G'day folks and welcome to another trading day with your friendly, neighbourhood CMC Market Analyst!

For real-time up-to-date data/news/research/ideas/strategies, check out our insights panel on the CMC Markets Invest platform and follow us on Twitter:

Azeem Sheriff - @Azeem__Sheriff

Tina Teng - @Tinateng_CMC

CMC Markets ANZ - @CMCMarketsAUSNZ

CMC Markets Singapore - @CMCMarketsSG

CMC Markets Canada - @CMCMarkets_CA

Trading Idea of the Day

NASDAQ:TSM - Taiwan Semiconductor Manufacturing Company - (BULLISH - long term & BULLISH - short term)

- Key levels on the chart - consider taking trades from key support/resistance zones.

- Taiwan Semiconductor Manufacturing (NYSE:TSM) is set to make history with one of the largest foreign investments in the United States. The company will announce plans on Tuesday to build its second chip plant in Arizona, increasing its investment in the state to $40B.

- Warren Buffet recently took a major position in TSMC in a bet that the world cannot do without silicon.

- Price trading near key weekly support of $75

- Price is trading near the 200-moving day average (red line).

- There is positive momentum on the MACD indicator, indicating bullish price action momentum.

- RSI is currently in the middle of the range which indicates neither overbought nor oversold, but if you're bullish, can wait a little bit more until RSI is more in the oversold (<50) region for additional confirmation.

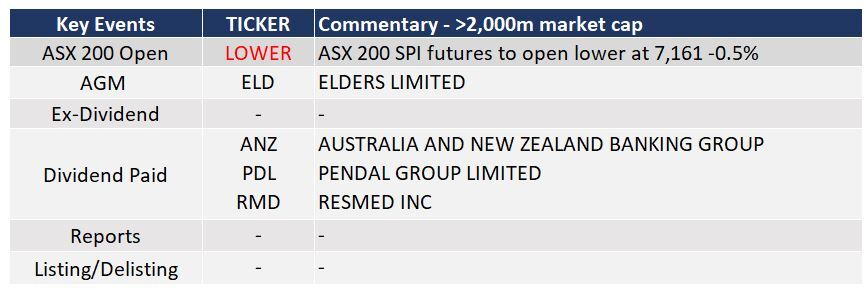

ASX & Economic Key Events

ASX Key Events Calendar (TODAY)

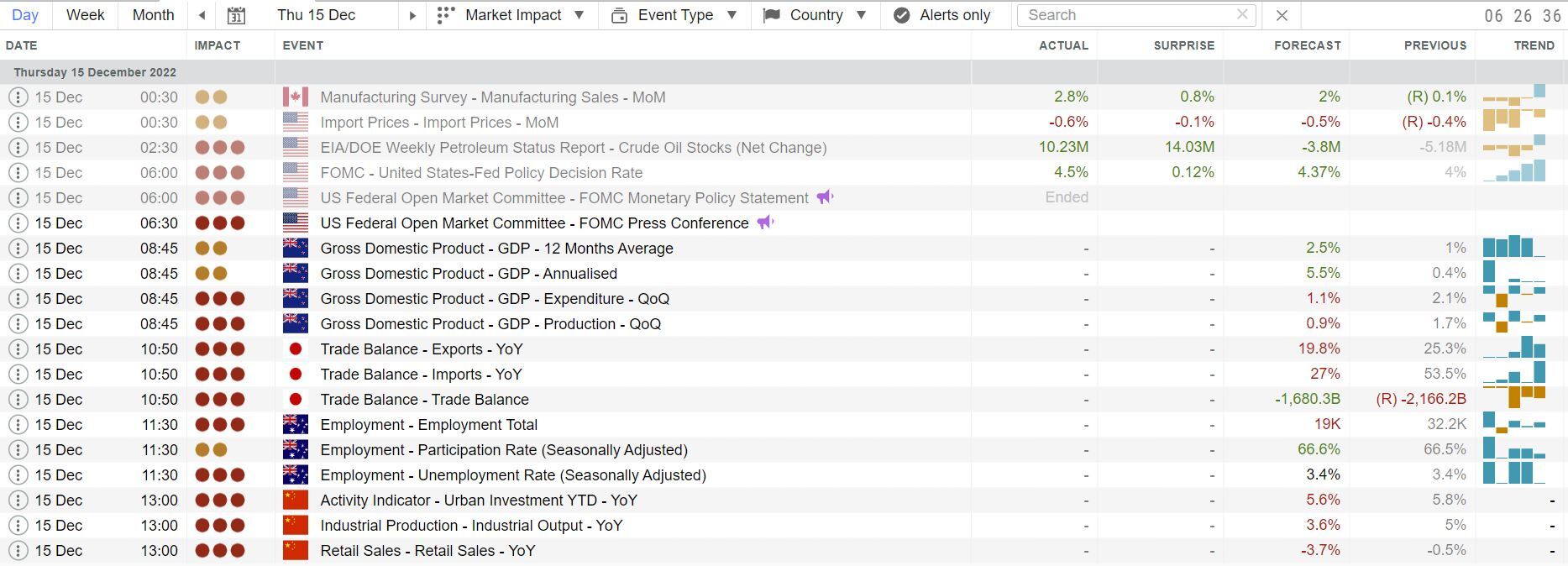

Economic Key Events (TODAY)

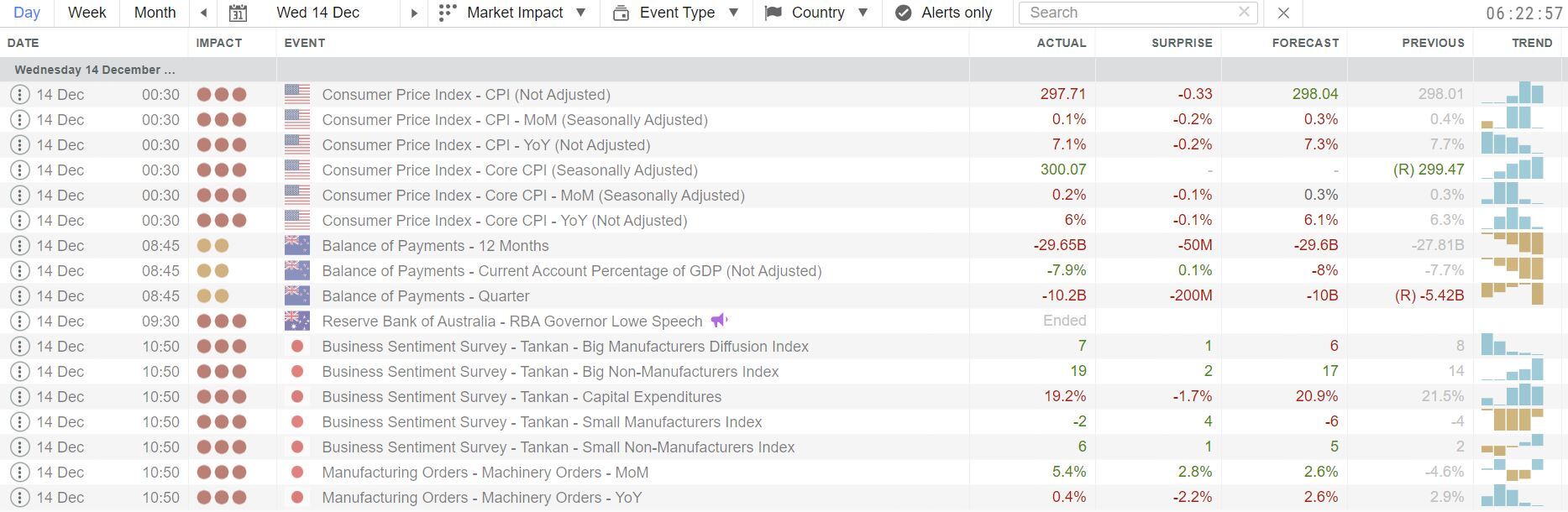

Economic Key Events (YESTERDAY)

OPTO For Investors Research

Article of the Day: Will content moderation scrutiny weigh on Meta’s share price?

Podcast of the Day: The Lead-Lag Report’s Michael Gayed on this year’s treasury anomaly

APAC Daily Report

Click here to access our daily APAC report, prepared by my fellow market analyst @TinaTeng_CMC

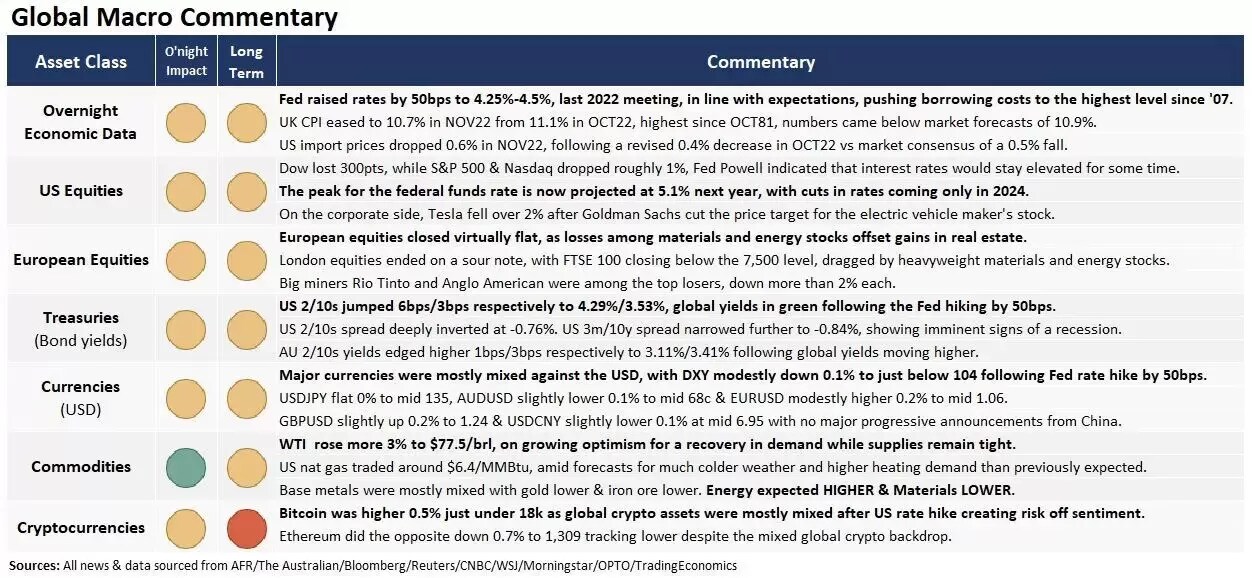

Market Snapshot & Highlights as of 8:00am AEDT

EXPECTATIONS: Energy HIGHER (higher oil prices) & Materials LOWER on overall higher base metal prices.

Global Markets Headlines

Fed raises interest rates half a point to highest level in 15 years (CNBC)

- The Fed projects raising rates as high as 5.1% before ending inflation battle (CNBC)

- Bank of England seen hiking by a half-point as inflation shows signs of peaking (CNBC)

- Binance CEO says deposits are ‘coming back in’ but sees ‘bumpy’ road ahead for the crypto firm (CNBC)

- European Central Bank set for 50 basis point rate hike on hopes that inflation has peaked (CNBC)

- UK inflation falls from 41-year high as fuel price surge eases (CNBC)

- Morgan Stanley upgrades its 2023 growth outlook for China, expects stronger and earlier rebound (CNBC)

(All news & data sourced from AFR / The Australian / Bloomberg / Reuters / CNBC / Wall Street Journal / Morningstar / OPTO / Trading Economics)