What does over the counter (OTC) mean?

OTC stands for over-the-counter. In trading terms, over-the-counter means trading through decentralised dealer networks. A decentralised market is simply a market structure consisting of various technical devices. This structure allows investors to create a marketplace without a central location. The opposite of OTC trading is exchange trading, which takes place via a centralised exchange.

An example of OTC trading is a share, currency, or other financial instrument being bought through a dealer, either by telephone or electronically. Business is typically conducted by telephone, email and dedicated computer networks.

What is an OTC trade?

The OTC market is arranged through brokers and dealers who negotiate directly. An advantage of the OTC market is that non-standard quantities of stock or shares can be traded.

The OTC market often includes smaller securities. It consists of stocks that do not need to meet market capitalisation requirements. OTC markets could also involve companies that cannot keep their stock above a certain price per share, or who are in bankruptcy filings. These types of companies are not able to trade on an exchange, but can trade on the OTC markets.

These are not the only types of companies on the OTC market, however. Larger, established companies normally tend to choose an exchange to list and trade their securities on. But well known, large companies trade OTC too. For example, blue-chip stocks Allianz, BASF and Roche and Danone are traded on the OTCQX market.

OTC markets

The over-the-counter market is a network of companies that serve as a market maker for certain inexpensive and low-traded stocks, such as UK penny stocks. Stocks that trade on an exchange are called listed stocks, whereas stocks that are traded over the counter are referred to as unlisted stocks.

Although there are differences between OTC and major exchanges, investors shouldn’t experience any significant variations when trading. A financial exchange is a regulated, standardised market and could therefore be considered safer. It may also be seen as enabling faster transactions.

What can I trade over the counter?

OTC markets and exchange markets are the two standard ways of organising financial markets. Stock trades must take place either through an exchange, or via the OTC market. However, some stocks trade on both an exchange and OTC.

Debt securities and other financial instruments, such as derivatives, are traded over the counter. Equities are also traded on the OTC market. Particular instruments such as bonds do not trade on a formal exchange – these also trade OTC by investment banks. OTC systems are used to trade unlisted stocks, examples of which include the OTCQX, OTCQB, and the OTC Pink marketplaces (previously the OTC Bulletin Board and Pink Sheets) in the US. These provide an electronic service that gives traders the latest quotes, prices and volume information.

How to trade bonds in the UK >

What is the OTC Markets Group?

The OTC Markets Group is an essential part of the OTC market. It’s a network of over 100 broker-dealers with headquarters in New York. The group prices and trades a vast range of securities and markets on the OTC markets platform. The OTC Markets Group provides price and liquidity information for almost 10,000 OTC securities. It operates many of the better known networks, such as the OTCQX Best Market, OTCQB Venture Market and Pink Open Market.

Benefits of OTC markets

The OTC market also consists of shares of companies that do not wish to meet strict exchange requirements. Some businesses do not want to pay the cost the exchanges charge. The NYSE has a schedule of fees and charges for its exchange services. Administrative fees can go up to $250,000 a year. Their listing fees can go up to $150,000, depending on the size of the company. Various other charges may also exist.

OTC transactions are free from exchange fees. The OTC market helps companies and institutions promote equity or financial instruments that wouldn’t meet the requirements of regulated well-established exchanges.

The OTC market can be split into two categories: the customer market, where dealers trade with their clients, and the inter-dealer market, where dealers trade amongst each other. The price a dealer quotes can differ depending on who they are interacting with.

Are there any risks of OTC trading?

The OTC markets have experienced improvements in recent years. This results in higher liquidity and better information for traders. Electronic quotation and trading have enhanced the OTC market; however, OTC markets are still characterised by a number of risks that may be less prevalent in formal exchanges.

Regulations

Investors may experience additional risk when trading OTC. While brokers and dealers operating in the US OTC markets are regulated by the Financial Industry Regulatory Authority (FINRA), exchanges are subject to more stringent regulation than OTC markets.

Transparency

OTC prices are not disclosed publicly until after the trade is complete. Therefore, a trade can be executed between two parties via an OTC market without others being aware of the price point of the transaction. This lack of transparency could cause investors to encounter adverse conditions. Comparatively, trading on an exchange is carried out in a publicly transparent manner. This can give some investors added assurance and confidence in their transactions. How securities are traded plays a critical role in price determination and stability.

Volatility

Another factor with OTC stocks is that they can be quite volatile and unpredictable. They can also be subject to market manipulation, so risk management techniques are recommended when trading over-the-counter. A stop-loss order will automatically close a position once it moves a certain number of points against the trader. A limit will close a position once it moves a certain number of points in favour of the trader. For both types of orders, traders can set triggers at predetermined price levels so they can define their profit and loss amounts in advance.

What are the benefits of moving to a major exchange?

Transferring to a bigger, official exchange can be advantageous. A major exchange like NASDAQ offers increased visibility and liquidity. Making the switch can be favourable to a company’s financing efforts. An organisation can increase its visibility with institutional investors. Companies moving to a major exchange can also expect to see an increase in volume and stock price.

Requirements

So how does a company make the jump to a major exchange? It must meet the new exchange’s financial and regulatory requirements. These include price per share, corporate profits, revenue, total value, trading volume and reporting requirements. Reports are filed and can be viewed by the public. Shareholders and the markets must be kept informed on a regular basis in a transparent manner about company fundamentals.

The NYSE requires all its listed companies to have 1.1 million publicly held shares. These must be held by a minimum of 2,200 shareholders and the minimum share price must be $4.00. It also asks for an average monthly trading volume of 100,000 shares.

The transition process

The company transitioning from OTC to a major exchange must be approved for listing by the relevant exchange. A completed application is necessary, along with various financial statements. This can include complete statements of shares outstanding and capital resources. A press release may have to be issued to notify shareholders of the decision. The fact that a company meets the quantitative initial listing standards does not always mean it will be approved for listing. The NYSE, for example, may deny a listing or apply more stringent criteria.

Once a company is listed with an exchange, providing it continues to meet the criteria, it will usually stay with that exchange for life. However, companies can also apply to move from one exchange to another. If accepted, the organisation will usually be asked to notify its previous exchange, in writing, of its intention to move. Despite the elaborate procedure of a stock being newly listed on an exchange, a new initial public offering (IPO) is not carried out. Rather, the stock simply goes from being traded on the OTC market, to being traded on the exchange.

Following the move, a company’s stock symbol may change. Stocks that move from the OTC to NASDAQ often keep their symbol. This is because the OTC and NASDAQ both allow up to five letters. In contrast, NYSE regulations limit a stock’s symbol to three letters. Read more about trading during stock market hours.

Over-the-counter (OTC) stocks are securities that aren’t listed on a major exchange and instead trade via brokers and dealers who negotiate with each other directly. These tend to be stocks with a smaller market cap or those that cannot keep a steady share price, which are often requirements made by stock exchanges. Learn about the differences between share dealing and derivative stock trading.

OTC stocks can sometimes be hard to buy and sell as there isn’t a high level of liquidity within this market as there is on a major stock exchange, meaning that they trade in lower volumes. This can make it difficult for an investor to sell shares at the price they want.

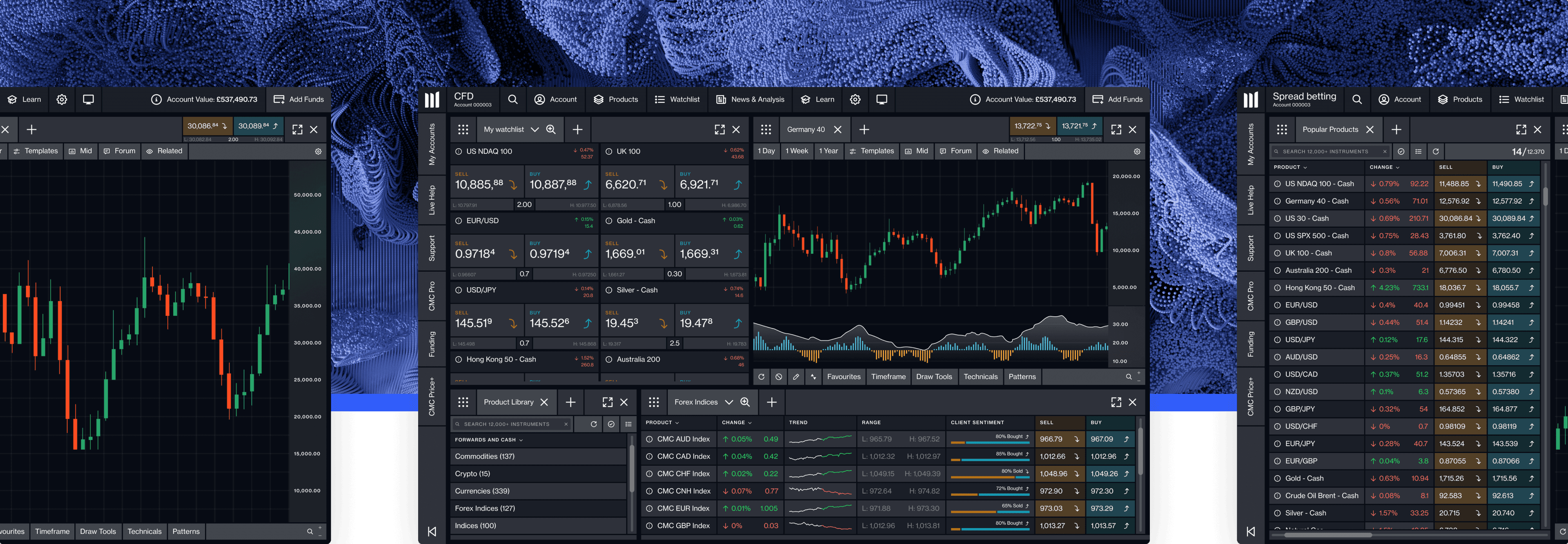

You’ll need to find a broker that allows you to invest in OTC instruments, which many provide, but not all. At CMC Markets, we offer an alternative of spread betting and CFD trading on more than 9,000 shares that are listed on major exchanges such as the NYSE, LSE, and Nasdaq. Open an account to get started.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only, and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.