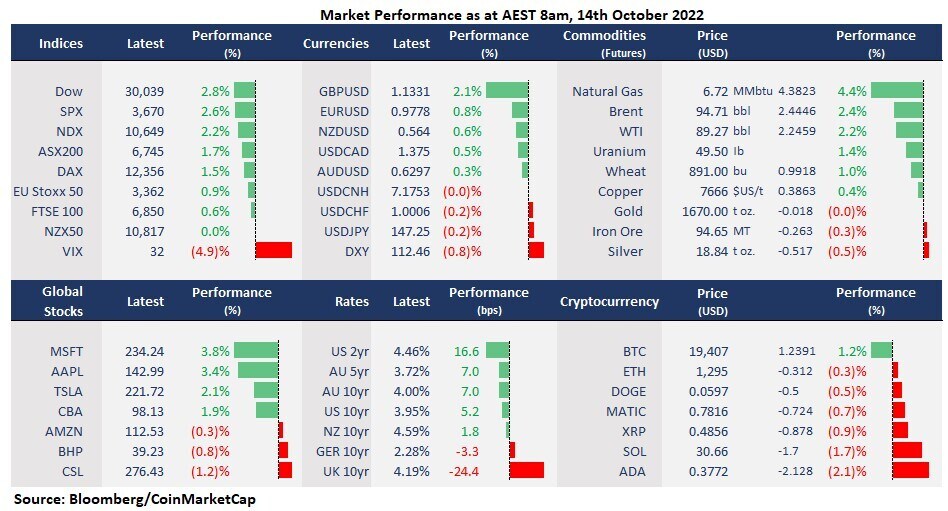

Wall Street reversed early losses and sharply rebounded on the hotter-than-expected CPI data. The US headline inflation printed at 8.2%, higher than an estimated 8.1%, and the core CPI excluding food and energy came in at 6.6%, above the consensus of 6.5%, which is also the highest since 1982. However, the broad equity markets reversed early losses and rallied into the close as the sharp decline throughout September may have already priced in high rates and Fed’s 75 basis points rate hike in November. The 10-year bond yield retreated from the day-high at 4.06% to 3.95%, while the US dollar index fell 0.75% to 112.37, and the British Pound jumped 2% against the dollar on news that the UK government may reverse parts of its tax-cutting plan. However, the CBOE fear gauge, the VIX, stayed above 30 at a relatively higher level, suggesting that further volatility is ahead.

- Dow swung 1500 points in a single day movement, up more than 800 points, or 2.83%, closing at the session high. S&P 500 rose 2.6% and Nasdaq jumped 2.23%. All the 11 sectors in the S&P 500 finished higher, with energy and financials leading gains, both up more than 4%. The tech sector also performed strongly as chip stocks, including Nvidia and Intel, rebounded more than 4%. Most mega-cap tech giants were higher.

- JPMorgan Chase, Citigroup, Wells Fargo, and Morgan Stanley are all up between 3-5% ahead of their earnings later today. It is expected that JP Morgan’s commercial loans grew in the third quarter, with an expectation for the EPS at $2.88, up from $2.76% in the second quarter.

- Netflix’s share jumped 5% on an announcement that the company will start charging $6.99 per month for its ad-supported tier starting on 3 November, ahead of its third-quarter earnings report next week.

- Apple and Goldman Sachs launched interest-bearing savings accounts with the aim of increasing iPhone users. Apple announced a buy-now and pay-later feature in its Apple Pay earlier this year, marking the tech giant to enter the Fintech business.

- British Pound jumped 2% against the US dollar on a report of Sky News that the UK government is in talks to scrap part of its tax cut proposal. The UK 10-year gilt yield jumped to 4.41% before falling to 4.19% on the news.

- The Japanese Yen is the only major Asian currency that finished lower against the US dollar after the BOJ governor confirmed to keep the ultra-loss monetary policy a day ago. The USD/JPY rose to 147.20 at AEST 8 am after hitting a fresh 24-year high at 147.97.

- Asian markets are set to open higher following Wall Street’s turnaround. ASX futures were up 1.66%. Nikkei 225 futures jumped 2.25% and Hang Seng Index futures rose 1.66%.

- Crude reversed the last three-day losses on a softened US dollar and a rebound in broad risk assets. Traders’ focus shifted back to OPEC +’s outsized output cut after the International Energy Agency warned of a global economic recession that may be accelerated by the elevated oil prices.

- Bitcoin bounced off a session low of the key support at just above 18,000, suggesting traders continue betting on a bottom price at this level.