Our FX Active account comes with fully transparent execution and ultra-tight spreads from 0.0 pips on six major FX pairs. Also benefit from a 25% spread discount on all other FX pairs, when compared to our standard pricing. Specifically suited for high-volume forex traders.

Designed for Forex Traders

Why trade FX Active with CMC?

- Spreads from 0.0 pipsTrade FX pairs from 0.0 pips* on six major pairs, including NZD/USD, EUR/USD and USD/JPY

- More FX pairsAccess 300+ FX pairs on our Next Generation Platform, or 175+ pairs on MetaTrader 4

- 25% spread discountThis offer is available on over 300 FX pairs and created for active forex traders, when compared to our standard pricing

- 24/5 supportOur support team is available 24 hours, Monday – Saturday (in line with global market hours)

- Minimise slippageFully automated, lightning-fast execution so that you can trade with confidence

*Available for FX Active accounts only. Commission is charged at 0.0025% per transaction.

Read our T&Cs for MT4 and our Next Generation platforms. By creating a live account, you accept these T&Cs.

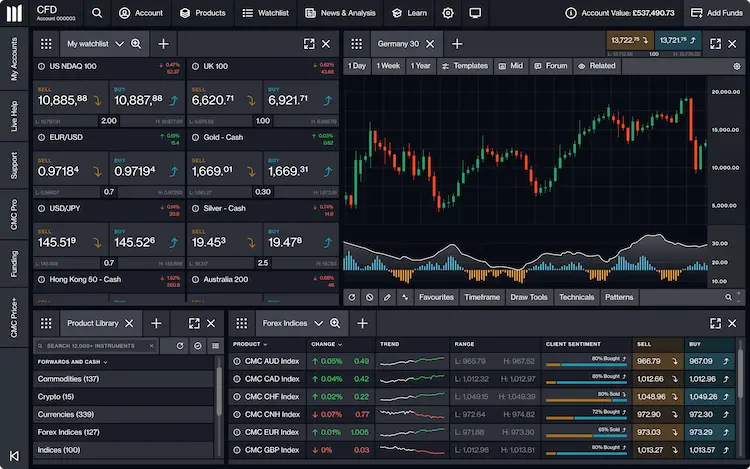

You can choose from our award-winning Next Generation CMC platform or power your trades on MT4, either way we'll give you the tools to master your moves and trade with confidence.

Plus, with an FX active account you'll get transparent pricing and tight spreads from 0.0 pips on 6 major FX pairs. Are you trading in the right league?

- MT4

The world's most popular trading platform

Spreads from 0.0 pips* on 6 major FX pairs

No scalping restrictions

Free premium indicators & EAs

- Next Generation

Award-winning CMC platform

Spreads from 0.0 pips* on 6 major FX pairs

Best-in-class insight and analysis

Web platform, iOS and android app

*Commission is charged at 0.0025% per transaction. MT4 commission charged up front for opening and closing.

Learn the art of CFD trading

- What is CFD trading and how does it work?Learn More

A contract for difference is a financial derivative product that pays the difference in settlement price between the opening and closing of a trade. CFD trading enables you to speculate on the rising or falling prices of fast-moving global financial markets (or instruments) such as shares, indices, commodities, currencies and treasuries.

- NYSE vs NASDAQ: What's the difference?Learn More

Take a look at the world’s largest listed companies: Amazon, Berkshire Hathaway, JP Morgan Chase, Microsoft. They all rank among the largest companies in the world, and they are all listed in the US. With a combined value of more than $49 trillion, US-based stocks account for around 70% of the global market.

- What is forex (FX) trading?Learn More

FX trading, also known as foreign exchange trading or forex trading is the exchange of different currencies on a decentralised global market. It's one of the largest and most liquid financial markets in the world. Forex trading involves the simultaneous buying and selling of the world's currencies on this market.

Join over 1 million global traders and investors

FX Active

Frequently asked questions

Commission is charged at a fixed rate of 0.0025% per transaction. This works out at US$2.50 per US$100,000 worth of currency trade so US$5 to open and close a trade at this volume. MT4 commissions are charged upfront for opening and closing trades.

FX Active has fully transparent commissions across all forex pairs at 0.0025% per transaction, as well as minimum spreads from 0.0 pips on six major FX pairs, and a 25% spread reduction compared with our standard CFD account on all the other currency pairs we offer. MT4 commissions are charged upfront for opening and closing trades.

There is also a holding cost for trades held overnight, which is essentially a fee for the funds you borrow to cover the leveraged portion of the trade.

With an FX Active account, you can trade on all the markets and instruments available on our standard CFD platform. So as well as FX on our Next Generation platform, you can trade on indices, commodities, shares, ETFs, share baskets, forex indices, cryptocurrencies, plus rates and bonds. Through MT4 platform, you can also trade on indices, commodities, and cryptocurrencies. Note that only AUD/USD, EUR/USD, GBP/USD, NZD/USD, USD/CAD, and USD/JPY have spreads from 0.0 pips.

On our Next Generation platform, there are more than 330 forex instruments to trade, while on MT4 with us, you can trade on over 175 FX pairs.

FX Active is an account designed for high-volume traders, who want to get even more from their forex trading. It features tighter spreads and a fixed rate commission, enabling pure price transparency. As well as trading on over 300+ FX pairs through Next Generation platform, or 175+ FX pairs through the MT4 platform, all other non-FX instruments are also available to trade in the same way as with a standard CFD account.