US February consumer price index (CPI) data might be overshadowed by the ongoing banking rout, but it will also distract investors from the current market fizz. The headline US inflation rate is expected to further cool down to 6% from 6.4% in January, which may support the Federal Reserve in slowing down rate hikes at next week's meeting.

However, the SVB and Signature Banks’ collapse rings a louder bell to the Fed, with analysts now seeing a pause or at least a slowdown in rate hikes from the March meeting. The upcoming inflation data will be most likely to show a further slowdown in consumer price increases, after the recent non-farm payrolls data showed a pickup in the unemployment rate and a slowdown in wage growth.

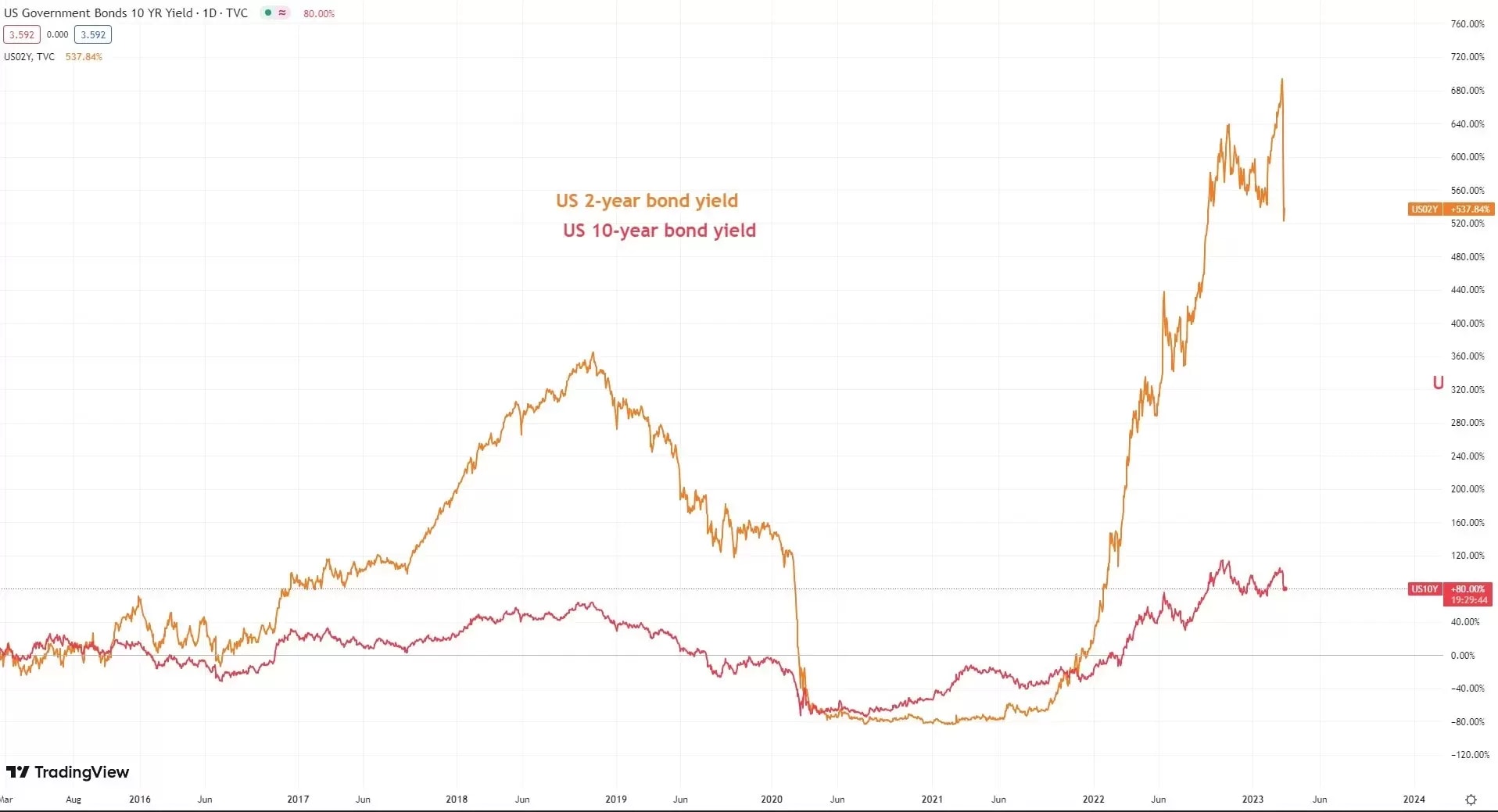

US bond yields tumble

US bond yields sharply retreated after SVB’s fallout rattled financial markets, with the Fed rate-sensitive 2-year yield bond plunging 100 basis points in the last three trading days, suggesting markets strongly project a pause in Fed’s rate hikes in the March meeting.

Cooler CPI data will certainly further boost investors’ policy optimism and lift markets further, assuming that there will not be a further contagious effect from SVB and Signature Bank’s failures.

Tech stocks are resilient amid Fed bets

Another observation is that the tech stocks hold strong as investors expect the Fed to pivot sooner than previously projected amid the current banking stock rout. The tech-heavy index, Nasdaq, outperforms both Dow and S&P 500 since January this year. The below chart also illustrates that the index tends to continue to climb higher during the period when Fed hold the rate at its peak before a sell-off when the Fed starts cutting rates.

So, what stage is it for inflation, a rate-hike cycle, and a stock market trajectory? US inflation hit a peak of 9.1% in June 2022 and has slowed for seven consecutive months, to 6.4% in January this year, though CPI was hotter than expected in January. Another cool down in inflation is likely to see the Fed further slow down its tightening steps.

Plus, the US bank failure may bring the Fed pivot forward, or we can say that the central bank is very close to a pause in rate hikes. Stock markets will probably have another ride of the policy pivot before a crisis-driven sell-off.

Possible 10% volatility in the Nasdaq amid US CPI

The Nasdaq is being supported by the 200-day moving average at around 11,880. A further cooling in US CPI may take the index to rebound and test the high in February around 13,000, or about a 10% rally if the Fed meets market expectations to pause rate hikes in March. On the flip side, sticky CPI data may cause a further sell-off and send the index lower, to between 10,636 to 11,000.