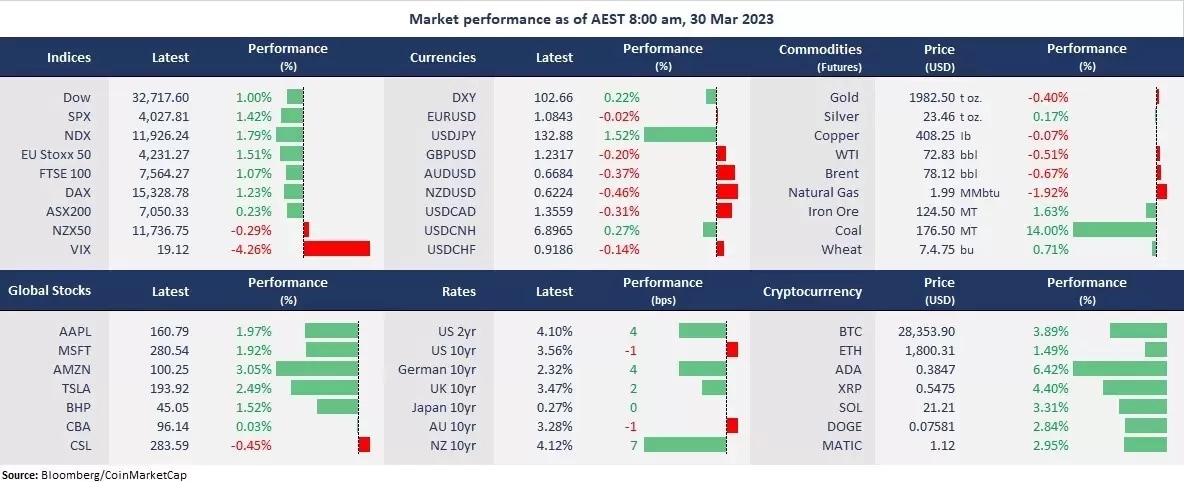

US stocks rebounded sharply, with all three benchmark averages up more than 1% as risk-on sentiment fuelled the tech rally on Wall Street. With recession fears fading, the market’s focus is now on the upcoming US PCE data later this week, which is seen as the Fed’s favorite inflation parameter. Ironically, the recent bank crisis seems to have accelerated a bottom reversal on Wall Street. The three major indices point to a positive close in March, particularly in the tech-heavy index, Nasdaq, up 14% year-to-date. Growth stocks switched on a turbulence mode amid strengthened odds for the Fed to pivot sooner. According to the CME FedWatch Tool, the Federal Reserve Bank may have to pause rate hikes in May. The fear gauge, VIX, fell 4% to 19.12, the lowest seen on 9 March.

On the other hand, the US dollar strengthened as rates stayed at the one-week high level, sending commodities down, including gold and oil. Bonds may have been overbought in March when markets were nervous about the bank’s drama. However, caution still needs to remain in the mind as the Fed may not be as market-friendly as thought if inflation does not pave the way.

Equity markets across Asia are set to open higher following the positive sentiment. ASX futures were up 0.68%, Hang Seng Index futures rose 0.38%, and Nikkei 225 futures advanced 0.80%.

Price movers:

- All 11 sectors in the S&P 500 finished higher, with real estate and technology stocks leading gains, up 2.32% and 2.1%, respectively. Both financials and energy sectors stayed robust, rising 1.5%. Healthcare lagged broad gains and only finished 0.24% higher. Micron Technology jumped 7% amid positive guidance, lifting other tech stocks, with all the well-known names, like Apple, Microsoft, Amazon, and Meta, up 2-3%.

- Apple confirmed the dates for WWDC 2023, the company’s annual developers’ conference that unveils new devices, including iPhone, iPad, Apple Watch, Apple TV, and Mac software. The event will begin on 5 June and run through 9 June.

- Bitcoin reclaimed the 28,000 level after the selloff induced by Binance’s lawsuit with the CFTC. While the regulatory crackdowns are seen as an ongoing issue for crypto exchanges, the recent bank crisis sparked liquidity optimism in cryptocurrencies, fuelling bottom-reversal bets by traders.

- Gold futures retreated as the US dollar regained strength. The precious metal may continue to face a pullback risk as rates and the USD seem to tick up again, with possible near-term support of around 1,915.

- Crude oil fell despite a draw in the US crude inventory data. A strengthened US dollar pressed on oil prices, and Russian production fell by 300,000 barrels per day, less than the previously announced 500,000.

ASX and NZX announcements/news:

- Healthscope sells 11 private hospitals to HCW for A$1.2 billion. HCW will fiancé $A730 million of the purchase and raise $320 million from investors. HMC Capital will contribute $123 million to capital raising.

- Link Group is yet to reach a settlement agreement with the FCA and would extend the deadline to sell its Fund Solutions business over the collapse of an investment fund run by Neil Woodford.

Today’s agenda:

- New Zealand ANZ Business Confidence. The data bounced slightly but stayed historically low since January due to high inflation and rising rates.

- US final Q4 GDP. The country’s economic growth showed less momentum from the first two estimates due to a sharp decline in housing investment.