Wall Street finishes lower as risk sentiment soured following Home Depot’s disappointing earnings report. The home improvement retailer’s shares fell 2% after posting the biggest revenue miss in more than 20 years and lowered its guidance for 2023 due to weakened consumer demands, dragging on other retailer’s shares, such as Target and Walmart, which will report their earnings later today. The US debt ceiling talks were still in a stalemate, adding to the downside pressure of equities, especially in those growth-sensitive sectors, including energy, industrials, and materials. By contrast, growth stocks continued to outperform in the down market, with Alphabet leading gains amid its newly released AI development in Google. The company’s shares have risen 10% since the announcement at its annual investor conference last week.

On the economic front, the US April retail sales came as weaker than expected, printing at 0.4% month on month versus an expected 0.8% increase. The data again suggest that consumer power abated at the back of the economic headwinds.

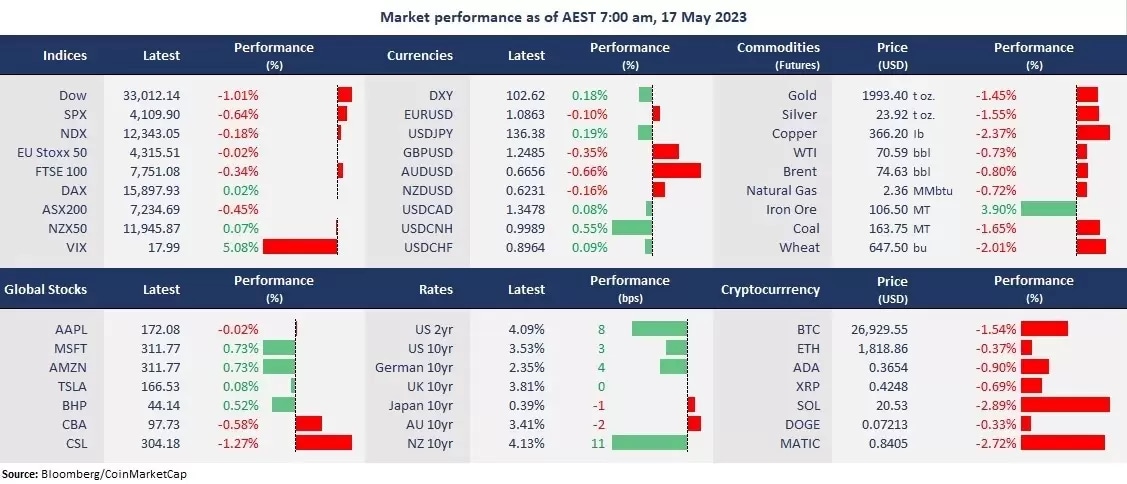

The US bond yields climbed for the third straight trading day and lifted the USD dollar higher, pressing on commodity markets in general. China’s weaker-than-expected economic data added to the selloff in metals and energy, sending copper and oil down.

Asian markets are set to open mixed, with the ASX 200 futures down 0.50%, the Hang Seng Index futures down 0.14%, and Nikkei 225 rising 0.17%.

Price movers:

9 out of 11 sectors in the S&P 500 finished lower, with energy and real estate leading losses, down 2.54% and 2.61%, respectively. Technology and communication services are the only sectors that ended in the green, buoyed by big tech companies.

- Amazon joined the generative AI race, planning to integrate a ChatCPT-like bot into its online store. The e-Commerce giant said it would plug an interactive conversational experience that helps users to answer questions and give personalized product suggestions. The new technology is similar to Alibaba’s Tongyi Qianwen, which was announced in early April.

- Home Depot’s shares fell 2% following the first quarter earnings report. The retailer reported earnings per share at $3.82 vs. $3.80 expected. The revenue was at $37.26 billion vs. $38.28 billion expected. The company expects sales revenue to decline between 2% and 5% for the fiscal year, down from a flat forecast previously.

- Tesla’s CEO Elon Musk expects the challenging economic environment to persist for the next 12 months. He believes that Tesla is well positioned during this period and Tesla Model Y will be the best-selling car globally this year.

- Chinese offshore Yuan tumbled to the lowest level against the US dollar since December 2022 following the disappointing Chinese economic data in April. USD/CNH rose to just under 7, a critical psychological resistance of the pair. The strengthened USD may be supported by risk-off sentiment broadly on Wall Street.

- Gold prices fell due to a firmed USD and a jump in the US bond yields. Gold futures fell nearly US$30 per ounce to 1,993, the lowest seen in early May. Gold may continue to retreat once breaking down the potential near-term support of a 50-day moving average at 1,970.

ASX and NZX announcements/news:

- No major announcement.

Today’s agenda:

- Japan’s Q1 GPD.

- Australian Q1 Wage Price Index q/q.