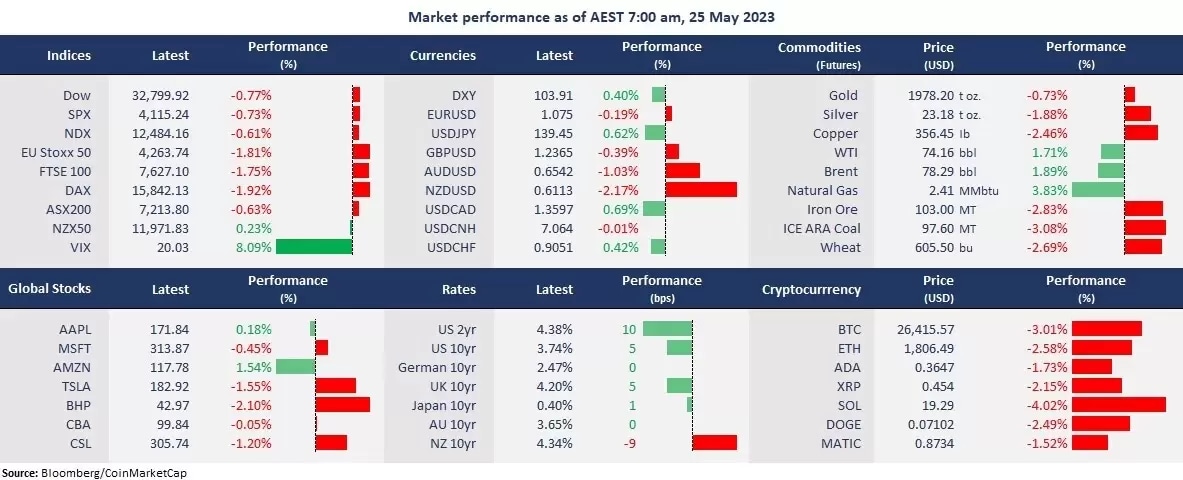

US stocks fell for the second straight trading day as debt talk gained no results only one week before the deadline. Sentiment soured amid rising default risk, sending cyclical stocks down on the economic uncertainties, with the volatility index jumping for 8% to above 20. The FOMC meeting minutes showed that members were split on whether to continue rate hikes, suggesting that the Fed was less confident about further tightening measures. However, the notable movements are in the climbing of US bond yields and the strengthening of the US dollar, which strongly indicates that the Fed may keep rates higher for longer, even though it may end a rate hike cycle in the coming month, and funds fly to the king dollar for safety.

By contrast, Nvidia’s shares soared 18% in after-hours trading following better-than-expected earnings reports due to strong demands in cloud computing and generative AI applications. The chipmaker also provided positive guidance into the current quarter. Nvidia’s jump may lead Nasdaq to gain further at the open in futures markets. AI-related tech shares across Asia will likely take a ride.

In commodities, base metals, such as copper, slumped further on the gloomy demand outlook due to the bumpy Chinese economic recovery. Gold was pressured by a firmed US dollar, and oil was still on a double-bottom reversal trend, mostly due to a technical dip-buy, and a draw in the US stockpile also added to the upside momentum.

Broad Asian markets are set for a lower open, with ASX 200 futures down 0.50%, the Hang Seng Index futures down 1.01%, and Nikkei 225 sliding 0.20%.

Price movers:

- 10 out of 11 sectors in the S&P 500 finished lower, with real estate and financials leading losses, down 2.21% and 1.31%, respectively. Energy is again the only sector that ended in the green, up 0.52% as oil prices extended gains.

- Nvidia blew away earnings expectations in the first quarter. The chipmaker reported earnings per share at US$1.09 adj. versus US$0.92 expected. The revenue was at US$7.19 billion vs. US$6.52 billion expected. Both its data center and gaming revenue beat analysts’ estimates. The company said the growth was driven by demands for GPU chips from cloud computing and generative AI applications. Nvidia expected 11 billion in revenue for the current quarter, well above an expected US$7.5 billion.

- Snowflakes’ shares slumped 11% in after-hours trading due to a guidance miss, despite a beat on earnings expectations. The cloud data platform provider reported earnings per share at US$0.15 versus US $0.05 estimated. The revenue was at US$624 million versus US$608 million expected. However, the company expected its product revenue to be at US$2.6 billion, lower than the consensus of US$2.7 billion for the fiscal year 2024.

- Chinese electric car marker Xpeng’s shares plunged 5% on the US markets amid a miss on earnings expectations. The company faced macro headwinds, and fierce competition from Tesla and BYD, reporting a 50% year-over-year decline in revenue and forecasted a drop in car deliveries to between 21,000 and 22,000 for the current quarter.

- New Zealand dollar tumbled 2.2% against the USD following the RBNZ’s dovish rate hikes. The bank raised the OCR by 25 basis points but signalled that its rate hike campaign might have ended. Read more.

ASX and NZX announcements/news:

- Fonterra (ASX/NZX: FSF) reported a profit after tax of NZ$1,326 million for the third quarter of FY23, up NZ$854 million annually, and announced an opening 2023/24 season forecast Farmgate Milke Price of NZ$7.25 to $8.75 per kgMS, with a midpoint of NZ$8 per kgMS. The company increased its full-year earnings guidance to NZ 65-80 cents per share from NZ 55-75 cents per share.

Today’s agenda:

- US Q1 GDP (second estimate)