Last week, the US tech earnings, such as Netflix and Tesla, did not follow through with big banks’ strong performance, pressuring Wall Street, with the three benchmark US indices finishing the week lower. Both Dow and the S&P 500 snapped a five-week winning streak. The mega-cap companies, including Microsoft, Alphabet, Meta Platforms, and Amazon, will continue to steer market sentiment with their earnings reports this week. Plus, the US’s first GDP and PCE data are also a focus for investors to gauge the economic trajectory.

Elsewhere, China’s mixed economic data weighed on Asian markets last week. Australia’s inflation data and the Bank of Japan’s policy meeting will be in the spotlight this week, providing clues about major central banks’ policy path.

What are we watching?

- The US bond yields climbed further: US bond yields rose for the second straight week as Fed is expected to continue its rate hike cycle in May, which may strengthen the US dollar again, and press on commodity prices.

- Gold fell below 2,000: Gold futures finished under 2,000 last week, the first time since March. The strengthened US dollar and climbing bond yields started pressuring the precious metal again.

- Copper and Crude oil lost steam: The growth-sensitive commodities, such as copper and crude oil prices, fell due to risk-aversion sentiment as the weak US economic data and disappointing tech earnings sparked growth concerns. The stabilized US dollar and climbing bond yields also pressured commodity markets

- Cryptocurrencies declined sharply: Bitcoin fell 8.6% to under 28,000 from above 30,000, and Ethereum was down 11.8% to under 1,900 from above 2,100 last week as risk appetite faded amid a downbeat move in the US tech shares last week.

Australian markets

The ASX 200 was dragged by mining stocks due to a decline in raw material prices, such as copper and iron ore. BHP’s shares fell 2.5%, and Rio Tinto slid 2.9% weekly. 5 out of 11 sectors finished lower last week, with energy and materials leading losses, both down more than 2%, while banking stocks buffered a broad selloff in the ASX following Wall Street’s moves.

The Australian dollar declined against the US dollar but strengthened against the New Zealand dollar. Commodity currencies were under pressure in general as the greenback showed signs of rebound due to rising US bond yields. The New Zealand dollar fell after the country reported cooler-than-expected first-quarter CPI data.

The Australian first-quarter inflation is the most influential economic data this week. A further decline in the headline CPI may reduce the pressure of the RBA on rate hikes and send the Aussie dollar lower.

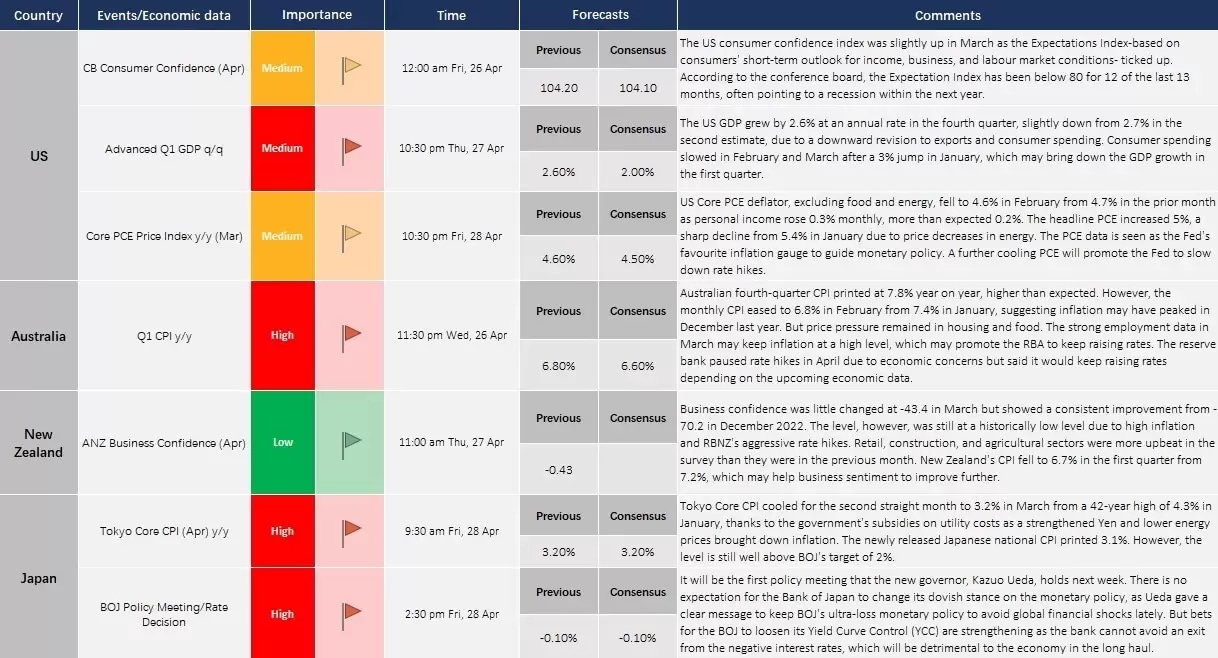

Economic Calendar (24 April – 28 April)