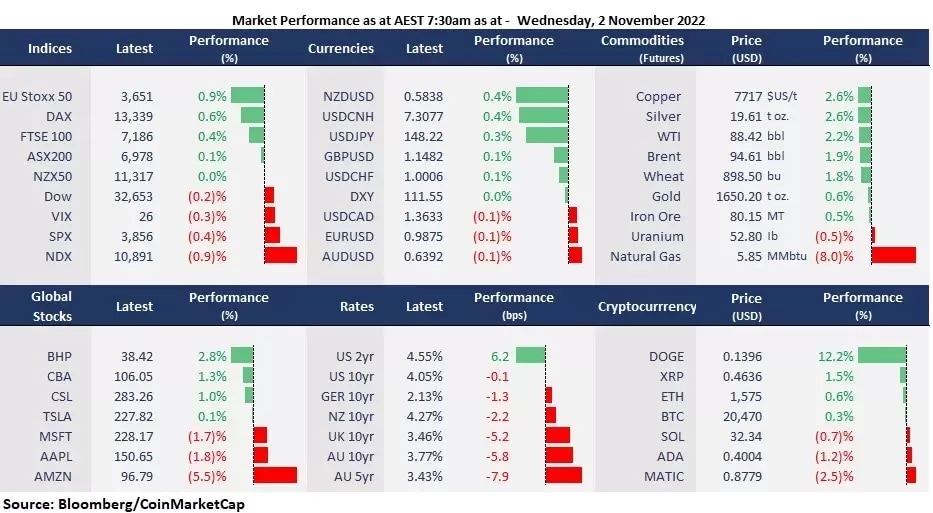

US stocks fell for the second straight trading day as the September job opening data came as stronger-than-expected, which strengthens the odds for the Fed to continue its aggressive tightening monetary policy. The US ISM Manufacturing PMI printed at 50.2, better than an estimated 50.0, but still at a two-year low level. While the US 10-year bond yields fell slightly to 4.05%, the US dollar index anchored above 111. The Fed is expected to raise the interest rate by another 75 bps, taking the funds rate to 4% tomorrow, but whether it will signal a slowdown from December remains a focus.

- Growth stocks remained underperformed, with Nasdaq down 0.89%. 6 out of the 11 sectors in the S&P 500 finished lower, with Consumer Discretionary and Communication Services leading losses, both of which were down more than 1%, while the energy sector outperformed again, up 1%. Both Amazon and Alphabet fell to a 52-week low due to the selloff in the tech sector, and Apple slip 2%, sliding for the second straight trading day due to production concerns. Meanwhile, Meta Platforms and Snap jumped more than 2% and 3%, respectively, on a report that the FCC commissioner calls on the government to ban TikTok.

- Uber’s shares soared 15% due to a beat on the revenue expectation, along with positive guidance. The company reported EPS at 61 cents loss and revenue at $8.34 billion, or a 72% growth year over year. It had a net loss of $1.2 billion in the third quarter, with $512 million due to revaluations of its equity investments. CEO Dara Khosrowshahi expects a strong October due to booming travel, easing lockdowns and shifts in consumer spending.

- AMD slightly missed the third-quarter revenue expectation due to weakened PC demands. The chipmaker’s EPS came to $0.67, less than an estimated $0.68. And the revenue is at $5.6 billion, lower than the $5.65 billion expected. Its share prices fell slightly after-hours as the company preannounced its miss on revenue earlier in October. And its strong gaming and data centre revenue has offset the PC slump.

- Bank of England smoothly commenced its quantitative tightening by selling £750 million worth of bonds, with the 10-year gilt yields falling slightly to 3.46%, suggesting that the government bonds are still in strong demand.

- Chinese stocks soared on the unofficial social post of Covid-Zero-Exit, with Hang Seng Index surging more than 5% on Tuesday. All the Chinese tech shares, including Alibaba, Baidu, JD.com, Tencent, and Meituan jumped between 7-11% at HKEX.

- Asian markets are set to open mixed ahead of the Fed’s pivotal event. ASX futures were up 0.07%. Nikkei 225 futures were down 0.47% and Hang Seng Index futures fell 0.30%. The Reserve Bank of Australia rose the OCR by 25 bps to 2.85%, warning higher-for-longer rate hikes to come amid sticky inflation on Tuesday.

- The WTI futures jumped 2% on speculation of China’s Covid-Zero-Exist, along with better-than-expected Chinese Caixin manufacturing PMI data. Hope for the Fed to slow down rate hikes also supported rebounding optimism in the oil markets.

- Dogecoin soared another 10% following a 47% surge a day ago amid Elon’s takeover of Twitter. Both Bitcoin and Ethereum were slightly up, to just above 20,500 and 1,570, respectively.