Discover the costs associated with trading CFDs across all products, including spreads, margins, and overnight holding fees.

Spreads | Holding cost | Margins

When trading on leverage, you will need to consider various costs, including the spread, margin, and overnight fees. Additionally, you will need to take into account other potential charges and factors that may affect your trading costs, as detailed below.

- Forex

- Indices

- Commodities

- Shares

- Treasuries

- Cryptocurrencies

Product |

|---|

- |

- |

- |

- |

- |

Min spread | Holding cost (buy) | Holding cost (sell) | Margin rate |

|---|---|---|---|

- | -% | -% | -% |

- | -% | -% | -% |

- | -% | -% | -% |

- | -% | -% | -% |

- | -% | -% | -% |

Share CFD commissions

Share CFDs attract a commission charge each time you enter and exit a trade. This charge varies depending on the country where the share product originates.

Country/market | Commission charge | Minimum commission charge |

|---|---|---|

UK | 0.08% | GBP 9.00 |

US | 2 cents per unit | USD 10.00 |

Australia | 0.09% | AUD 7.00 |

Austria | 0.10% | EUR 9.00 |

Belgium | 0.10% | EUR 9.00 |

Canada | 2 cents per unit | CAD 10.00 |

Denmark | 0.10% | DKK 90.00 |

Finland | 0.10% | EUR 9.00 |

France | 0.10% | EUR 9.00 |

Germany | 0.10% | EUR 9.00 |

Hong Kong | 0.18% | HKD 50.00 |

Ireland | 0.10% | EUR 9.00 |

Italy | 0.10% | EUR 9.00 |

Japan | 0.10% | JPY 1,000 |

Netherlands | 0.10% | EUR 9.00 |

New Zealand | 0.10% | NZD 7.00 |

Norway | 0.10% | NOK 79.00 |

Portugal | 0.10% | EUR 9.00 |

Singapore (SGD) | 0.10% | SGD 10.00 |

Singapore (USD) | 0.10% | USD 10.00 |

Spain | 0.10% | EUR 9.00 |

Sweden | 0.10% | SEK 89.00 |

Switzerland | 0.10% | CHF 9.00 |

For non-US, non-CA shares, the commission is calculated as a percentage charge of the value of the order. Commissions on US shares are charged at 2 cents per share.

All commission charges will be converted to your account currency at the prevailing CMC Markets currency conversion rate.

Our costs explained

- Holding costs

- Commissions

- Market data fees

- Guaranteed stop-loss order charges

- Dormant account charges

Holding costs

At the end of each day (5pm New York time), open CFD trading positions may be subject to a charge called a holding cost. The holding cost can be positive or negative depending on whether you are long or short. Forward contracts on indices, forex, commodities and treasuries are not subject to holding costs.

Holding costs for indices are based on the underlying interbank rate of the index (see table): plus 2.5% on buy positions and minus 2.5% on sell positions.

For share CFDs, holding costs are based on the underlying interbank rate for the currency of the relevant share (see table) plus 2.5% on buy positions and minus 2.5% on sell positions.

FX holding costs are based on the tom-next (tomorrow to next day) rate in the underlying market for the currency pair.

Holding rates for cash commodities and treasuries are based on the inferred holding costs built into the underlying futures contracts, from which the prices of our cash commodity and treasury products are derived.

Holdings costs for share baskets, forex indices and commodity indices are calculated via a weighted sum of the constituents' holding cost rates, plus CMC's fee on buy positions or minus CMC's fee on sell positions.

Please note this information has been provided for reference, and the rates may not match exactly if recalculated. If you have any questions, please contact our client services team.

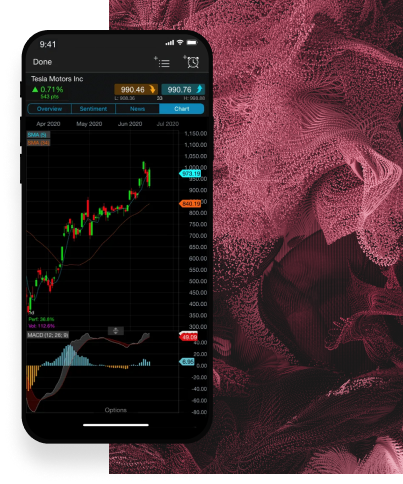

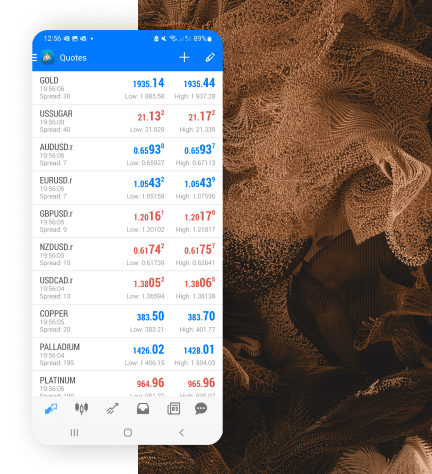

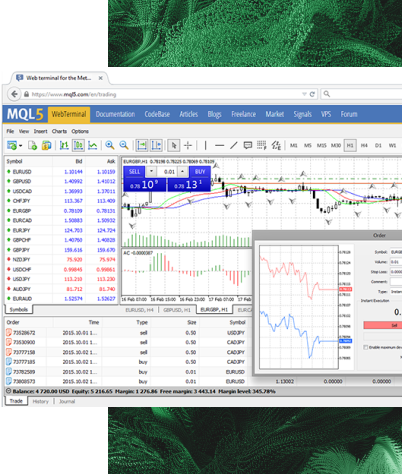

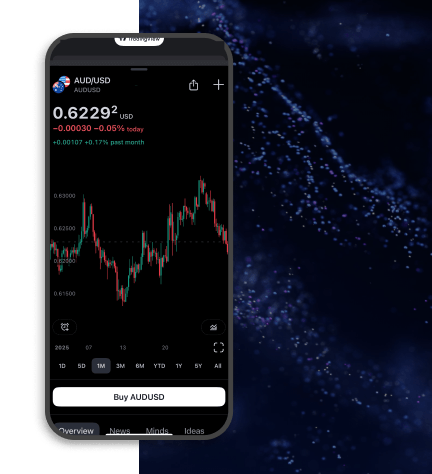

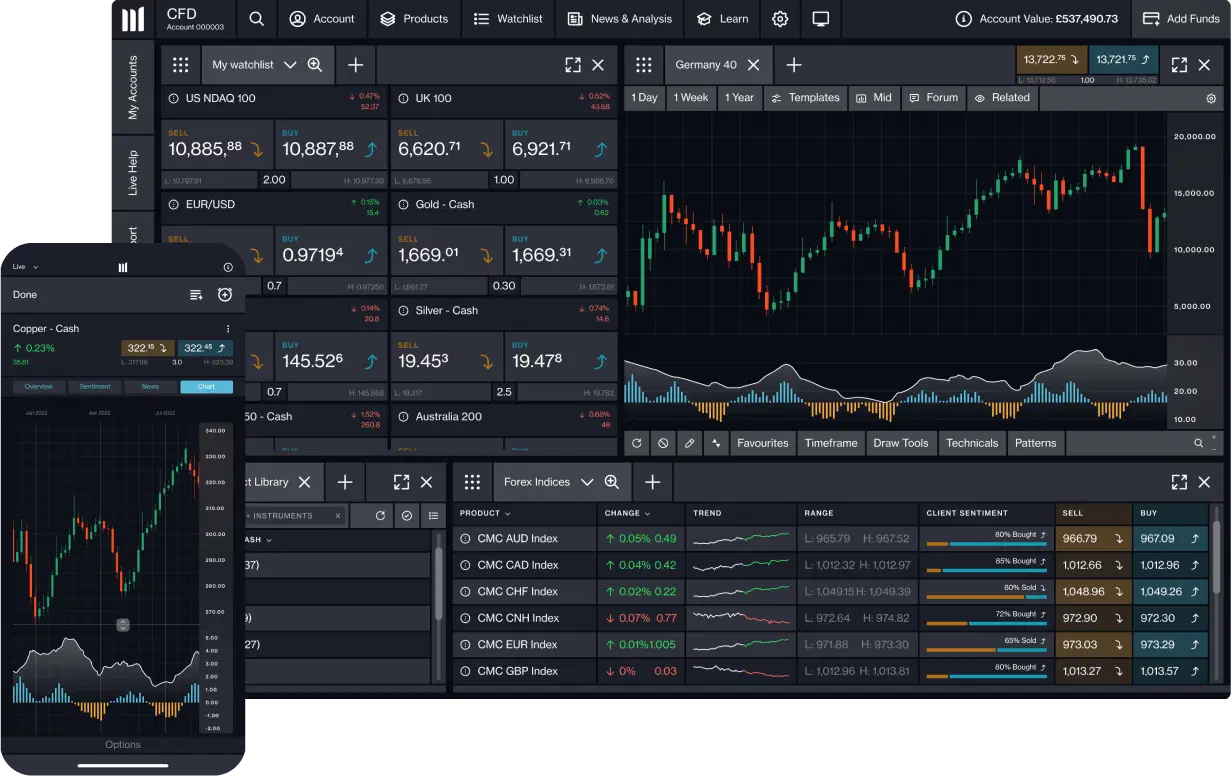

Explore all of our platforms

- CMC web platform

- CMC mobile app

- MetaTrader 4 (MT4)

- MetaTrader 4 (MT4) WebTrader

- TradingView

Discover an award-winning trading experience on our Next Generation platform.

Trade with tight spreads on over 12,000 instruments

Minimal slippage with ultra-fast execution speed

100% automated execution

Join over 1 million global traders and investors

Winner 2023

#1 web platform

ForexBrokers

Winner 2024

Best Mobile Trading Platform

ADVFN International Financial Awards 2024

Winner 2025

Most Currency Pairs

ForexBrokers

Winner 2025

#1 Commissions & Fees

ForexBrokers

Funding

Frequently asked questions

You can initially fund your account by transferring funds from your bank account or via POLi. A credit or debit card, or PayPal, can be used for funding after an initial deposit has been made from a bank account. There is a 1.5% charge for both credit and debit card payments. We don't accept cheque or cash deposits. Please ensure that any payment you make to fund your account is from a card or account in your name. Any payment from third-party sources will be returned. We do not accept AMEX or Diners cards.

Please note we will only take deposit requests over the phone if your account is approaching margin call.

To add a new card after your initial funding, simply log into your account and select Account > Funding > Card. You will then be prompted to enter an amount, followed by your card details. Once you have made a payment from your card it will automatically be registered for future deposits and withdrawals.

3D Secure is a fraud prevention measure that acts as an additional layer of security when making card payments online. If you’re registered with 3D Secure, you’ll be directed to your issuing bank’s verification page when you deposit funds using your card.

Your payment has most likely not been processed. If in doubt please check your account transactions or alternatively call us on 0800 26 26 27 or via email at support@cmcmarkets.co.nz and we will be happy to help you.

POLi is an online payments service that enables you to make safe, real-time payments to CMC Markets directly from your online bank account. Note: CMC Markets will not charge you for this transaction.

You can sign in to your account as soon as your application has been successful and you have clicked on the verification link sent to your registered email address. However, you won’t be able to place a trade unless there are sufficient funds in your account to open a position. The initial funding to your account needs to be made via a POLi or Bank transfer. If you prefer to test strategies in a risk-free environment, our free demo account will allow you to practise trading with virtual funds.

We are using the latest version of - POLi 3 which is compatible on both Mac and PC. This version removes the need to download any software.