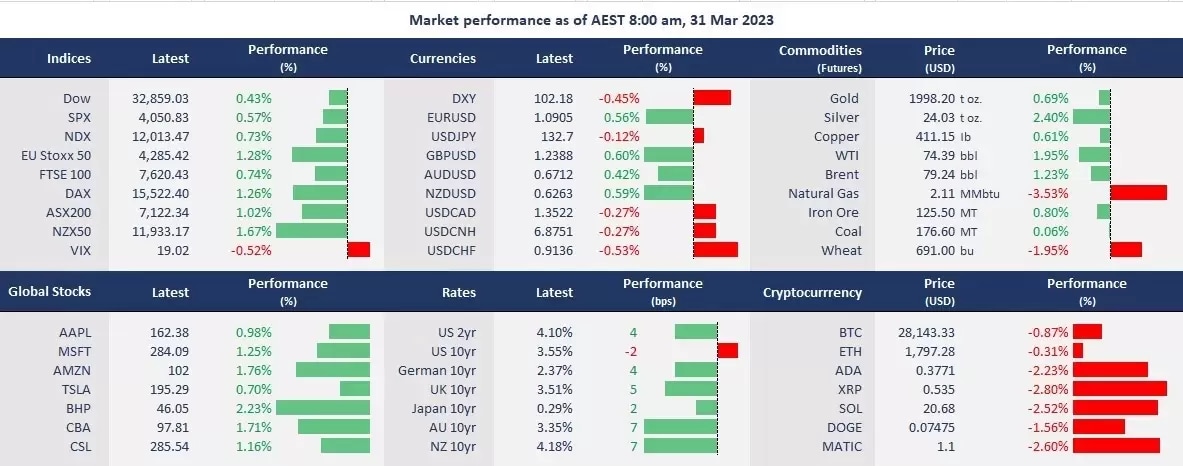

Risk-on continued to lead Wall Street to gain, with tech and real estate outperforming broad markets for the second session as rates stabilized. The US stocks are heading off a positive print for March ahead of the key inflation gauge, the US PCE deflator due for release later today, when the data is expected to cool further, paving the way for the Fed to scale back its monetary tightening process.

On the economic front, the US final Q4 GDP is revised to 2.6% from the first two estimates of 2.7% and 2.9%, respectively. The jobless claim rose by 7,000 to a three-week high of 198,000. “Bad news” is “good news” now as dip-buyers may focus on the Fed policy optimism following the bank crisis.

Notably, the Chinese markets flew again following Alibaba’s split, with its $20 billion logistics arm preparing for an initial public offering in Hong Kong. JD.com is also catching up with the trend, filing for its two units’ debuts.

Equity markets across Asia are set to open mixed. ASX futures were up 0.51%, Hang Seng Index futures were down 0.26%, and Nikkei 225 futures advanced 0.50%.

Price movers:

- 10 out of the 11 sectors in the S&P 500 finished higher, with the most rate-sensitive segments, real estate and technology stocks leading gains, both up more than 1%. Financials is the sector that ended in the red as fears of the bank crisis continued to weigh.

- Tesla plans to build a battery plant in the US, partnering with CATL, a dominant Chinese manufacturer specializing in lithium iron phosphate. Tesla faces fierce competition from both domestic and Chinese rivals and is eager to cut costs and pump up production.

- The Chinese EV maker NIO’s ADR shares jumped 6% following the news that the company is partnering with Norwegian smart-energy provider Tibber “in order to offer complementary smart charging solutions to NIO users in Norway, Germany, Sweden, and the Netherlands.”

- The US ADR shares of Alibaba and JD.com rose 3.5% and 7.8%, respectively, after the two Chinese tech empires announced preparing to debut their business units on the Hong Kong stocks exchange. The ramp-up in the Chinese IPOs may signal that the Chinese government will start to relax its scrutiny of the tech sector after a lengthy regulatory overhaul.

- Commodities, including gold and oil, rose in general due to a further drop in the US dollar. Gold futures rebounded towards the 2,000 level again but may face a near-term pullback risk as the precious metal is technically overbought. Watch the trending video

- The oil futures rose for 3 out of the last four sessions as the bank-induced recession fears eased, and supply concern may become a concern again.

- Bitcoin topped 29,000 before falling to just above 28,000. The leading cryptocurrency also shows signs of being overbought, but its rebound trend is still intact. Watch the trending video

ASX and NZX announcements/news:

- HMC Capital has completed a $125 million placement for $3.5 a share. Trading is expected to resume today on the ASX.

- Bravura Solutions's chairman, Nei Broekhuizen, is to retire. Andrew Russel is appointed as interim chairman.

- Rio Tinto and First Quantum Minerals are entering a joint venture to unlock the La Granja copper project in Peru, with First Quantum acquiring a 55% stake.

- Civmec wins $100 million worth of contracts for manufacturing, construction, and maintenance activities for Albermarle and Fortescue Metals Group.

Today’s agenda:

- Tokyo Core CPI for March y/y. Japan’s national CPI cooled further to 3.3% in February, a sharp decline from 4.3% in January. The data is expected to slow further to 3.1% in March,

- China’s NBS manufacturing and services PMI for March. The country’s economy accelerated its recovery pace since January, but the data may show slightly fewer monuments in March.

- The US PCE for February.