G'day folks and welcome to another trading day with your friendly, neighbourhood CMC Market Analyst!

For real-time up-to-date data/news/research/ideas/strategies, check out our insights panel on the CMC Markets NextGen platform and follow us on Twitter:

Azeem Sheriff - @Azeem__Sheriff

CMC Markets - @CMCMarketsAUSNZ

Trading Idea of the Day

ASX:FMG - Fortescue Metals Group - BEARISH BIAS

- Key levels on the chart - consider taking trades from key support/resistance zones.

Iron ore shipments have been dropping to China week on week, as China's property crisis continues and demand for iron ore reduces.

China's 0 COVID policy has not helped as well, with Shanghai looking to go back into lockdown after multiple cases identified, which can severely limit any property development projects in play.

Expecting FMG to move further lower to price of 14 which is next key support zone.

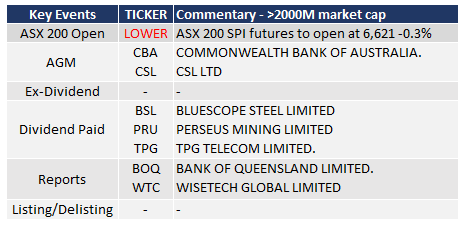

ASX & Economic Key Events

ASX Key Events Calendar (TODAY)

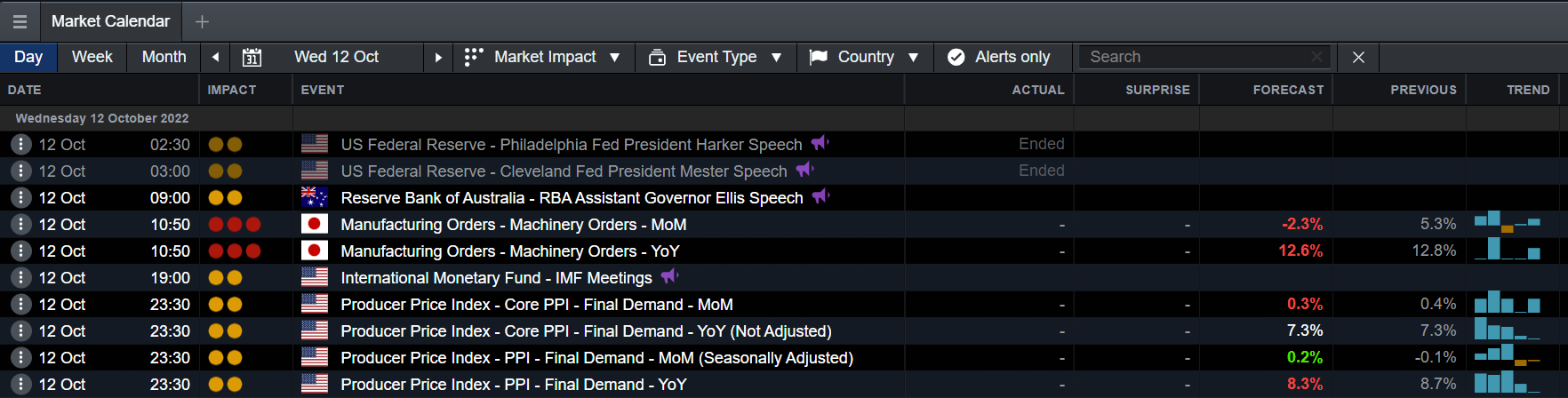

Economic Key Events (TODAY)

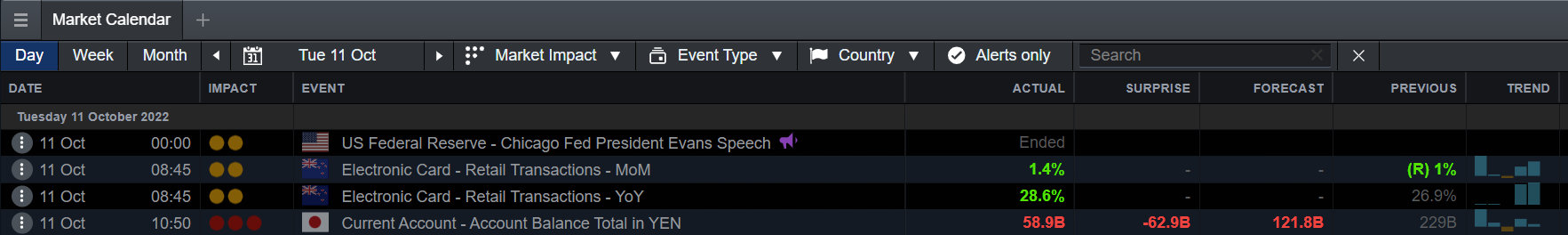

Economic Key Events (YESTERDAY)

OPTO For Investors Research

Article of the Day: Sprott Gold Miners ETF struggles as gold prices drop

Podcast of the Day: Tidal Financial CIO Michael Venuto on the ETF industry

APAC Daily Report

Click here to access our daily APAC report, prepared by my fellow market analyst @TinaTeng_CMC

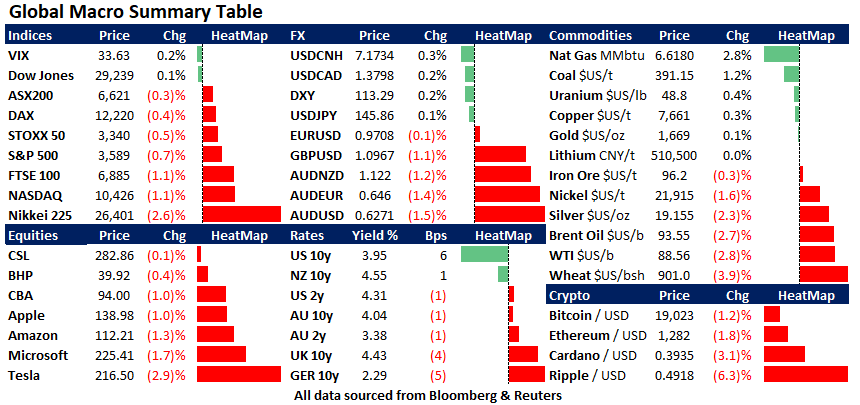

Market Snapshot & Highlights as of 8am AEST

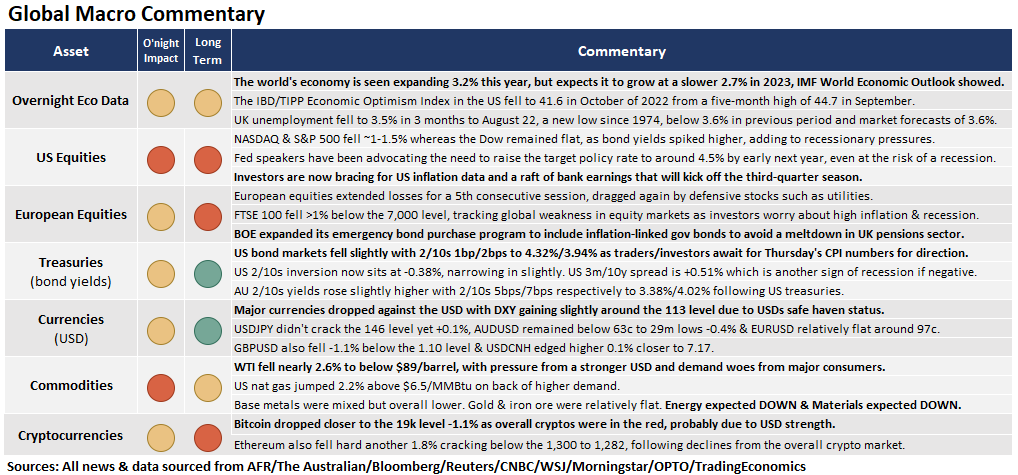

EXPECTATIONS: Energy LOWER (lower oil) & Materials LOWER on overall lower base metal prices.

Global Markets Headlines

Bank of England’s Bailey tells pension funds they have 3 days to rebalance (CNBC)

IMF cuts global growth forecast for next year, warns ‘the worst is yet to come’ (CNBC)

Auto giant Stellantis looks to Australian materials, including nickel, for its EVs (CNBC)

All you need to know about the Nord Stream gas leaks — and why Europe suspects ‘gross sabotage’ (CNBC)

Saudi Arabia Defied U.S. Warnings Ahead of OPEC+ Production Cut (WSJ)

America’s Oldest Bank, BNY Mellon, Will Hold That Crypto Now (WSJ)

(All news & data sourced from AFR / The Australian / Bloomberg / Reuters / CNBC / Wall Street Journal / Morningstar / OPTO / Trading Economics)