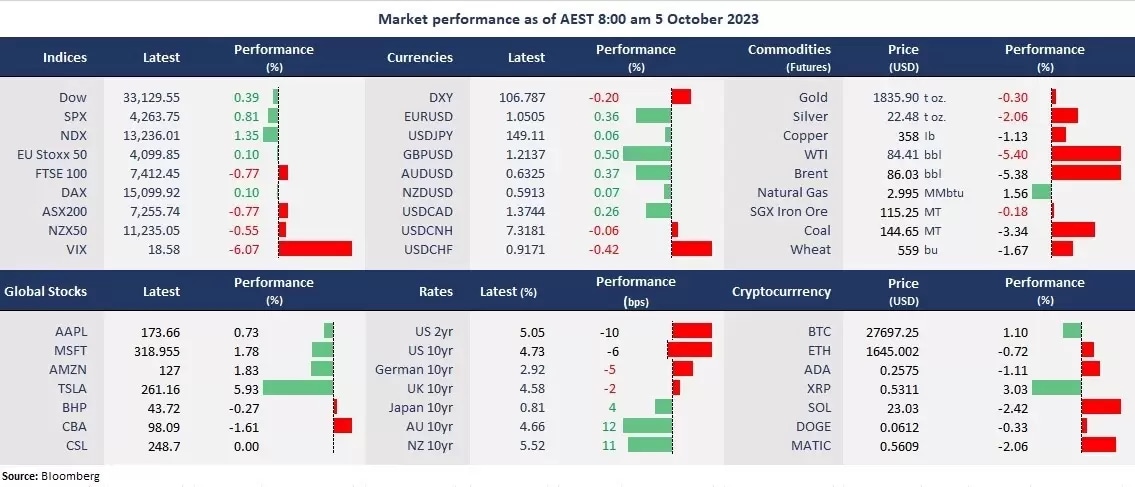

Wall Street rebounded as bond yields pulled back from 16-year highs following weaker-than-expected US ADP job data, implying a slowdown in the labour market ahead of the non-farm payroll release on Friday. At the same time, crude oil prices plummeted due to economic uncertainties after the OPEC + alliance decided to keep the current output cuts to the end of 2023. The oil plunge provided markets with a reprieve by easing inflationary concerns. “Bad news is good news,” as both the economic front and the plunged oil prices may promote the Fed to moderate its hawkish stance on rate hikes. Notably, most mega-cap tech stocks rebounded, while the energy sector slumped. The sector rotation may indicate a potential reversal trend for October.

In the APAC region, both the RBA and the RBNZ decided to hold their OCRs on economic concerns but signalled to keep the interest rates at a restrictive level for a longer period. The central banks’ decisions may have provided relief to the respective stock markets but pressured the local currencies. Futures point to a higher open across the APAC region. The Nikkei 225 futures were up 1.6%, the ASX 200 futures rose 0.36%, and Hang Seng Index futures fell 0.18%.

Price movers:

- 9 out of 11 sectors in the S&P 500 finished higher, with Consumer Discretionary, leading gains, up 1.97%, supported by Tesla. Other growth sectors, such as Technology and Communication Services, also rebounded from the slump in the previous day, up 1.25% and 1.28%, respectively. By contrast, energy stocks were the laggards, down 3.36%, due to a slump in crude oil prices.

- Tesla jumped more than 5% and closed above the 50-day moving average amid the broad tech shares’ comeback. Tesla reported a third-quarter delivery number that disappointed investors. However, the EV makers maintained its guidance for a 1.8 million delivery target in 2023, which indicates a rebound in car production in the fourth quarter, coupled with optimism towards its Cybertruck launch.

- Crude oil prices tumbled more than 5% after OPEC+ decided to keep the output cuts to the end of 2023. The decision was widely expected, but the recent data shows that the organization’s output volume rose for the second month in September after hitting a more than two-year low in July. Uncertainties around the global economy and the transition to EVs may shrink fuel demand from 2024 onwards.

- The US dollar weakened against most other G-10 currencies but was sightly higher against the Japanese Yen. The BOJ did not seem to intervene in the exchange rate after USD/JPY touched 150 on Tuesday. However, the 10-year JGB rose to 0.81%, the highest since August 2013, indicating another BOJ’s policy tweak may be near.

ASX and NZX announcements/news:

- No major announcement.

Today’s agenda:

- New Zealand Commodity Prices (Sep) m/m

- Australia Trade Balance (Aug)

- Japan 30-yr Bond Auction

Maximize your potential gains! Take immediate action and seize the investment opportunities that await you. Login to the platform now!