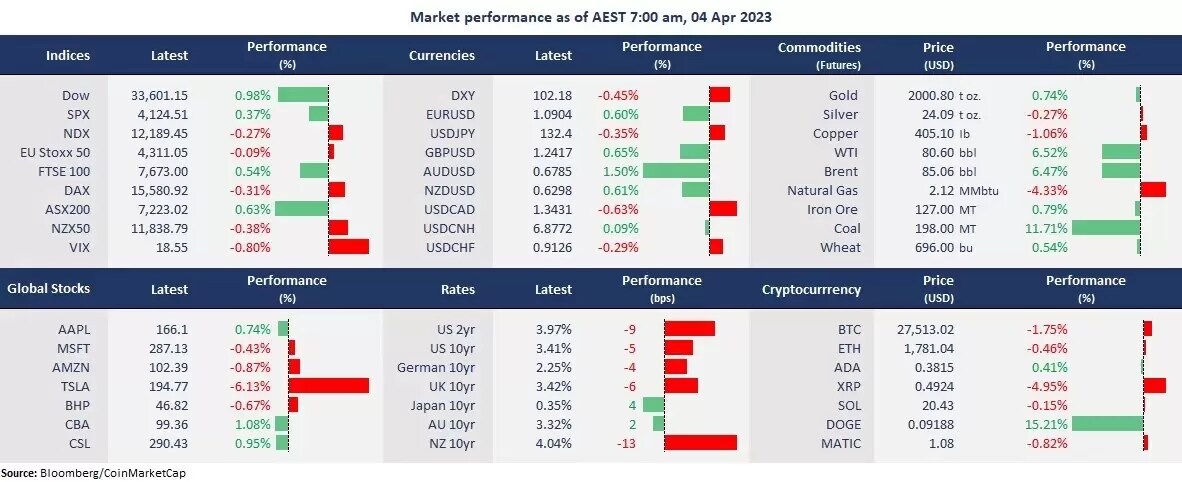

Wall Street finished mixed to start the month after Monday’s oil prices jump. OPEC+’s unexpected production cut caused oil to soar more than 6%, sending energy stocks higher and buoying Dow and S&P 500. The tech sector, however, lost its shine, with the Nasdaq closing in the red after a three-week gain.

The Fed’s rate-sensitive US bond, the yield on the 2-year note fell to a one-week low of below 4%. The US dollar weakened as bond markets continued to price in a Fed’s dovish turn, pushing gold futures to above 2,000 again. The market seemed to be very calm in response to the oil market frenzy as the VIX stayed at a relatively low level of just above 18, though the surge in oil price may complicate central banks’ rate decision.

The Reserve Bank of Australia will decide on the cash rate later today, with a strong expectation that the bank may pause rate hikes as indicated in the last meeting. The ASX 200 was buoyed by energy stocks following the oil price surge, and futures point to a slightly higher open, up 0.11%. Other regions in Asia, such as Hang Seng Index futures, were slightly up 0.01%, and Nikkei 225 futures fell 0.28%.

Price movers:

- Both WTI and Brent futures jumped more than 6% to a one-month high following the news that the OPEC+ decided to cut production by 1.16 million barrels per day, bringing total output cut to 3.66 million on top of its 2 million barrels reduction and 500,000 barrels cut by Russia. Will oil price hit 100 again?

- 7 out of the 11 sectors in the S&P 500 finished higher, with energy leading gains, up 4.91%. Major oil producers, such as Occidental Petroleum and Exxon Mobil, rose 4.42% and 5.94%, respectively. The growth sectors lagged due to a drop in Tesla stocks, dragging consumer discretionary down 0.91%.

- Tesla’s shares fell 6.13% following the first quarter EV delivery number. The company delivered a record of 422,875 electric vehicles and produced 440,808 cars, aligning with its own expectation but falling short of FactSet consensus. The main concern of investors is that its price cuts will squeeze the gross profit margin.

- Google is to cut down on employee services to “deliver durable savings through improved velocity and efficiency,” such as fitness classes, staplers, tape, and frequency of laptop replacements. The company laid off 12,000 employees, or 6% of its workforce, amid slowing sales growth in January. Google’s parent, Alphabet’s shares, fell 0.16%.

- Gold futures rose to above 2,000 again as the US dollar fell on a slip in bond yields. Gold price may head off its all-time high of above 2,070 on the prevailing trend. From a technical perspective, however, the precious metal may face a pull-back risk.

- Dogecoin surged more than 20% in the last 24 hours after the token's mascot was included in Twitter, where users' account's blue bird is replaced with Shiba Inu.

ASX and NZX announcements/news:

- Seek's FY23 revenue will be A$15 million lower than estimate but the decline will be offset by lower operation costs. The company keeps its guidance for A$560 million in EBITDA and A$250 million in net profit.

- Super Retail's founder, Reg Rowe, retires from today and Mark O'Hare, Mr. Rowe's business adviser, was nominated as his replacement.

Today’s agenda:

- NZIER business confidence. The data fell to -70 in January, the lowest since April 2020, due to an expectation for the RBNZ to raise the rate higher and sticky inflation.

- RBA rate decision. Despite a call for a 25 bps hike according to consensus, the reserve bank may pause this time to avoid risks of an economic crisis.