The Fed will announce its rate decision for the third time this year tomorrow morning in the APAC time . While the reserve bank is widely expected to raise the interest rate by one more 25 basis points before a pause, investors seem to get prepared for a rhetorical shock by fleeing to safe assets. Well, you may not need to be so worried about the Fed decision this time as the reserve bank has scaled back its hiking pace to 25 basis points since January. And it would be a bad decision to insist on aggressive rate hikes amid the recent banking crisis as depositors have started the early stage of a “bank run”. The recent practice of big banks’ takeover of small banks is not a good sign for the wider banking system and the broad economy, as soured sentiment is a crucial issue that erodes trustworthiness toward banks. And it is the reason why gold and alternative assets, such as cryptocurrencies, popped recently. Funds start flowing into cash-rich big-cap companies and fleeing away from those debts-heavy small-caps. In the below discussion, I displayed some charts to illustrate the major trends in the markets.

Fed’s possible capitulation in inflation fights

A slowdown in rate hikes and a reverse balance sheet unwinding could tell the Fed has already considered capitulating its inflation fights. Since March, the US Federal Reserve’s balance sheet has reversed most of its reduction amounts from the last few months due to the SVB’s fallout. The Fed launched a program to backstop deposits using the emergency lending authority through secondary credit, which aimed at troubled banks. Its balance sheet swelled back to $8.73 trillion from $8.34 trillion from 12 March to 21 March. The regional banking rout seems to have ended the Fed’s balance sheet reduction progress or at least a significant disruption. With the US soon hitting the debt limit again, it is unlikely for the Fed to carry on its dedicated approach to fighting inflation as the tightening policy has taken effect in cooling consumer prices in the last 9 months.

Source: US Federal Reserve

Stock markets may not be in a hurry to return to a bear market

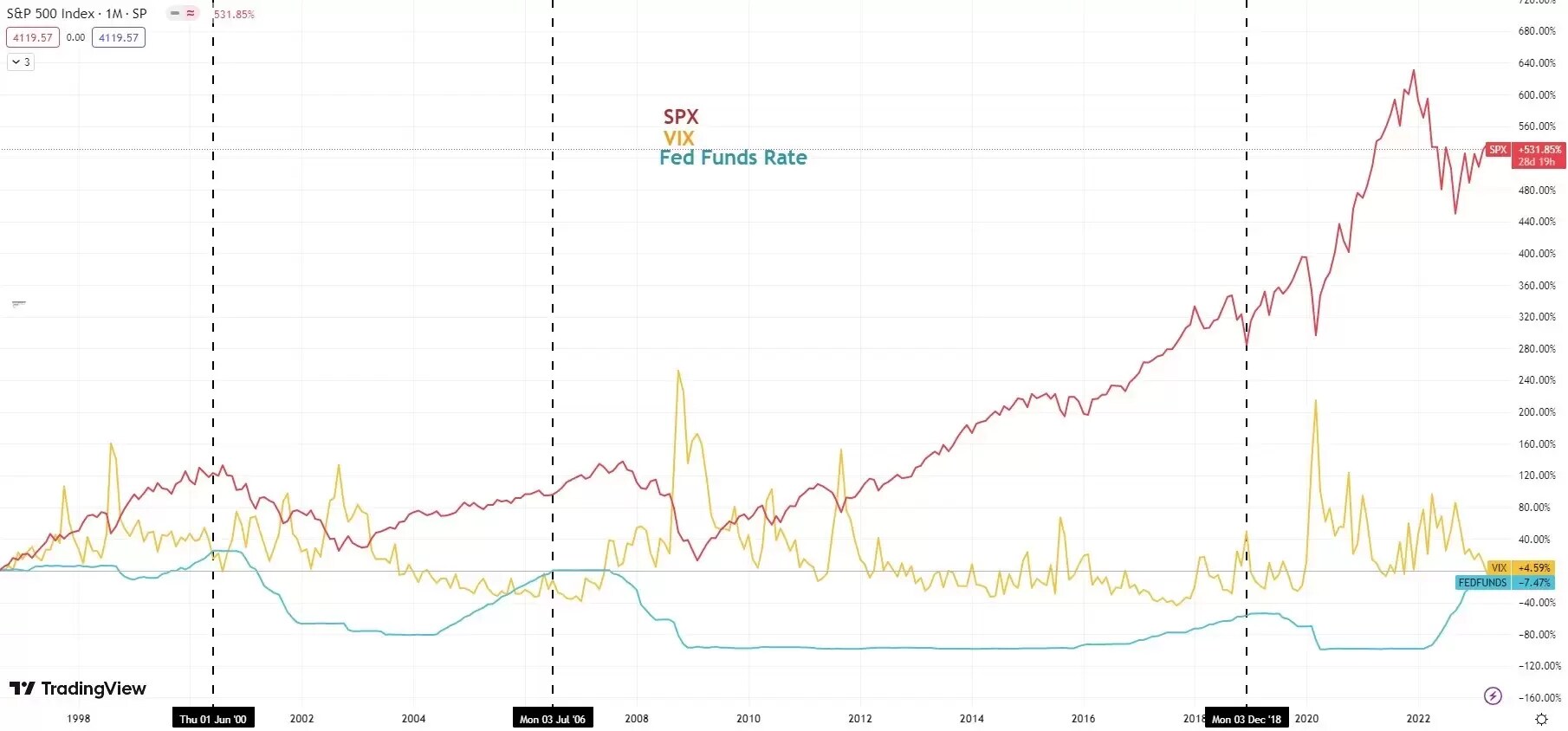

Source: TradingView as of 3 May 2023

Despite the recent selloff, the US stock markets could maintain their upside momentum as the Fed’s capitulation may spark a relief rally on Wall Street since an economic recession is unlikely to be imminent. If Fed pauses rate hikes from June, it could hold the rate at such a high level for the rest of the year till inflation cools to 2% or a recession-induced economic downturn. The CBOE Volatility Index is also garbling at a relatively low level, suggesting risk appetite stays strong.

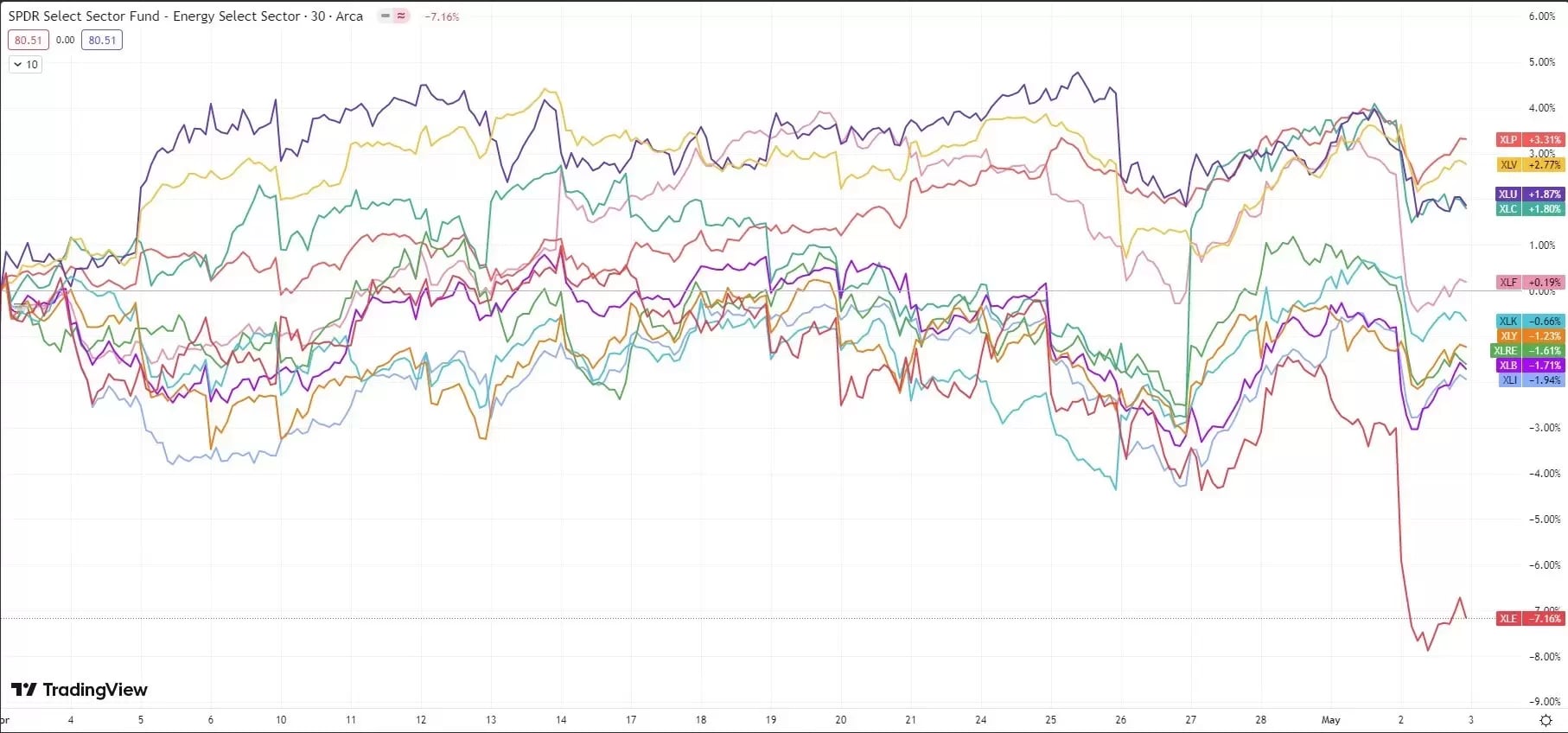

Funds sought safety

The notable trend is that investment funds started flowing into big-cap stocks for safety since early March, which can be seen in the contrasting moves between the SPDR S&P 500 ETF Trust (SPY) and the small-cap stocks, iShares Russel 2000 ETF (IWM). The flow can also be noted in the recent strong performance in the US big techs and banks versus small startups and reginal banks.

Another observation is that funds favour defensive sectors, such as consumer staples(XLP), healthcare(XLV), and utilities(XLU), but flee away from cyclical sectors, including energy (XLE), industrials (XLI), and materials (XLB).

Gold could continue to refresh highs on the USD’s weakness

Based on the above narrative, a dovish Fed is likely to send the US dollar lower and continue to lift gold prices, as seen in the above chart. Gold is also one of the typical haven assets that endure a crisis.

Bitcoin is on the rise

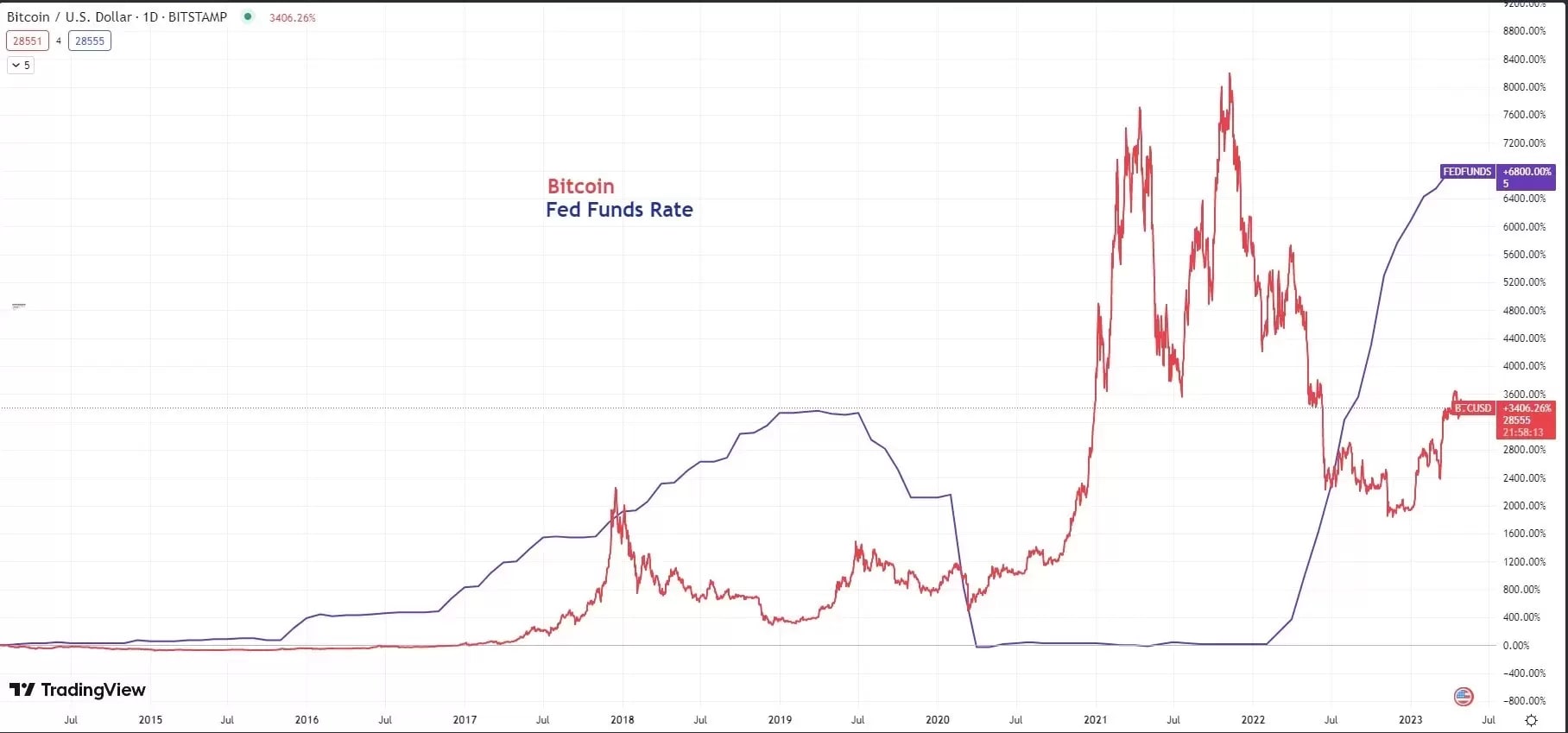

Source: TradingView as of 3 May 2023

Cryptocurrencies usually benefit from a relaxed liquidity environment, with Bitcoin jumping 40% since the SVB’s rout. The reason behind it is that Fed’s emergency lending facilities may have marked a new chapter of cash tap. Bitcoin rose when Fed held on rates, as illustrated in the above chart.