US stocks bounced off session lows and finished lower after the two-day strong rally as the US economic data, including the US ISM services PMI and ADP non-farm payroll, offered strong prints overnight, sending bond yields higher, with the 10-year US Treasury yield up 11 bps to 3.74%. Despite a jump in rates across the board, Wall Street seems to be digesting another supersized rate hike of 75 basis points by the Fed in November from the first three-day resilient moves. For now, traders may look ahead to the September job number that is due for release on Friday, where a slowdown in hiring may further boost the rebounding optimism.

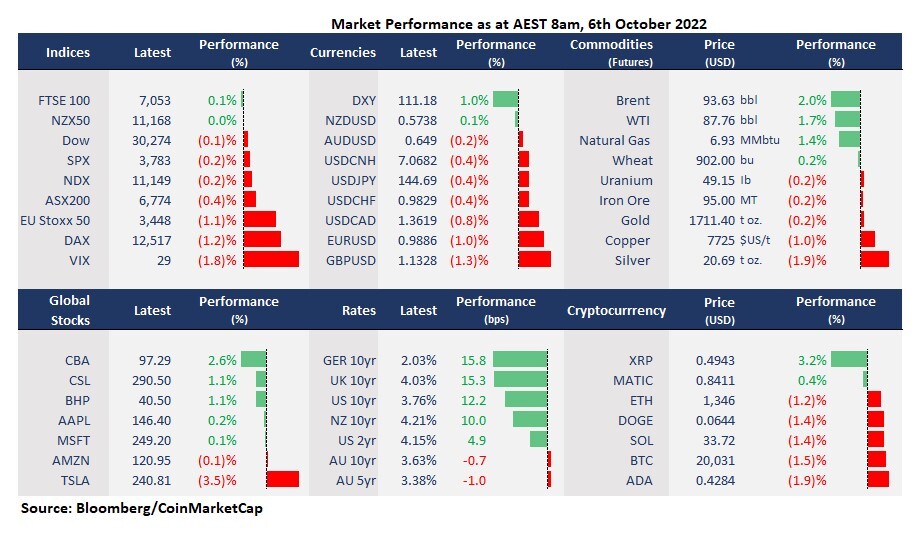

- Dow fell 0.14 %, S&P 500 was down 0.2%, and Nasdaq falls 0.25%. 8 out of 11 sectors in the S&P 500 finished lower, with Utilities and Real Estate leading losses, down 1.92% and 2.38% respectively. Energy outperformed for the third consecutive trading day, up 2.06%.

- Tesla’s shares fell 3.6% after CEO Elon Musk revived the $44 billion deal to buy Twitter. Musk tweeted that the social media may become an “everything app” after he took it private, a similar magnitude as the Chinese super app, WeChat that owned by the tech giant, Tencent.

- Weak September service PMIs in Europe point to an inevitable economic recession in the region, while bond yields surged again. A slew of major European countries, including German, French and Italian reported weaker-than-expected service PMI data, with the Germany data plummeting to 45.0, the lowest since the beginning of the pandemic period. The UK 10-year bond yield jumped back to above 4% from 3.86% a day ago, and the Italian 10-year bond yield swung back to 4.45%.

- Asian markets are set to open lower following the US session. ASX futures were down 0.40%. Nikkei 225 futures fell 0.23% and Hang Seng Index futures declined 0.23%. The NZX 50 was flat at the open. The Hang Seng index jumped 6% after returning from the public holiday on Wednesday, which may boost sentiment in the Chinese mainland shares after the golden week holiday next week.

- RBNZ raise the Official Cash Rate by 50 basis points to 3.50% for the fifth time in a row. The Reserve Bank of New Zealand stayed hawkish and hinted a larger hike may be on the table in its next meeting. The New Zealand dollar spiked on the announcement before paring gains.

- Crude oil prices rose for the third straight trading day amid a decision for a large output cut by OPEC+. The organisation decided to cut production by 2 million per barrel, the most since the pandemic period in 2020.