Since the end of September, Germany’s Dax Index has risen by more than 20%, placing it in a bull market. Despite the rally, the index is still down more than 10% from its early 2022 highs. Now, the index appears overbought and could be set for a reversal.

The Dax’s rebound came as the euro bounced off its September low versus the dollar. The stronger euro may help to ease high inflation across Europe, where surging prices have forced the European Central Bank to increase interest rates.

Dax may be overbought

The Dax seems overbought, its relative strength index (RSI) having peaked at a five-year high of nearly 81 on 15 November. The RSI remains well above 70 at time of writing. When the RSI last exceeded 80 in November 2017, the index traded sideways until January 2018 and formed a major top, resulting in a nearly 25% decline through December 2018 and a high that was not surpassed until February 2020.

Going further back, the RSI hit 82 in March 2015. That was followed by a significant market top in April and a decline of nearly 30% through February 2016. Although past performance is not a reliable indicator of future performance, the above chart shows that, at certain points in the last eight years, the Dax has experienced weakness in the months after its RSI exceeded 80.

If the Dax declines from its current, apparently overbought levels, it could fall back to around 13,500.

The Dax’s recent rally was primarily due to massive increases in the share prices of Siemens and SAP, which account for nearly 25% of the index’s gains. Since the end of September, Siemens has gained almost 40%, while SAP has increased by more than 30%. Meanwhile, Linde has risen by almost 20%, accounting for nearly 10% of the index's advance.

Siemens appears over-extended

If these stocks continue to perform well, the Dax could rise further. However, the Siemens share price appears to have formed a double bottom, and the objective of that pattern has already been met. Additionally, like the Dax itself, Siemens has seen its RSI climb to 79, and the last time it was that high was in May 2020. That peak was followed by a short-term drop of almost 14%.

Like the broader Dax index, Siemens appears to be trading on the recent strength of the euro. If the euro continues to rise, it’s possible that the Siemens share price could also increase. Likewise, if the euro weakens, Siemens stock may pull back.

Linde boosted by strong euro

A similar relationship between currency and stock also appears to exist in the case of Linde, but to a lesser extent than we’re seeing with Siemens. The key difference is that, while the euro has trended lower, Linde has been able to make new highs. But it is also clear that when the euro strengthens, Linde's stock tends to get an extra boost. And when the euro weakens, Linde's stock falls. To sum up, Linde stock has had bigger gains on euro strength and a smaller move down – or even a move higher – on euro weakness.

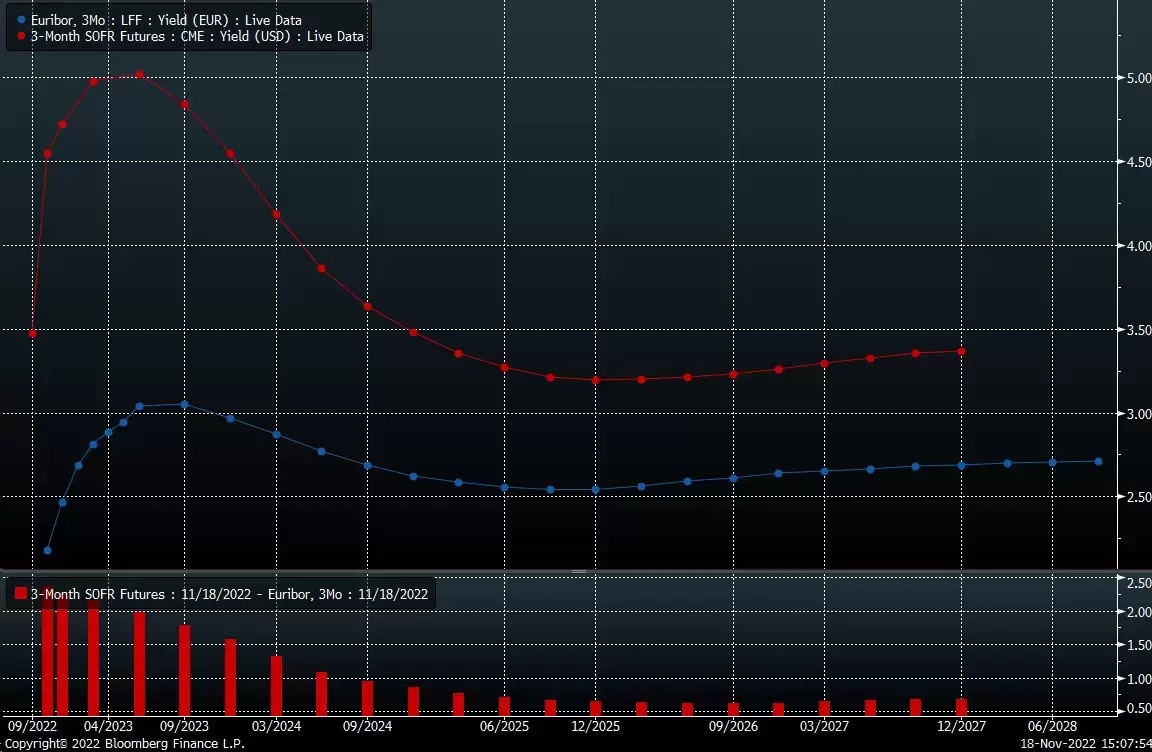

This means that investors will have a big say on the Dax’s direction, regardless of whether the euro weakens or strengthens. Where the euro goes against the dollar largely depends on how high the market sees the US Federal Reserve and the ECB raising interest rates, and whether those interest rate spreads are widening or contracting.

If the Fed is the more aggressive force, then the euro’s recent rally isn't likely to last much longer. Such a scenario would give the dollar the upper hand, potentially sending the Dax lower.

Charts used with the permission of Bloomberg Finance LP. This report contains independent commentary to be used for informational and educational purposes only. Michael Kramer is a member and investment adviser representative with Mott Capital Management. Mr Kramer is not affiliated with this company and does not serve on the board of any related company that issued this stock. All opinions and analyses presented by Michael Kramer in this analysis or market report are solely Michael Kramer's views. Readers should not treat any opinion, viewpoint, or prediction expressed by Michael Kramer as a specific solicitation or recommendation to buy or sell a particular security or follow a particular strategy. Michael Kramer's analyses are based upon information and independent research that he considers reliable, but neither Michael Kramer nor Mott Capital Management guarantees its completeness or accuracy, and it should not be relied upon as such. Michael Kramer is not under any obligation to update or correct any information presented in his analyses. Mr. Kramer's statements, guidance, and opinions are subject to change without notice. Past performance is not indicative of future results. Past performance of an index is not an indication or guarantee of future results. It is not possible to invest directly in an index. Exposure to an asset class represented by an index may be available through investable instruments based on that index. Neither Michael Kramer nor Mott Capital Management guarantees any specific outcome or profit. You should know the real risk of loss in following any strategy or investment commentary presented in this analysis. Strategies or investments discussed may fluctuate in price or value. Investments or strategies mentioned in this analysis may not be suitable for you. This material does not consider your particular investment objectives, financial situation, or needs and is not intended as a recommendation appropriate for you. You must make an independent decision regarding investments or strategies in this analysis. Upon request, the advisor will provide a list of all recommendations made during the past 12 months. Before acting on information in this analysis, you should consider whether it is suitable for your circumstances and strongly consider seeking advice from your own financial or investment adviser to determine the suitability of any investment. Michael Kramer and Mott Capital received compensation for this article.