G'day folks and welcome to another trading day with your friendly, neighbourhood CMC Market Analyst!

For real-time up-to-date data/news/research/ideas/strategies, check out our insights panel on the CMC Markets Invest platform and follow us on Twitter:

Azeem Sheriff - @Azeem__Sheriff

Tina Teng - @Tinateng_CMC

CMC Markets ANZ - @CMCMarketsAUSNZ

CMC Markets Singapore - @CMCMarketsSG

CMC Markets Canada - @CMCMarkets_CA

Trading Idea of the Day

ASX:FLT - Flight Centre Travel Group Ltd - BULLISH BIAS (long term) - BULLISH BIAS (short term)

- Key levels on the chart - consider taking trades from key support/resistance zones.

- Price is significantly undervalued and at a key support, a level not seen since the beginning of COVID.

- The reopening and pent-up travel demand narrative is only gathering momentum, with FLT expecting a gradual recovery in FY23 followed by a 'larger scale recovery during FY24' as the world opens up even more.

- Flight Centre's corporate travel segment has returned to pre-covid form based on their latest updates, contributing $58m to their underlying earnings. The company said corporate transaction levels are also back at pre-covid levels, with revenue at approximately 95% which is a positive sign for FY23 and shareholder expectations.

- Leisure bookings remain subdued, impacted by the 'lack of competition and spare capacity. The leisure segment lags as outbound travel remains impacted by a lack of competition and capacity, leading to a lack of bookings available and abnormal prices.

- Management expects revenue margins to remain below pre-covid levels over the forecast period but partially offset by cost margin improvements.

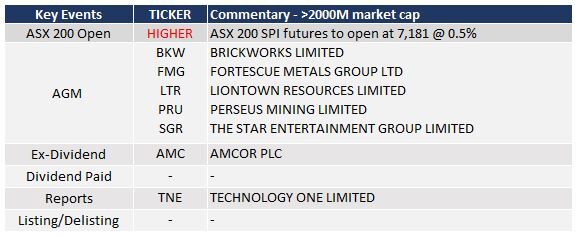

ASX & Economic Key Events

ASX Key Events Calendar (TODAY)

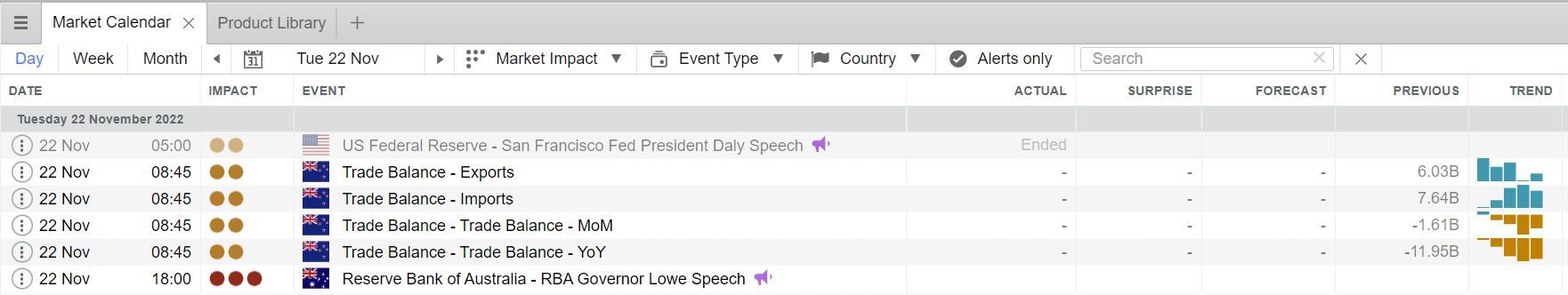

Economic Key Events (TODAY)

Economic Key Events (YESTERDAY)

OPTO For Investors Research

Article of the Day: Berkshire, Bridgewater and Tiger expand positions in chip stocks

Podcast of the Day: BlackRock’s Carolyn Weinberg on the democratising power of ETFs

APAC Daily Report

Click here to access our daily APAC report, prepared by my fellow market analyst @TinaTeng_CMC

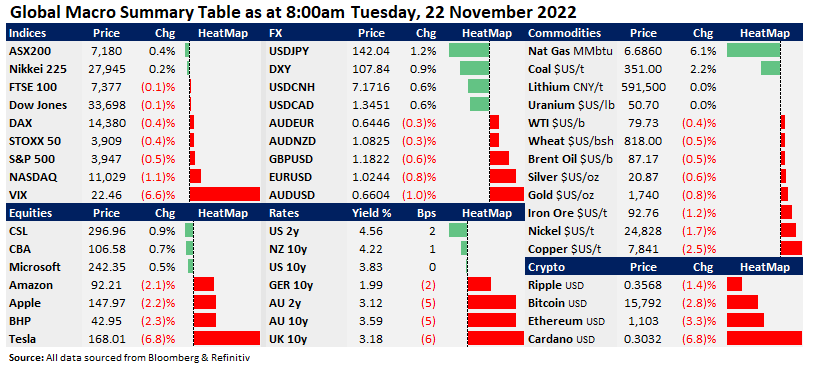

Market Snapshot & Highlights as of 8:00am AEDT

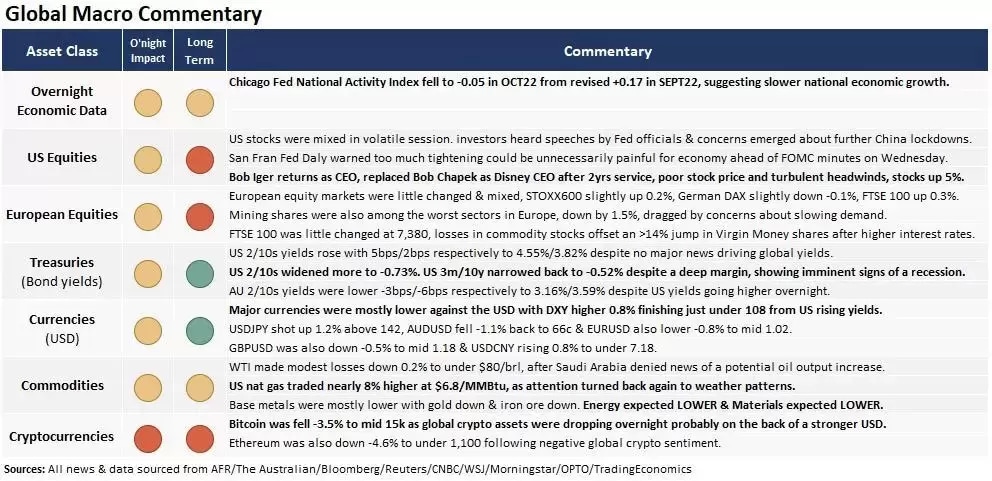

EXPECTATIONS: Energy LOWER (lower oil prices) & Materials LOWER on overall lower commodity metal prices.

Global Markets Headlines

- Disney blindsided Chapek with CEO move after contacting Iger on Friday (CNBC)

- Collapsed crypto exchange FTX owes top 50 creditors over $3 billion, new filing says (CNBC)

- FTX-owned service being used to launder hundreds of millions ‘hacked’ from FTX, researchers say (CNBC)

- China reports first Covid deaths since May lockdown in Shanghai (CNBC)

- Coinbase tumbles as bitcoin slide continues, investors fear contagion from FTX (CNBC)

OPEC+ Eyes Output Increase Ahead of Restrictions on Russian Oil (WSJ)

(All news & data sourced from AFR / The Australian / Bloomberg / Reuters / CNBC / Wall Street Journal / Morningstar / OPTO / Trading Economics)