The NZ election is only weeks away, and the latest Newshub-Reid Research poll shows that the National Party is at 39.1%, the Labour Party is at 26.5%, and the Green Party is at 14.2%, pointing to a better chance for a National win, though the result can be complicated, with New Zealand First rising to be above the 5% threshold to be able to enter the Parliament. From a financial market perspective, investors will focus on how the result potentially impacts the New Zealand stock market and the Kiwi dollar. Below are the possible market trends that could be shaped by the election results based on historical stats and from macro views.

The NZX may perform better over the period of a national-led government

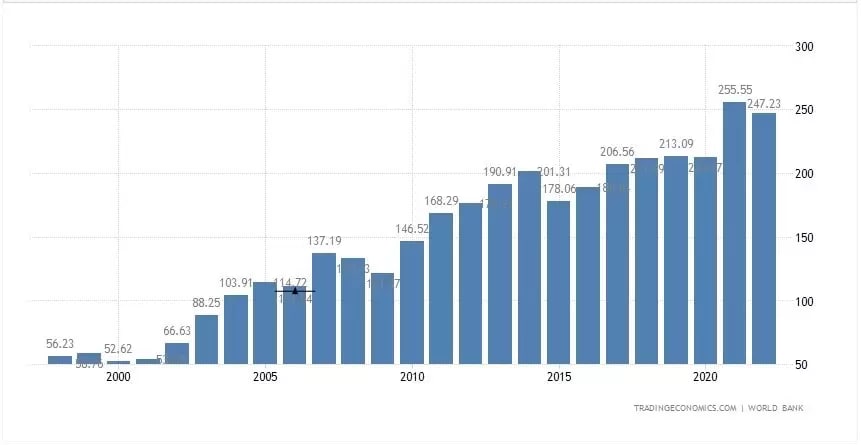

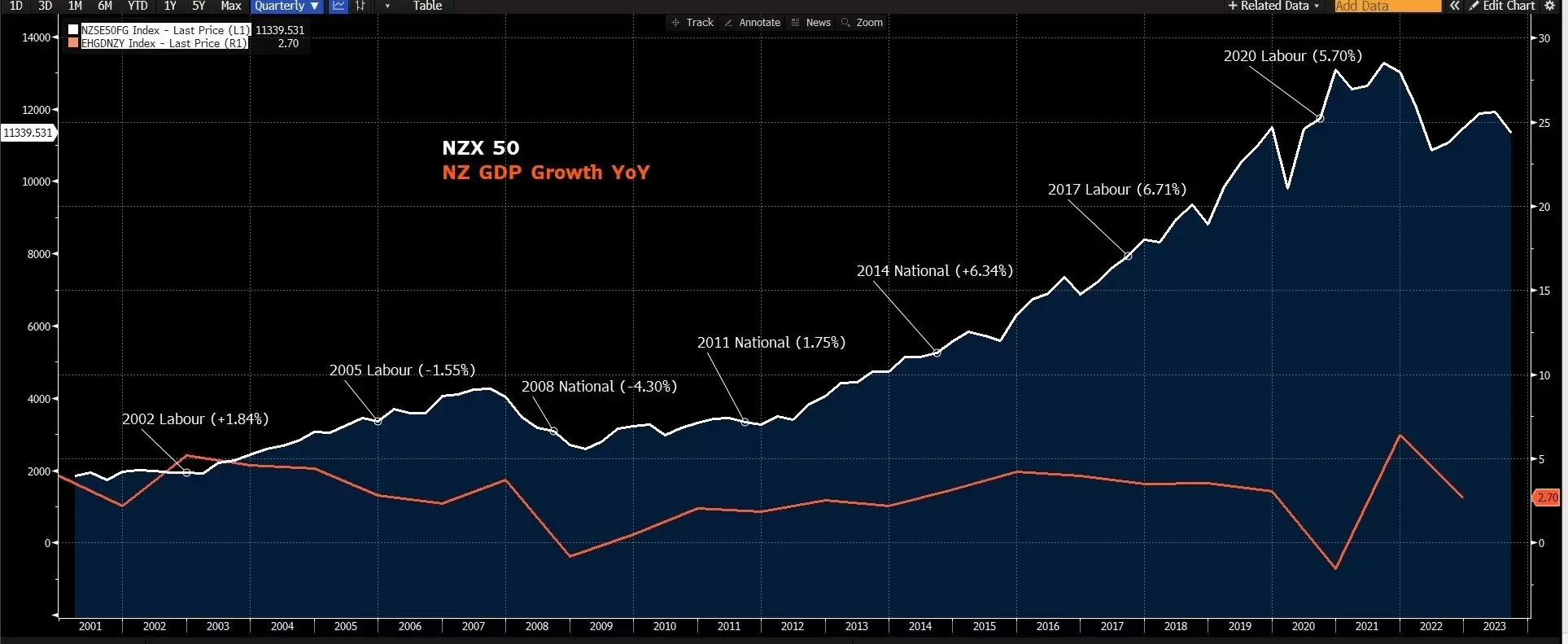

National won 6 times, and Labour won 5 times in the past 11 elections since 1990. The NZX 50 rose 3.8% on average following a National win in the 3 months post-election, and it fell 0.2% on average during the same period following a Labour win. In the longer term, the NZX 50 rose about 6.2% on average over the period of a National-led government, while the index rose 1.2% on average over the Labour Party’s governing term. These stats suggest that the local stock markets are more cheerful for a right-wing-led government whose policy is usually more pro-economic growth. In history, New Zealand’s GDP jumped to US$201.31 billion in 2014 from a trough of US$121.37 billion in 2009, over the period when the National was the leading party. In the meantime, the GDP growth was much flatter over the period of a Labour Party-led government.

However, this stock market performance pattern does not necessarily apply to the period from the election day to year-end, as the immediate market reaction can be impacted by other factors such as the central bank’s monetary policy, transitionary uncertainties, and liquidity conditions. Since 2022, National has won 3 times, and Labour has won 4 times in the past 7 elections. The average performance of the index is a 1.3% increase for National victory and a 3.2% rally for labour from the election day to the end of that year. But this concludes that elections tend to boost the stock market in the short term, whichever party wins the election.

The NZX performance from election day to the year-end (2002-2020) vs. NZ GDP growth YoY

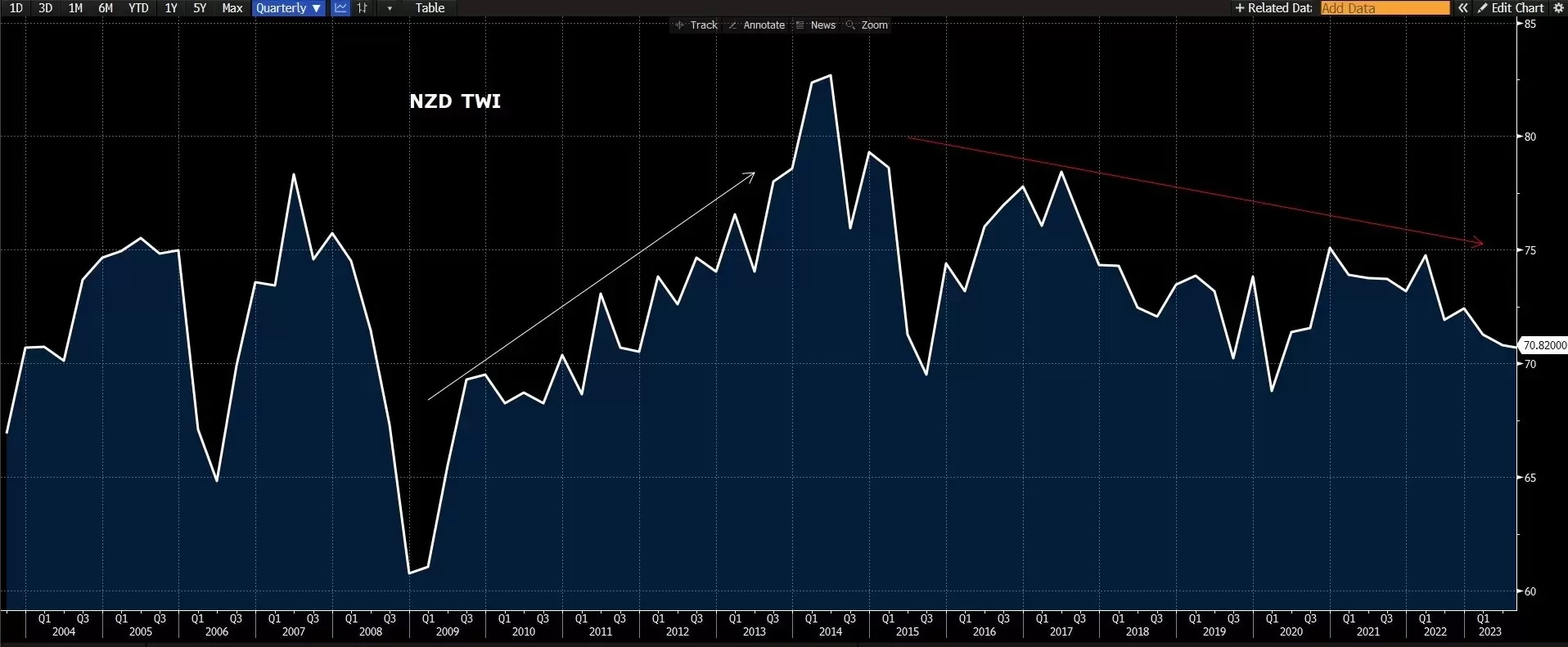

A National win may strengthen the Kiwi dollar

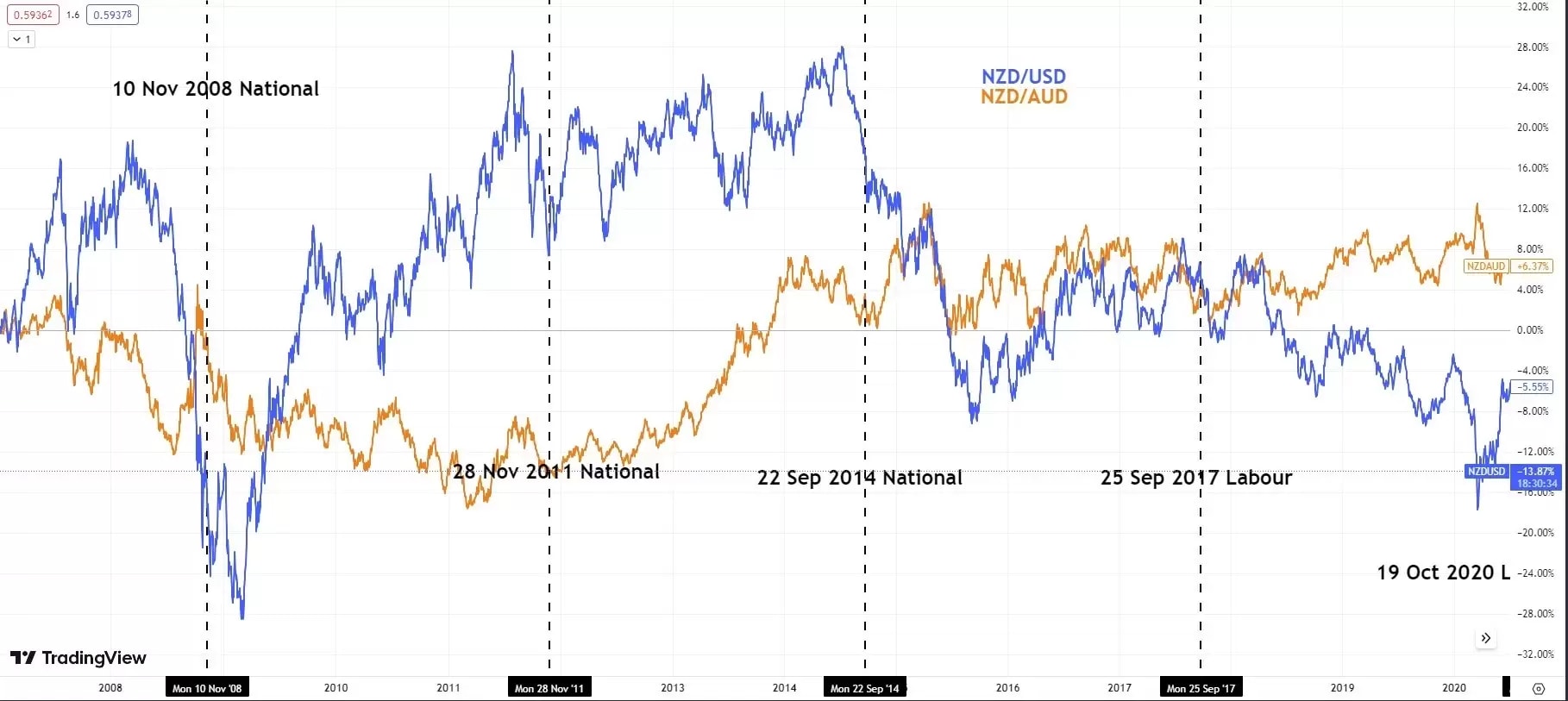

A National win tends to hold the New Zealand dollar’s strength as the party’s policy is more pro-growth and boosts business and investment confidence, in turn firming the local currencies. The NZD Traded Weighted Index was on the rise over the period when the national party took the lead in government from 2008 to 2017, and the index has weakened since Labour won the election at the end of 2017. The US dollar and Australian dollar have the biggest weight on the NZD TWI, which shows similar trends against the Kiwi dollar during the same time frame.

However, global markets have a major impact on the local currency at the same time. The New Zealand dollar is usually seen as a risky currency vulnerable to global risk sentiment. The New Zealand dollar weakens during a Fed rate hiking cycle, and vice versa. A strong US dollar usually causes a slowdown in international trade due to the tightened market liquidities, which can be felt since 2022, when most central banks started their aggressive monetary tightening policies.

In history, the New Zealand dollar usually weakened in the week following the election due to uncertainties. Since 2008, the Kiwi dollar only strengthened against the US dollar in the first week after the National won election in 2011. The dollar weakened straight after the election day for the rest of the past seven elections.