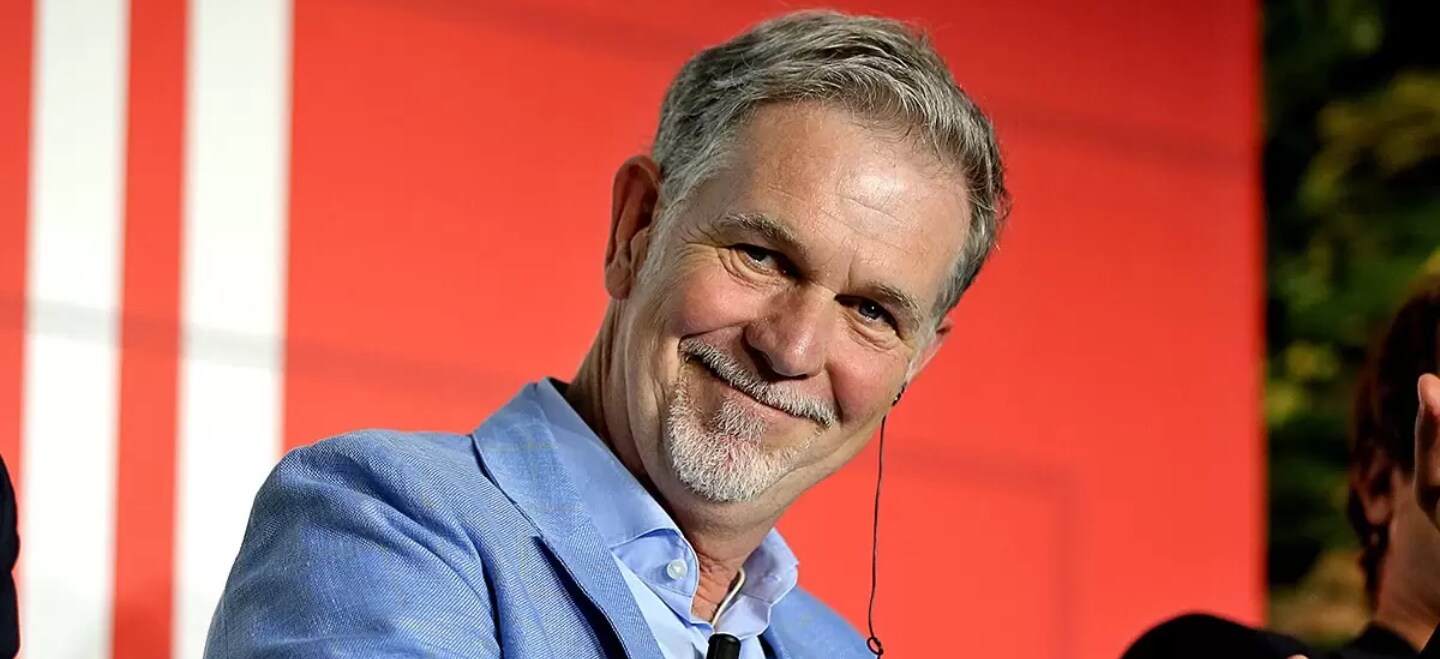

Tech optimism continued to boost risk sentiment and buoyed Wall Street, despite the debt ceiling talk impasse, with the big tech home Nasdaq up 21% year-to-date, entering a bull market. The live streamer Netflix’s shares surged more than 9% amid its success in the ad-supported tier, contributing about 5 million monthly active users. Meta Platforms unveiled its custom computer chips to aid AI development, adding fuel to the tech rally. Nvidia’s share also jumped 5% to the highest level since December 2021 ahead of its earnings report next week.

On the earnings front, Walmart’s March quarter earnings topped expectations and raised full-year guidance, suggesting consumer power was resilient despite economic headwinds. The US jobless claims were also lower than expected, indicating the US economy may not be as bad as thought. This strengthens a belief that the Fed will not start a rate-cut cycle this year.

Notably, the US bond yield rose for the fifth straight trading day, with the 2-year Treasury yield hitting 4.22% at a more than two-month high, lifting the US dollar index to rise above 103.50 for the first time since 20 March and pressing on commodity markets, with gold futures down US$25 per ounce to 1,960.

Asian markets continued the divergence moves. While the Japanese stocks were on fire, with Topix freshening record highs for three days in a row, Chinese tech giant Alibaba’s disappointing earnings sent the Hang Seng Index down. Asian markets are set to open mixed with the ASX 200 futures up 0.23%, the Hang Seng Index futures down 1.26%, and Nikkei 225 rising 1.01%.

Price movers:

- 7 out of 11 sectors in the S&P 500 finished higher, with growth sectors, including consumer discretionary, technology, and communication services, leading gains, up 1.54%, 2.06%, and 1.79%, respectively. Defensive sectors, such as consumer staples, healthcare, and utilities, were lower. And the real estate stocks also slid due to higher rates.

- Netflix’s shares jumped 95 after the company unveiled details about the ad-supported tier’s success. The live streamer launched a cheaper option of its live streaming option in late 2022 after two consecutive use losses. The division is seen as critical for the company’s future growth, which helped the company to gain about 5 million monthly active users.

- Walmart’s shares rose more than 1% after the retailer reported stronger-than-expected quarterly earnings amid strong grocery sales. The report shows consumers spent more on groceries than discretionary items, but demand stayed resilient. The earnings per share came as US$1.47 vs. $1.32 expected on revenue of US$153.30 billion vs. $148.76 billion expected. Its sales were up 8% year on year. It also raised earnings for the full-year guidance to between US$6.10 to US$6.20 per share.

- The Chinese e-commerce giant Alibaba’s ADR shares slid 5.5% amid tepid earnings results and the announcement to spin off its cloud business. It was the first quarterly result after the company’s business unit split. The company’s earnings per share came to 1.34 yuan, short of analysts’ estimate of 2.08 yuan, despite greater-than-expected revenue of 208.2 billion yuan.

- The USD/JPY rose to above 138.70. At the same time, the Chinese Yuan weakened further, with USD/CNH topping 7.05, both of which are the highest seen in November 2022, as the monetary policy divergence between the US and Asian countries continued to lift these pairs.

- Gold prices fell for the third straight trading day to the lowest since late March. A potential double-top pattern may take the metal price to approach further potential support of 1,900.

- Bitcoin slumped below 27,000 due to a strengthened USD. The head-and-shoulder-top pattern may take it lower to further support of 25,000.

ASX and NZX announcements/news:

- My Food Bag (ASX/NZX: MFB) announces that it has submitted a formal application to ASX Limited for its removal from the official list of ASX. The company’s FY23 revenue was at NZ$175.7 million, down 9.4% from a year ago. Its profit fell to NZ$18.2 million from NZ$34.0 million in FY22.

Today’s agenda:

- New Zealand trade balance.

- Japanese National Core CPI for April y/y.

- New Zealand credit card spending.