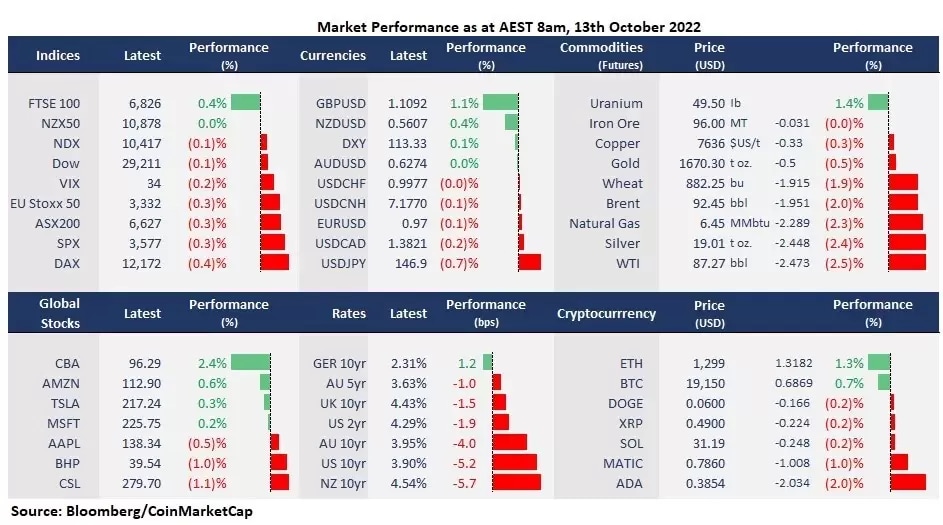

Wall Street finished lower after a seesaw session ahead of the key inflation data that is due for release later Thursday, though the Fed meeting minutes for September show that majority of members are consistent with their guidance for “higher for longer” rates as they see inflation will stay stubbornly high. The consensus says the US headline inflation will be 8.1% year on year for September, down from 8.3% the prior month, while the core inflation excluding food and energy is expected to be 6.5%, higher than 6.3% in August. Rates were slightly down, with the US 10-year bond yield sliding to 3.90% from 3.95% a day ago. Traders will eye the 4% mark for the 10-year bond yield, and hotter-than-expected inflation may take rates higher and sink risk assets again.

- S&P 500 extended its fifth straight trading day losing streak, down 0.33%, to 3,577.03. 8 out of 11 sectors in the S&P 500 finished lower, with Utilities and Real Estate leading losses, down 3.41% and 1.4%, respectively, while Consumer Discretionary, Consumer Staples, and Energy were higher. Mega-cap techs were mixed, and big banks, including JPMorgan Chase, Citigroup, and Wells Fargo rose ahead of the third-quarter earnings.

- A positive note from the Fed meeting minutes is that some participants signal cautious steps to approach the rapid rate hike path in the face of a significantly deteriorated economic outlook, which offers hopes that the Fed may soften its hawkish tone if the market rout gets worse.

- British Pound jumps on news that BOE may extend its emergency bond-buying. The BOE faces a dilemma at whether extend its temporary bond-buying program that commenced in late September. Despite a clarification by the governor, Andrew Bailey, to end the stimulus measure by the end of the week, the bank is also reportedly to privately signal to extend the program by Financial Times.

- Yen devalued to a fresh 24-year low on BOJ governor Kuroda’s vows to keep an ultra-loose policy. The USD/JPY soared to 146.97 at AEST 8:00 am. The Japanese 10-year government bond yield stayed at 0.24%.

- Asian markets are set to open mixed following Wall Street’s muted moves. ASX futures were down 0.11%. Nikkei 225 futures fell 0.19% and Hang Seng Index futures declined 0.50%.

- US dollar index eases gains as bond yields slid ahead of the key inflation data. The dollar strengthened against the Japanese Yen, while weakened against the British Pound, New Zealand dollar, and Canadian dollar.

- Crude oil extended losses after OPEC cut its 2022 forecast for oil demand for the fourth time in a row since April on concerns of a slowdown in global economic growth, especially deteriorated demand outlook in China.

- Spot gold price rises while gold futures slipped as the inflow of physical gold to Asian countries rises amid a jump in demand from China and India, while the outlook for gold is weakening in in west due to rising rates and a strong US dollar.

- Bitcoin continued the range movement above 19,000 for the last two weeks. According to Binance’s data, the trading volume for Bitcoin significantly increased in October, suggesting traders are betting on the bottom of the cryptocurrencies in the wake of the fiat currency’s chaos.