Read Michael Hewson's pick of the top stories to look out for this week (22-26 February), and view our key company earnings schedule.

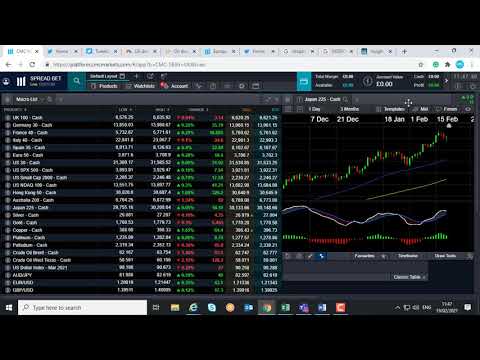

In this week's video update, David Madden talks about the mild retreat in global stocks due to an upward move in US government bond yields, and discusses the disappointing US jobless claims report. He also covers the major events of the week ahead, such as US, German and French GDP, as well as the Lloyds and HSBC results.

HSBC full-year results

Tuesday: HSBC has had its fair share of problems over the last 12 months. From navigating the intricacies of US-China relations over its business in Hong Kong, and the freezing of accounts of citizens at the request of Hong Kong police, to its involvement in the spat between China and the US over Huawei and the arrest of Huawei CFO Meng Wanzhou in Canada, it’s been a tough year. The bank is also in the middle of a three-year restructuring programme, as it seeks to cut costs and improve profitability.

Forced to cut its dividend last year by the UK’s Prudential Regulation Authority (PRA), HSBC said in Q3 that it hoped it would be able to start paying a dividend after reporting its full-year numbers. This seems somewhat premature and could be blocked by the PRA. In Q3 the bank reported a profit-before-tax of $3.07bn, a 36% drop from the previous year on revenue of $11.93bn. Loan-loss provisions were increased to $7.64bn with total provisions for the year expected to come in at the lower end of $8bn to $13bn, or around £10.3bn.

With the outperformance of US banks in recent weeks, the pressure is on for HSBC to perform similarly well in its investment banking unit operations, even as its domestic retail operations have to deal with tighter Covid-19 restrictions in the UK, and the HSBC brand takes a hit in Asian markets. In November, there was some chatter that HSBC may be looking to offload its US retail operations, which have caused the bank a great deal of pain in the past 10 years. HSBC’s foray into the US mortgage market cost it billions in the wake of the financial crisis over 10 years ago.

UK unemployment rate (December)

Tuesday: The ILO measure of unemployment for December could show another modest uptick from November’s levels, and move above 5% for the first time since before the Brexit referendum in March 2016. It is perhaps a little surprising that there hasn’t been a bigger move to the upside, even accounting for furloughed workers. One reason for the still fairly low reading is that the ILO measure is very much a lagging indicator, and isn’t particularly useful, as it doesn’t include furloughed workers or huge number of overseas workers who have left the UK to return to their home countries where, in most cases, Covid-19 cases are lower.

With the ever-tighter restrictions that were imposed in January, a number of struggling businesses may decide that it’s no longer worth keeping workers on furlough if they can’t reopen soon. Any further redundancies announced in January won’t be reflected in these ILO numbers, which means the claims numbers are probably a better reflection of where the labour market is, along with the employment data itself. Projections for unemployment show a rise of 7.5% by the summer, especially if furlough isn’t extended beyond the current deadline of April. The monthly jobless claims numbers are probably a more accurate reflection of the labour market, with these at 7.4% in December, and expected to move up to 7.5% in January. The employment rate fell to 75.2% over the three-month period in November, 1.1% lower than a year ago, with the 18–24 year old cohort accounting for half of that drop.

Germany Q4 GDP

Wednesday: The German economy went into recession at the beginning of 2020, contracting 2% in Q1 and then by 9.7% in Q2. The subsequent rebound in Q3 of 8.5% helped reverse some of the lockdown damage, however it won’t have prevented the German economy from shrinking by around 4% over the year. The latest adjusted Q4 GDP number is expected to confirm that the economy just about avoided a double-dip recession, with a 0.1% expansion. However that’s likely to be cold comfort, given that the current quarter is likely to see another contraction. Restrictions started to be reimposed in October last year, and while the German government has implemented a host of support measures to mitigate the impact on the services part of the economy, it’s still set to be a tough start to 2021, due to the delays in the European vaccine rollout plan.

Lloyds Banking Group full-year results

Wednesday: When Lloyds reported back in Q3, the bank was able to show a return to profitability after posting a first-half loss of £602m, with £676m of that coming in Q2, after it increased its loan-loss provisions by £300m to £4.1bn for the first nine months of the year. This was lower than expected, and more encouragingly the bank was able to report a statutory Q3 pre-tax profit of just over a £1bn, while also revising its estimate for full-year loan losses to the lower end of a £4.5bn to £5.5bn range.

The net interest margin was weaker, slipping from 2.79% to 2.4%, and a further deterioration could impact profit in Q4, however the recent steepening in UK yields may offset some of that possible weakness. The lowering of its loan-loss provision estimate in Q3 may have been a little premature given the tightening of restrictions throughout November and December, and which have remained in place this year.

The outlook continues to look highly uncertain, given that a lot more of its customers are likely to find themselves in financial difficulty in the months ahead. In its Q3 numbers, the bank outlined how many payment holidays were granted as a result of the first lockdown. On mortgages that number came in at around 477,000, equating to customer balances of £62.7bn, as well as 320,000 payment holidays on credit card balances. A large majority of these payment holidays have matured, with 83% of the mortgage holidays resuming payments, and 13% extended. The recent lockdown is likely to see these numbers edge up again. Since the bank last reported in October, the shares have risen over 30%, which means a lot of the good news may well already be priced in.

Aston Martin Lagonda full-year results

Thursday: In the first half of 2020 Aston Martin posted a £227m loss, as new boss Lawrence Stroll set about the huge task of turning the ailing business around, with a divergent strategy of focussing on the new DBX SUV, as well as its involvement in Formula One.

Car sales saw a fall of 41%, to 1,770 in the first half, as revenues fell to £146m. The restructuring of the business has helped pull the share price up strongly from its May lows of 555p from last year, with the shares up over 200% since then. In October Aston announced a new £1.3bn refinancing package that involves a 20% stake taken by Mercedes, which has helped boost sentiment in recent months. This investment will help boost development in providing engine and hybrid electrification technology, with Aston management looking to target the sale of 10,000 vehicles a year by 2025.

The new refinancing also involves the issuance of £1.2bn in new debt which will refinance the company’s existing borrowing as well as boosting its available cash funds to £500m. At the time Aston Martin said that the pace of recovery in sales of its cars was likely to vary on a region-to-region basis, particularly at a time when Covid-19 restrictions have hindered demand. Last year only 324 Aston Martin Vantage coupes were sold, a decline of 67%. A lot of faith appears to be being put into the new DBX, however most Aston Martin owners are probably not your typical SUV buyer.

First Solar Q4 20

Thursday: One of the stand out sectors of 2020, renewables were at the forefront of the rebound in stock markets last year. The majority of the gains came in the second half of the year, as it quickly became apparent that the Democrats would win the White House and set the energy agenda for the next four years. The First Solar share price has surged over the last 12 months, by over 150% from the March lows, and the solar panel company turned a Q3 profit of $0.29 a share on revenues of $546.8m.

One of the biggest solar power companies with a market cap of over $9bn, revenue growth has been patchy in recent years, but it did say it is on track to post annual revenues of between $2.6bn and $2.9bn in this current year, below last year's $3bn. The reason for the slowdown in revenues is because management took the decision to exit the Operating & Maintenance business, thus shrinking its focus. This in turn should improve its margins. Profits for Q4 are expected to come in at $1.26 a share.

Moderna Q4 results

Thursday: Moderna’s share price has seen massive gains, over 500%, in the last 12 months. The small company in Cambridge Massachusetts specialises in messenger RNA technology, and muscled its way to the forefront of the US response to the Coronavirus pandemic. Unlike AstraZeneca, the Moderna vaccine isn’t being provided at cost, which means the company is likely to make billions of US dollars from its product. The company has signed contracts with a number of governments inclduing the US, which signed up for 100m doses at $15 each, and the UK which signed up for 17m doses, which are set to be delivered in April.

In January Moderna raised its lower-end estimate for global production to 600m doses in 2021, with the hope it can deliver up to 1bn doses. Moderna’s biggest problem will be economies of scale. Can it build up its production capability to not only deliver on its Covid-19 vaccine, and also deliver new vaccine candidates for seasonal flu, HIV and the Nipah virus using the same biotechnology? The company is expected to post a loss of $0.37c a share for Q4, as it looks to invest in large scale manufacturing capacity.

Salesforce Q4 results

Thursday: Salesforce has benefited from the shift to working from home, despite being mostly geared towards office working. In August the company reported a big jump in Q2 earnings to $5.15bn, while earnings per share rose to $1.44, well above the $0.67 estimates. This outlook improved further in Q3 as revenues rose to $5.42bn, another 20% jump. As a result, the company revised its full-year revenue target up for the second quarter in a row, this time to $21.1bn as well as revising up its revenue target for 2022 to $25.5bn. Profit in Q3 rose to $1.15 a share and are expected to come in at $0.75 a share in Q4.

Salesforce cited its new Work.com product, which helps aid clients in the transition to remote working, for the big jump in revenues, while the Salesforce share price hit record highs after its elevation into the Dow in early September. Since those record highs, the shares have slipped a touch, with a good proportion of the fall down to the recent $27.7bn acquisition of Slack. This seems a rather high price given that to all intents and purposes Slack is simply a messaging application, whose nearest competition is Microsoft Teams, and where overall annual revenues are still at less than $1bn. Time will tell whether this acquisition is a shrewd move by Salesforce, but for now the outlook for the next 12 months is still a rosy one, given recent upgrades to its guidance.

US Q4 GDP

Thursday: One of the main reasons Q3 GDP was so positive was because personal consumption came in at 41%. We already know that this week’s second iteration of Q4 GDP numbers is set to be much weaker, however we could see a slight upward revision from the 4% level a few weeks ago, to 4.2%. The slowdown in consumer spending is one of the main reasons for the slowdown given that personal consumption accounts for over two thirds of US GDP and the slowdown in November and December is likely to reflect a rather weak end to 2020, and a drop to 2.5%. Expectations are for the second iteration of Q4 GDP to edge a little higher to 4.2%, from the 4% level a few weeks ago. This is still a sharp slowdown from the 33.4% seen in Q3, but the upward revision is likely to be as a result of a slight adjustment to consumption.

France Q4 GDP

Friday: It’s pretty much nailed on that France will see a double-dip recession if the performance in its economy in Q4 is any guide. The French economy only saw one positive quarter last year, having contracted for the previous three quarters before that. The most recent Q4 GDP estimate saw a contraction of 1.3%, which means that the prospect of a double-dip seems more likely than not. Recent PMI numbers have shown that little has improved in recent weeks, and French bars and restaurants seem unlikely to reopen much before Easter. Since Q4 of 2019 the French economy has contracted by -0.1%, -5.3%, in Q1 of 2020, and then -13.8 in Q2. The 18.7% rebound in Q3 has helped reverse some of that, however the French economy is still expected to decline in excess of 5% for the whole of 2020.

IAG full-year results

Friday: The costs to the airline industry of the coronavirus pandemic were no better illustrated than when, at the end of Q3, British Airways owner IAG revealed it had lost £5.1bn, losing on average about £20m per day between January and September. The numbers also revealed that the company had shed 10,000 jobs at BA and Aer Lingus at a cost of £250m. The company also suffered £1.6bn in hedging losses on fuel that was never delivered as the airline was unable to use it.

Passenger traffic in Q3 saw a fall of over 70%, and Q4 is unlikely to be any different. With new quarantine measures being introduced on international flights into England, this could fall further in Q1 of this year. With the reintroduction of tighter restrictions throughout the winter months, along with new travel restrictions, this latest quarter is unlikely to be much better. Unlike its French and German peers, IAG hasn’t gone cap in hand to the government for a bailout, though it has received a five year £2bn loan backed by the UK government. At the moment airlines are taking whatever measures they can to boost cashflow, while their fixed costs remain exactly that, and IAG secured £750m by selling Avios loyalty points to American Express. Aircraft still have to be maintained, and kept serviceable for the time when the airline can start to look at operating a normal service.

US personal spending and income (January)

Friday: US personal spending saw a strong rebound in the five months after the big declines seen in March and April of last year, post lockdown. This came to a shuddering halt in November with a slide of -0.4%, as various US States imposed lockdowns, and/or tighter restrictions. In December there was a slight improvement to -0.2%, however it still pointed to a weak end to what is normally a strong period for US retailers.

Despite that, the agreement between US lawmakers over a further $900bn fiscal support package at the end of December could have prompted a rebound in consumption patterns, while the prospect of an additional $1.9trn package in March is also likely to help in the coming months. The new stimulus payments are also likely to see a rise in personal spending by 0.5%, and personal income by 9.4%, in a fashion similar to last April.

Index dividend schedule

Dividend payments from an index's constituent shares can affect your trading account. See this week's index dividend schedule

Selected UK & US company announcements

| Monday 22 February | Results |

| Discovery (US) | Q4 |

| Invesco (US) | Q4 |

| Tristel (UK) | Half-year |

| Unisys (US) | Q4 |

| Tuesday 23 February | Results |

| Eagle Point Credit (US) | Q4 |

| HSBC (UK) | Full-year |

| Intercontinental Hotels (UK) | Full-year |

| Macy's (US) | Q4 |

| McAfee (US) | Q4 |

| Pubmatic (US) | Q4 |

| Square (US) | Q4 |

| Upwork (US) | Q4 |

| Wednesday 24 February | Results |

| Bain Capital (US) | Q4 |

| Casper Sleep (US) | Full-year |

| Genco (US) | Q4 |

| Heathrow Airport (UK) | Full-year |

| Iron Mountain (US) | Q4 |

| Marriott Vacations (US) | Q4 |

| Metro Bank (UK) | Full-year |

| Reckitt Benckiser (UK) | Full-year |

| Six Flags Entertainment (US) | Q4 |

| ViacomCBS (US) | Q4 |

| William Hill (UK) | Full-year |

| Thursday 25 February | Results |

| Anglo American (UK) | Full-year |

| Airbnb (US) | Q4 |

| Aston Martin Lagonda (UK) | Full-year |

| BAE Systems (UK) | Full-year |

| Best Buy (US) | Q4 |

| Beyond Meat (US) | Q4 |

| Carvana (US) | Q4 |

| Clear Channel (US) | Q4 |

| Cushman and Wakefield (US) | Q4 |

| Dell Technologies (US) | Q4 |

| DoorDash (US) | Q4 |

| Etsy (US) | Q4 |

| Eventbrite (US) | Q4 |

| Farfetch (UK) | Q4 |

| First Solar (US) | Q4 |

| Nikola (US) | Q4 |

| Olympic Steel (US) | Q4 |

| Papa John's (US) | Q4 |

| Park Hotels and Resorts (US) | Q4 |

| Salesforce.com (US) | Q4 |

| SeaWorld Entertainment (US) | Q4 |

| Serco (UK) | Full-year |

| Standard Chartered (UK) | Full-year |

| Virgin Galactic (US) | Q4 |

| Wayfair (US) | Q4 |

| Workday (US) | Q4 |

| Friday 26 February | Results |

| DraftKings (US) | Q4 |

| Foot Locker (US) | Q4 |

| IAG (UK) | Full-year |

| Rightmove (UK) | Full-year |

| Vistra (US) | Q4 |

Company announcements are subject to change. All the events listed above were correct at the time of writing.