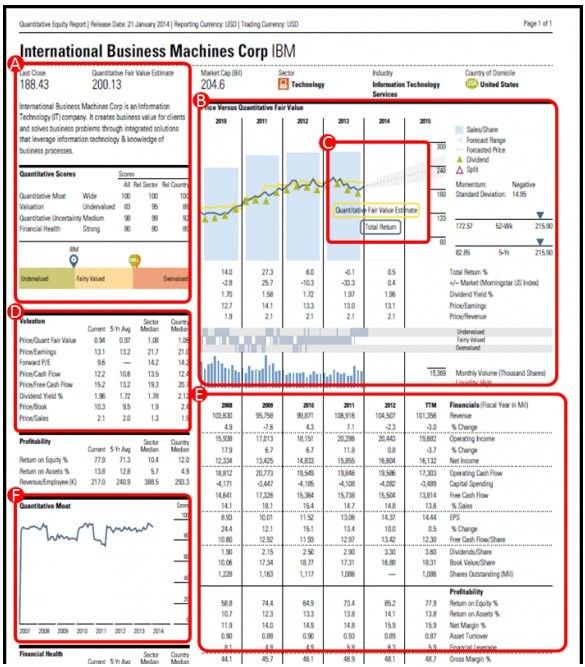

The research includes all the current cash fundamentals for a share, along with a series of value estimates, to reveal what the share could be worth versus its current underlying price. These value estimates are determined using Morningstar's proprietary calculations and metrics.

The quantitative equity research provided in the Morningstar reports is automated and uses a universal rule-based metric system to generate all its value estimates. This feature doesn't offer tailored investment advice or personal analysis; it does however provide a simple yet effective summary of the latest data releases impacting each share, and applies the same value logic to each one.

You can access the Morningstar quantitative equity research reports via the product dropdown menus in the trading platform. This feature is also available on our mobile trading apps.