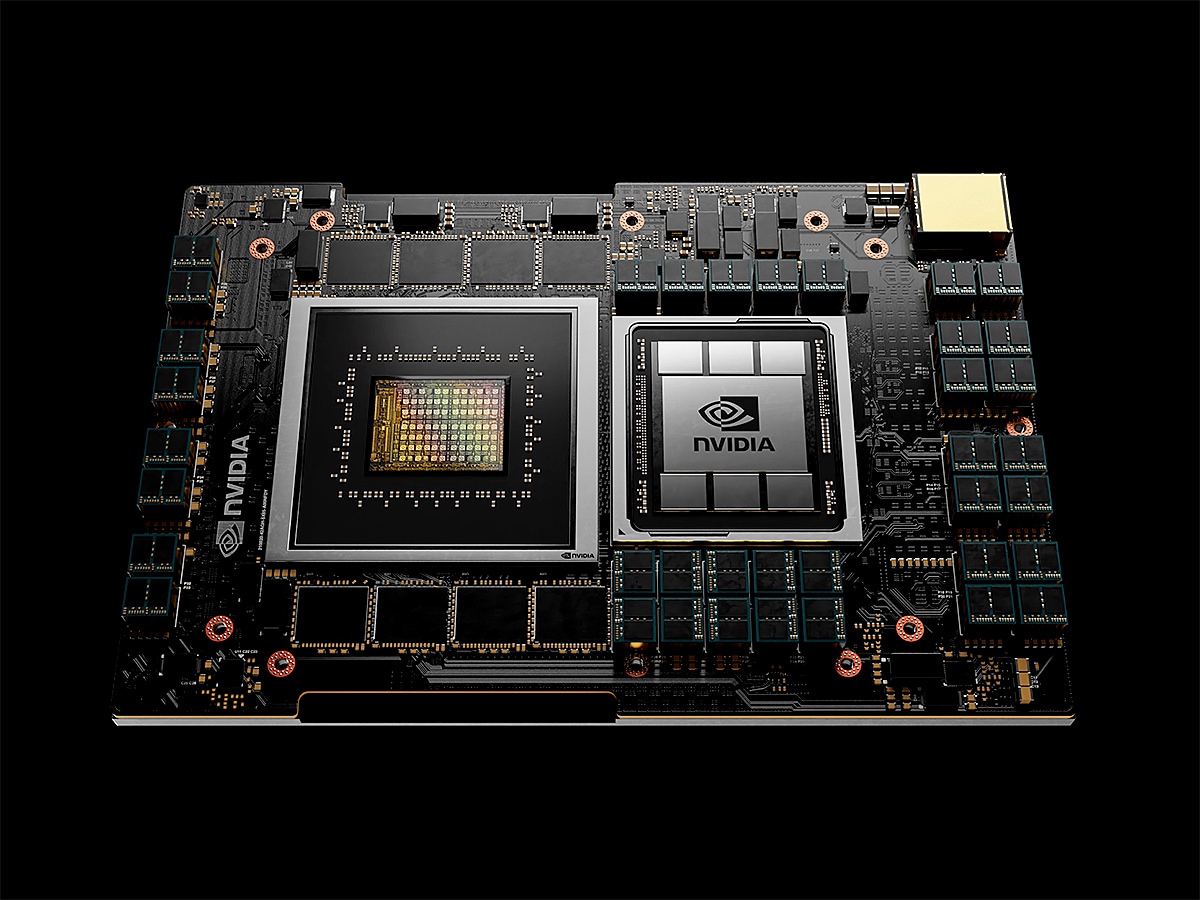

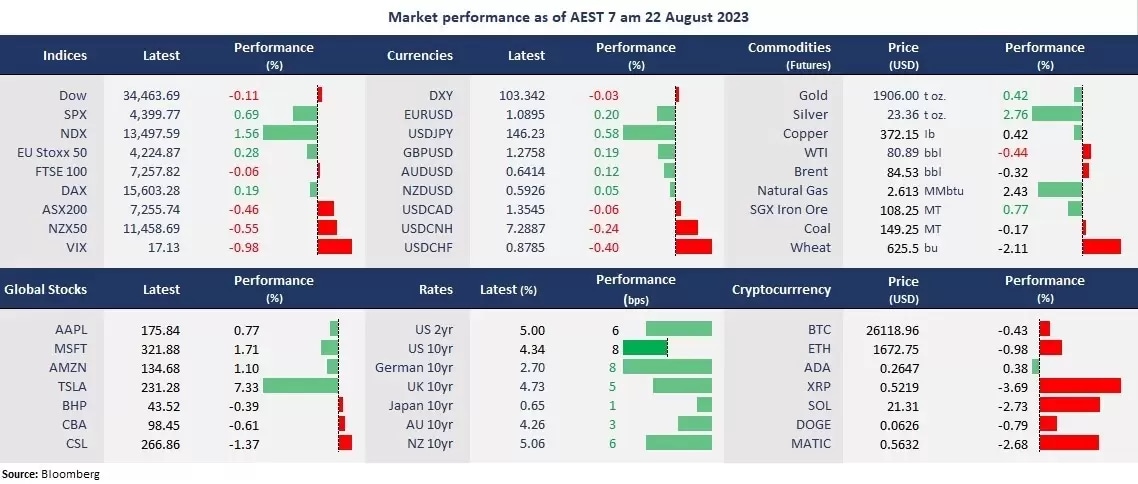

Wall Street finished mixed to kick off the week as enthusiasm rotated back to big tech names and led Nasdaq to snap a four-day losing streak. Nvidia surged 8.5% ahead of its earnings report this Thursday. Tesla jumped 7.3% from a one-month low after the EV maker’s shares retreated about 28% from its year-high in July. Dip-buys could be the main driver for the rebound, suggesting investors may be reassessing those AI-driven companies’ outlooks in a “higher for longer” rate environment.

On a controversial move, the US bond yields spiked further, with the yield on the 10-year Treasury climbing 9 basis points to 4.3%, a fresh 16-year high. And the yield on the 2-year peers rose to above 5% for the first time since March. Markets are pricing in the possibility of one more rate hike this year. Dow ended in the red amid underperformance in energy and financials due to surging bond yields. The decades-high Treasury yields increased bets for the bond market bottoming, which could cause huge volatility upon Fed Chair Powell’s rhetoric at the Jackson Hole Symposium later this week.

In Asia, China’s less-than-expected rate cuts weighed on sentiment and sent most regional stock markets down on Monday, with Hang Seng Index sinking to the lowest level since November 2022. At the same time, Nikkei 225 outperformed as Yen weakened further against the greenback, with USD/JPY rising to above 146. Futures point to a higher open across Asia. The Nikkei 225 futures were up 0.87%, the ASX 200 futures rose 0.32%, and the Hang Seng Index futures climbed 0.28%.

Price movers:

- 5 out of 11 sectors finished higher in the S&P 500, with Technology and Consumer Discretionary, leading gains, up 2.26% and 1.15%, respectively. Real Estate was the biggest laggard, down 0.88% on jumping rates. The energy sector lost steam on fallen oil prices, down 0.62%. Consumer Staples fell 0.64% as retailer’s stocks retreated.

- Zoom’s shares rose 4% amid strong second-quarter earnings. The software company’s earnings per share were US$1.34 on revenue of US $1.14 billion, beating estimates of US$1.05 and US$1.12 billion. Zoom’s management raised full-year guidance to US$4.63 to US$4.67 in adjusted earnings per share for fiscal year 2024. And it also invested in Ai startup Anthropic.

- The UK-based chipmaker, Arm, filed for a Nasdaq listing under the ticker symbol “ARM.” The company is owned by the Japanese conglomerate Softbank, which took Arum private in 2016. Arm is specialized in smartphone chips sought by Apple, Google, and Qualcomm. Its net sales fell 4.6% year on year in the second quarter due to high-interest rates.

- Drugmaker’s stocks rose in general as a new variant emerged in the US. Companies that are well known for making Covid vaccines rebounded since last week. Novavax jumped 11%, Moderna rose 9%, and Pfizer was up 0.9% on Monday.

- Chinese offshore Yuan strengthened following less-than-expected rate cuts by the POBC. USD/CNH fell 0.24% to just under 7.29 after rising to above 7.33. Most currencies in the APAC region rebounded against the USD in the late session, except the Japanese Yen, as the Eurodollar and British Pound all strengthened.

ASX and NZX announcements/news:

- G8 Education Limited (ASX: GEM)’s revenue rose 9% year on year to A$457,208, and profit jumped 76% annually to A$14,993 for the half ear ended 30 June 2023.

- BHP and Woodside Energy are set to report earnings later today.

Today’s agenda:

- BOJ Core CPI for July

- BRICS Summit – day 1

Maximize your potential gains! Take immediate action and seize the investment opportunities that await you. Login to the platform now!