Trade CFDs on more than 12,000 instruments across global markets with confidence on our Next Generation platform. Including Forex, Indices, Commodities, Cryptocurrencies and more. Or trade on MetaTrader 4 across 220+ global instruments. Whichever way you trade, we're dedicated to creating the best in-class trading platform, designed for the active CFD trader.

CFD Trading

CMC Markets Group

CMC Markets Group

CMC Markets PLC

Trade your way with CMC

- Forex

Access 300+ FX pairs on our Next Generation Platform, or 175+ pairs on MetaTrader 4. And trade with competitive spreads from 0.0 pips* with our FX Active account.Learn More

Access 300+ FX pairs on our Next Generation Platform, or 175+ pairs on MetaTrader 4. And trade with competitive spreads from 0.0 pips* with our FX Active account.Learn More - Indices

Over 80 cash and forward contracts on global indices including the Australia 200, US 30, US tech and more.Learn More

Over 80 cash and forward contracts on global indices including the Australia 200, US 30, US tech and more.Learn More - Commodities

Gain exposure to volatility across cash and forward commodities including bullion, energy, soft commodities and more.Learn More

Gain exposure to volatility across cash and forward commodities including bullion, energy, soft commodities and more.Learn More - Crypto

Trade popular cryptocurrencies, including Bitcoin and Ethereum plus a range of alt coins like TRON and NEO.Learn More

Trade popular cryptocurrencies, including Bitcoin and Ethereum plus a range of alt coins like TRON and NEO.Learn More - Shares

Trade over 10,000 shares across 24 global markets with tight spreads and lightning-fast execution.Learn More

Trade over 10,000 shares across 24 global markets with tight spreads and lightning-fast execution.Learn More

*Available for FX Active accounts only. Commission is charged at 0.0025% per transaction. View the T&Cs here.

Premium trading starts here

For high-volume traders, explore our exclusive ALPHA account services

Priority support

Exclusive offerings & event invitations

Tailored research

Check your eligibility today to access priority support, tailored one-to-one services and exclusive product offerings.

Find your favourite

Use the search box below to find your favourite instruments from over 12,000 instruments

Product |

|---|

- |

- |

- |

- |

- |

- |

- |

- |

Min spread | Buy | Day | Week | Trend |

|---|---|---|---|---|

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% | |

- | - | -% | -% |

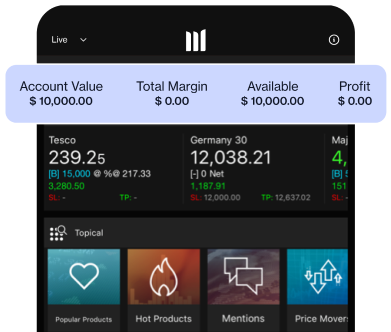

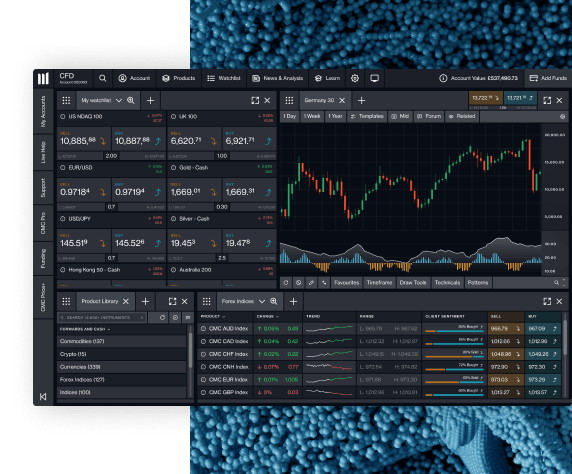

Explore all of our platforms

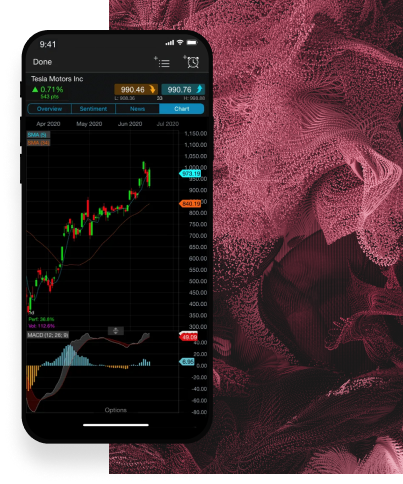

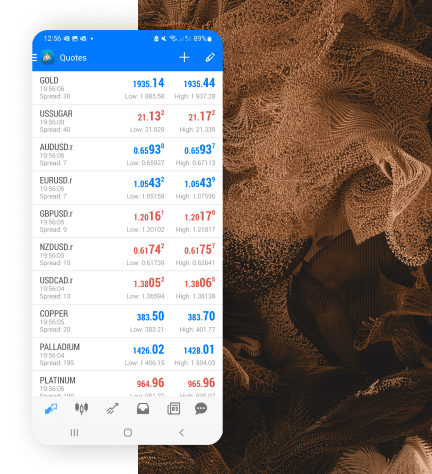

- CMC web platform

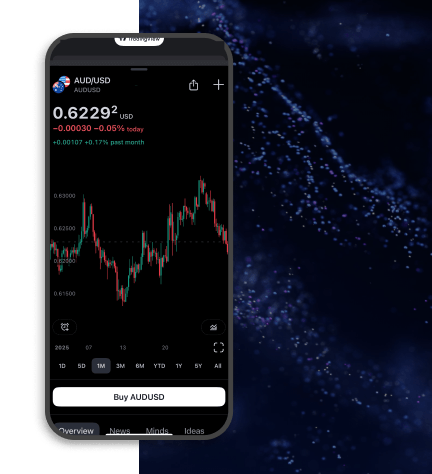

- CMC mobile app

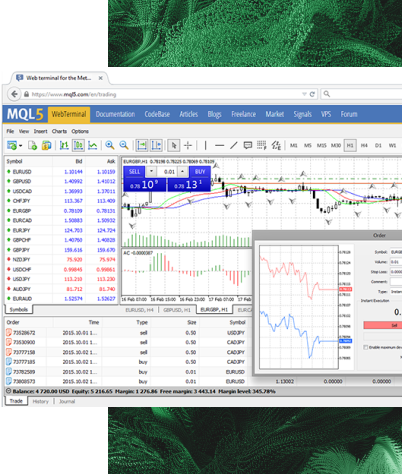

- MetaTrader 4 (MT4)

- MetaTrader 4 (MT4) WebTrader

- TradingView

Discover an award-winning trading experience on our Next Generation platform.

Trade with tight spreads on over 12,000 instruments

Minimal slippage with ultra-fast execution speed

100% automated execution

Learn the art of CFD trading

- What is CFD trading and how does it work?Learn More

A contract for difference is a financial derivative product that pays the difference in settlement price between the opening and closing of a trade. CFD trading enables you to speculate on the rising or falling prices of fast-moving global financial markets (or instruments) such as shares, indices, commodities, currencies and treasuries.

- NYSE vs NASDAQ: What's the difference?Learn More

Take a look at the world’s largest listed companies: Amazon, Berkshire Hathaway, JP Morgan Chase, Microsoft. They all rank among the largest companies in the world, and they are all listed in the US. With a combined value of more than $49 trillion, US-based stocks account for around 70% of the global market.

- What is forex (FX) trading?Learn More

FX trading, also known as foreign exchange trading or forex trading is the exchange of different currencies on a decentralised global market. It's one of the largest and most liquid financial markets in the world. Forex trading involves the simultaneous buying and selling of the world's currencies on this market.

Join over 1 million global traders and investors

Winner 2023

#1 web platform

ForexBrokers

Winner 2024

Best Mobile Trading Platform

ADVFN International Financial Awards 2024

Winner 2025

Most Currency Pairs

ForexBrokers

Winner 2025

#1 Commissions & Fees

ForexBrokers