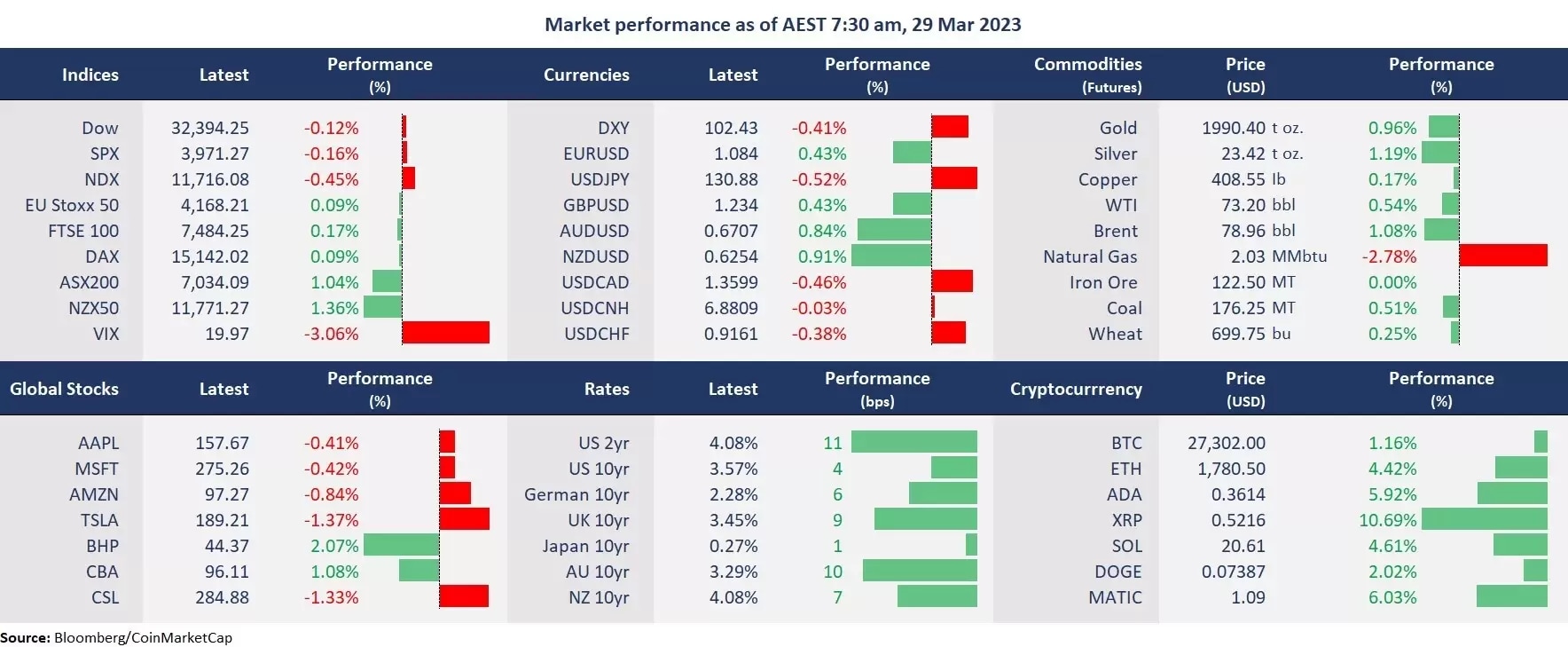

US stocks fell as rates rose for the second straight trading day, with the US 2-year bond yield up 11 basis points to 4.08%. The banking worries eased further following the First Citizen’s takeover of SVB’s deposits and loans. However, the US dollar continued to fall, on a strong expectation that the Fed will have to scale back on the tightening process. Commodities generally rose due to a softened US dollar, with gold and oil futures finishing higher.

In Asia, Chinese shares jumped at Alibaba’s announcement to split the organization into six business units, sending all the other well-known Chinese techs higher, with the Hang Seng Index up 1.11% on Tuesday. The region’s futures point to a higher open today because of the robust BYD Q4 earnings result, which may further push up the EV sector stocks.

ASX futures, however, are set to slip as futures were down 0.37% following Wall Street’s retreat, and Nikkei 225 futures fell 0.11%.

- 7 out of 11 sectors in the S&P 500 finished lower, with growth stocks leading losses. The communication services stock lost 1.02%, while the technology sector fell 0.46%. Energy shined again, up 1.45% on the rebound of oil prices. Industrial and materials also performed well as risk sentiment recovered further.

- Apple launches Apple Pay Later, allowing users to split their payments into four installments over six weeks. Individuals can apply for loans of between $50 and $1,000 without interest and fees. The tech giant’s shares fell for the second straight trading day due to a broad selloff in tech, testing near-term support of $156 per share. The Pay Later rival, Affirm, slumped 8% following the news.

- Alibaba’s ADR shares soared 14% on the US markets after the company announced to split the group into six business units, with the potential to spin off and go public separately. The action may pave the way for other big Chinese techs like Tencent and Baidu. Baidu’s shares rose 5%, and JD.com was up 4%.

- Tesla’s Chinese rival BYD’s net income surged 446% to 16.6 billion yuan ($2.4 billion), topping analyst estimates. The Chinese EV maker sold 1.86 billion cars in 2022, more than the previous four years combined. Before the earnings report, the company’s shares were up 1.7% in the Hong Kong stock market.

- Crude oil extended gains after a 5% jump on Monday as the risk-on momentum continued. Traders are awaiting the US crude oil inventories data later today. The stockpile is expected to rise for the third consecutive week. The Chinese manufacturing PMI data that is due for release on Friday will also be on close watch to provide clues on the oil market’s demand outlook.

- Gold futures rebounded as the US dollar dropped. The precious metal, however, may face a near-term pullback risk due to a rebuild in rates and a recovery in the risk sentiment

Today’s agenda:

- The Australian CPI data will be on close watch today. It is expected that the country’s inflation has hit a peak since it reported a cooler-than-expected CPI of 7.4% in January. Consensus calls for a 7.1% increase annually for February.

ASX and NZX announcements/news:

- The Western Australian lithium producer Liontown’s shares soared 65% on Tuesday after the company declined a $5.5 billion, or $2.5 per share bid from the New York-listed Albemarle. Liontown is apparently seeking a $3 per share deal.

- The Reserve Bank of New Zealand is seeking feedback on proposed new guidance for the financial sector amid the recent bank turmoil globally.