G'day folks and welcome to another trading day with your friendly, neighbourhood CMC Market Analyst!

For real-time up-to-date data/news/research/ideas/strategies, check out our insights panel on the CMC Markets NextGen platform and follow us on Twitter:

Azeem Sheriff - @Azeem__Sheriff

CMC Markets - @CMCMarketsAUSNZ

Trading Idea of the Day

NYSE:DIS - The Walt Disney Company - BULLISH BIAS

- Key levels on the chart - consider taking trades from key support/resistance zones.

- Disney’s diluted earnings per share (EPS) for the quarter increased to $0.77 from $0.50 in the prior-year quarter off the back of strong top-line growth.

- Disney credited its strong financial performance to improved operations among its domestic theme parks, large increases in live-sports viewership and significant subscriber growth on their streaming platforms. Namely, 14.4 million Disney+ subscribers were added in this quarter alone, increasing total subscriptions to 221 million across all of their streaming offerings.

- However, a looming recession may pose a threat to the performance of Disney’s Parks, Experiences and Products segment as consumer spending is expected to tighten as people begin to feel the pinch.

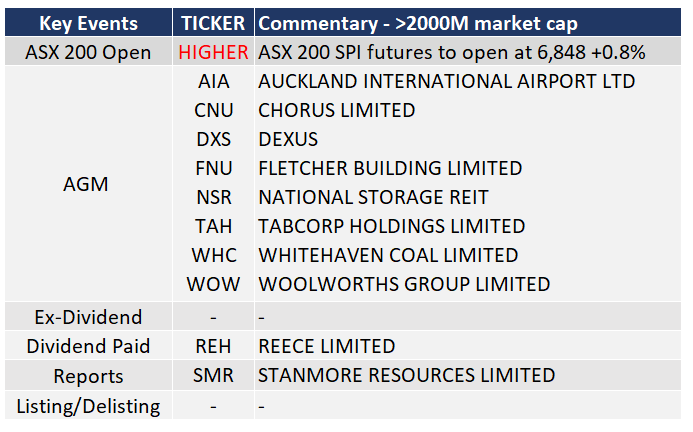

ASX & Economic Key Events

ASX Key Events Calendar (TODAY)

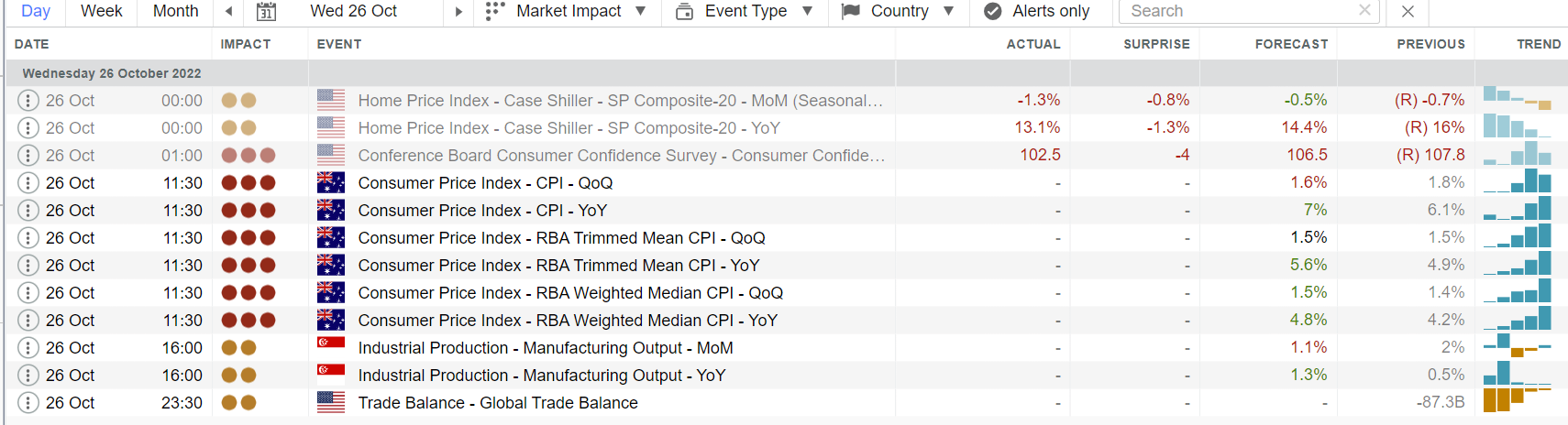

Economic Key Events (TODAY)

Economic Key Events (YESTERDAY)

OPTO For Investors Research

Article of the Day: Is it time for investors to focus on growth stocks over value?

Podcast of the Day: Why Cohesive Capital’s John Barber is bullish about private equity

APAC Daily Report

Click here to access our daily APAC report, prepared by my fellow market analyst @TinaTeng_CMC

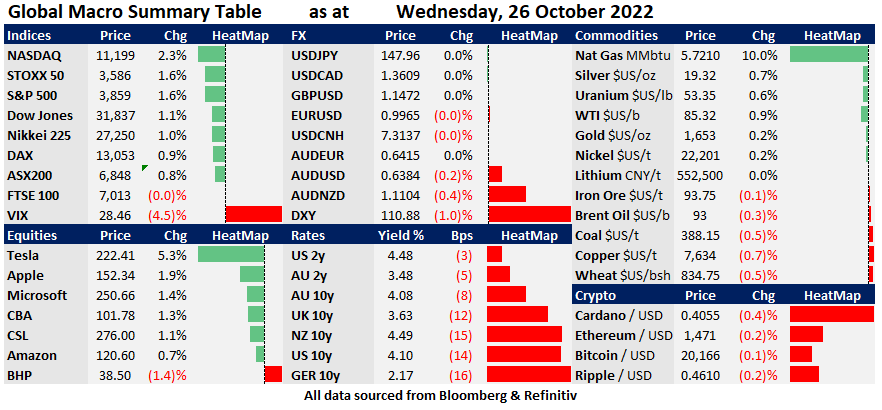

Market Snapshot & Highlights as of 8am AEDT

EXPECTATIONS: Energy HIGHER (higher oil prices) & Materials HIGHER on overall higher base metal prices.

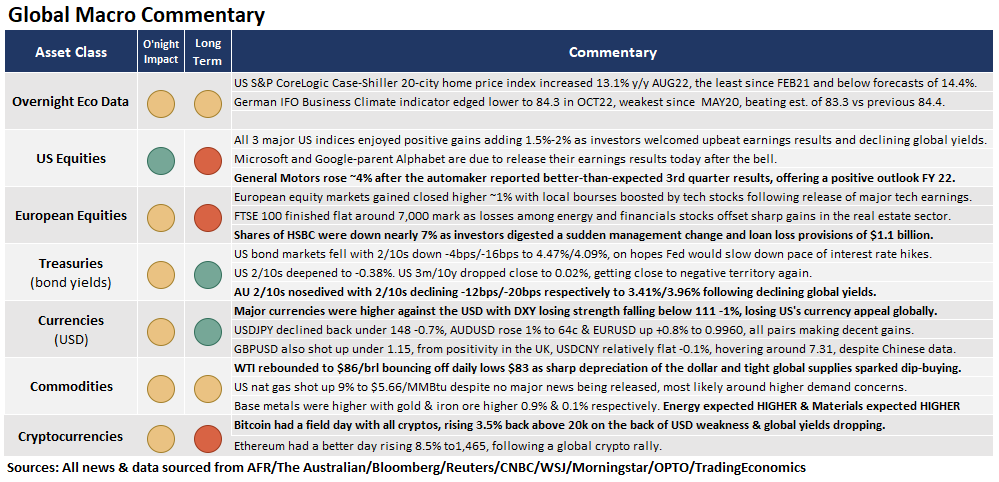

Global Markets Headlines

Alphabet misses on top and bottom lines as YouTube ad revenue drops in the quarter (CNBC)

U.S. home prices cooled at a record pace in August, S&P Case-Shiller says (CNBC)

Twitter is losing its most active users, internal documents show (CNBC)

(All news & data sourced from AFR / The Australian / Bloomberg / Reuters / CNBC / Wall Street Journal / Morningstar / OPTO / Trading Economics)