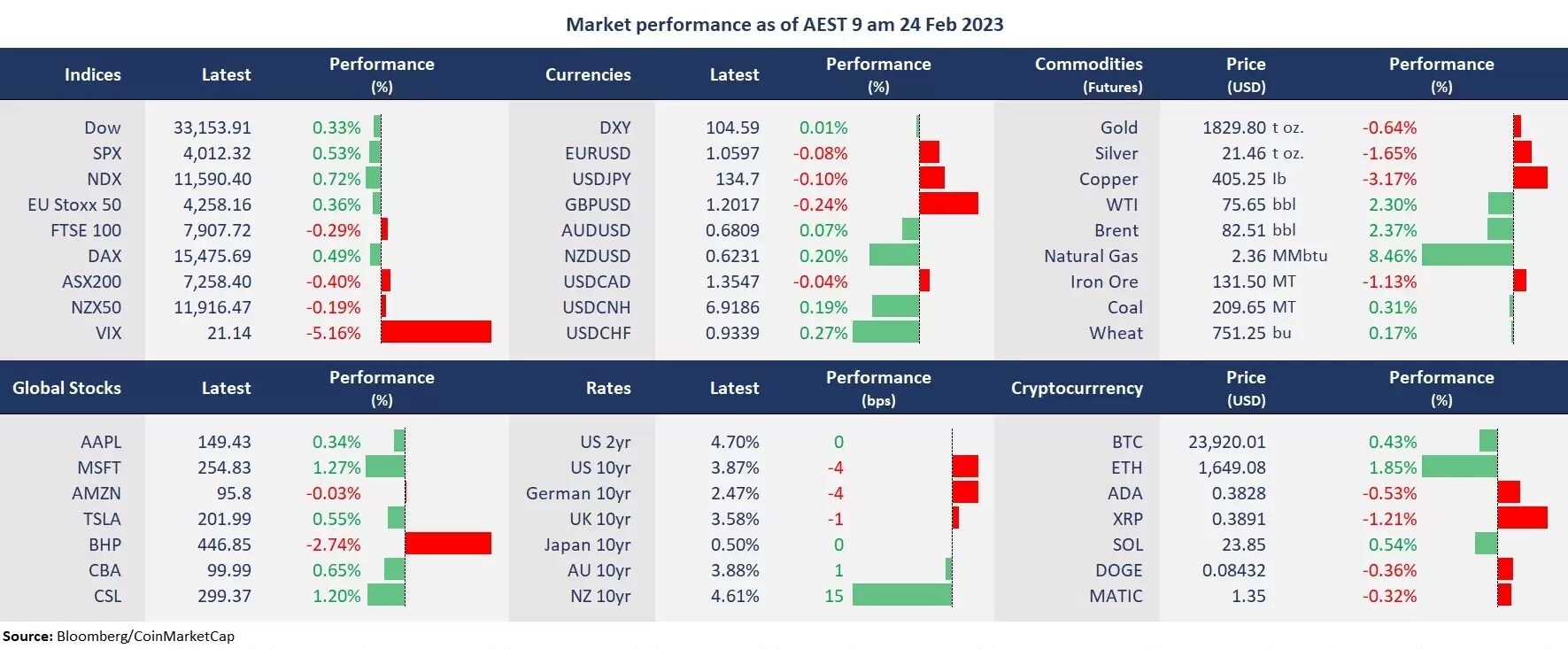

Wall Street drifted higher on Thursday, buoyed by tech stocks following Nvidia’s 14% surge after the software giant beat earnings expectations in its fourth-quarter report. Both US and EU government bond yields slid after the US fourth quarter GDP was revised to 2.7% annually, lower than the first estimate of 2.9%. Again, “bad news is good news” as investors hope for a soft tone from the Fed at the back of a slowdown in economic growth. Investors will eye on the upcoming US PCE data that is due for release later today, which is considered a favourite economic gauge by the Fed in deciding interest rates.

In Asia, BHP’s dividend cuts dragged on sentiment on the ASX, sending Australian markets down 0.4% on Thursday. Hang Seng Index extended losses, though JD.com rebounded after an intense selloff amid its massive subsidiary program to compete with Pinduoduo. Asian markets are set to open mixed after a broad selloff yesterday, with ASX futures up 0.11%, HSI futures down 1.31% and Nikkei 225 rising 0.22%.

- The S&P 500 snapped a 4-day losing streak, with 7 out of the 11 sectors in the S&P 500 finishing higher. The technology and energy stocks led gains, up 1.6% and 1.3%, respectively. The Communication Services sector lagged broad markets, down 0.66%, dragged by Netflix after the live streamer announced to cut prices in some countries amid fierce competition.

- Nvidia’s shares jumped 14% amid earnings beat as AI chip demands powered its outlooks. The company reported $0.88 in EPS and $6.05 billion in revenue, topping estimates of $0.81 and $6 billion, respectively. Its key division, the data center’s revenue rose 11% from a year ago. CEO Jensen Huang indicated that the AI boom has lifted Nvidia’s GPU sales to the US cloud service providers.

- Alibaba’s shares were slightly lower after an initial 6% jump in the US markets following its strong earnings report. The Chinese e-commerce giant’s profit surged 69% from a year earlier, thanks to the deep cost cuts. The company reported the fourth quarter revenue of 247.76 billion yuan, up 2.1% annually, while net income came as 46.8 billion yuan, well above an estimated 35 billion yuan.

- Crude oil erased yesterday’s losses on the news that Russia is planning to expand its output cut to 25% after it announced a 500,000 cut in March. However, the US inventory increased by 7.65 million barrels, more than 2.33 million expected for the week ending 17 February, marking the 8-straight week build.