sell when the trades no longer warrant investment – they no longer possess the qualities that drove you to buy them in the first place.

These are all valid reasons to sell, but the reason should also align with your goals and strategy. Even buy-and-hold investors should have a plan for how they’ll eventually start selling their holdings in retirement.

Just like deciding how you will enter, decide on how you will exit your investments. Consider using one, or more, of the reasons described above. Make them into rules that are specific to your strategy, such as setting percentage levels for losses or profits that will force you to exit.

They invest the same way retail traders do. Professionals will spend more time than most retail traders studying how the market works, developing strategies before making investments as it’s their full time profession and their livelihood depends on it. Small investors have an advantage, though – they can get in and out with more ease as they’re generally trading small positions compared to professionals who trade in much larger sizes which have the potential to move the market they are trading.

You can start investing with as little as a few pounds, as most modern brokers offer fractional shares which give you the opportunity to own some of that company without having to buy a whole share. This lowers the barrier to entry for buying a share in companies like Amazon.

*Tax treatment depends on individual circumstances and can change or may differ in a jurisdiction other than the UK.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.