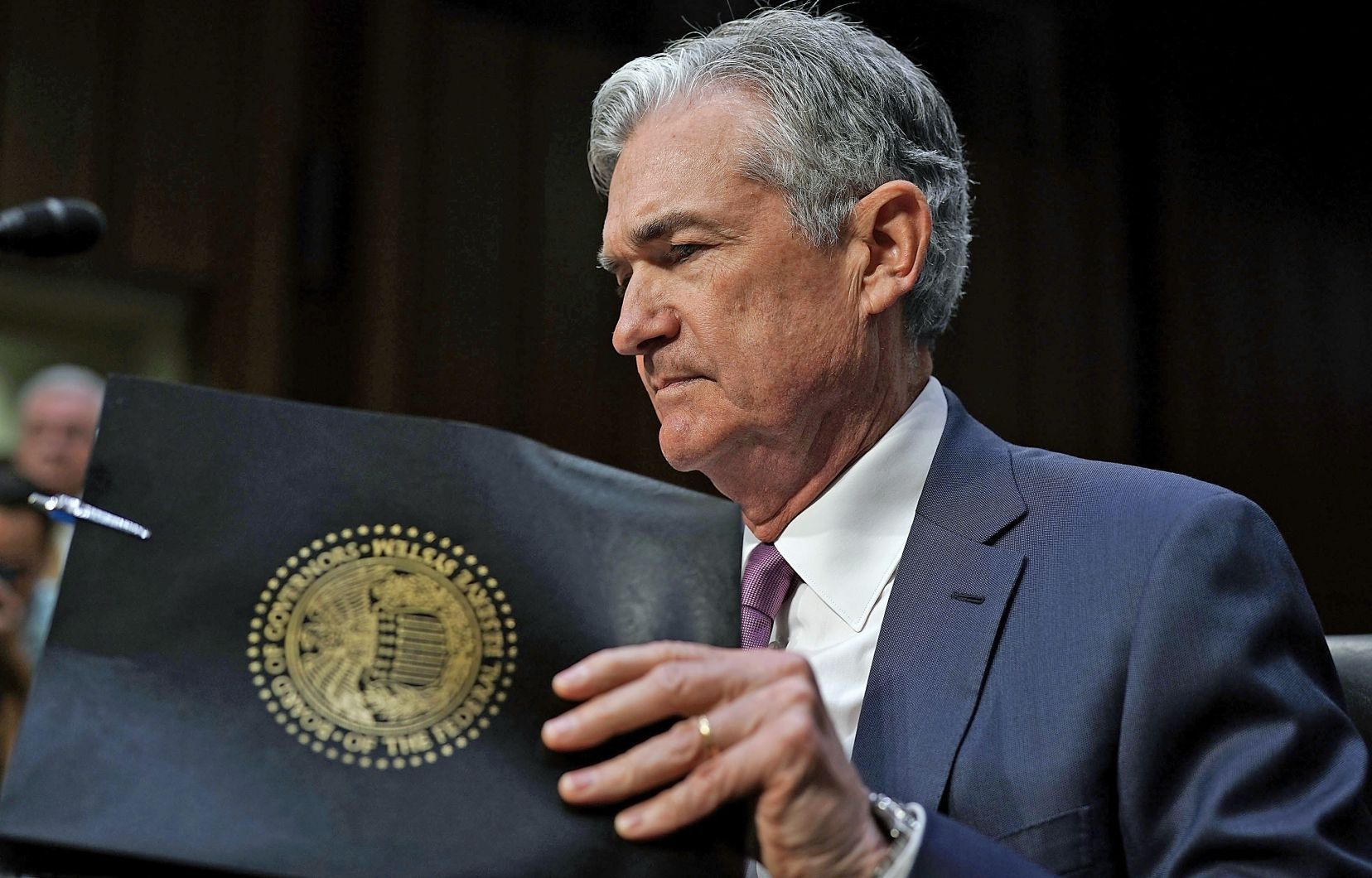

European markets underwent a mixed session yesterday constrained somewhat by uncertainty ahead of scheduled comments from Fed chairman Jay Powell, where he was expected to strike a slightly different and more hawkish tone in the wake of Friday’s bumper US jobs report.

Despite the uncertainty the comments were a bit of a damp squib, with Powell reiterating his comments about disinflationary trends being seen, while also insisting that the Fed still has some way to go to get inflation back to target, and that it could take until next year to do so.

In short Powell’s comments were only slightly more hawkish than his press conference remarks, however US markets didn’t seem to care that much, finishing the day strongly higher even as bond yields remained steady at their recent highs.

This resilience in the US looks set to translate into a positive European open later this morning.

Counterintuitively it was the Nasdaq that led the moves higher in the US yesterday, even as the prospect of rate cuts this year has gone, and the likelihood of two consecutive 25bps rate hikes in March and May has increased. Not only that, but there is also every indication that rates could go even higher than the 5.1% terminal rate that the market is currently pricing.

When you have the likes of Minneapolis Fed President Neel Kashkari reiterating his belief of a Fed Funds rate of 5.4% before a pause, someone who is normally considered one the more dovish voices on the FOMC, it would appear that once again US markets are indulging in wishful thinking, when it comes to where rates are likely to go over the next 12 months.

We will also get to hear from two more voting members later today with New York Fed President and vice chair John Williams due to speak just before the US open, followed soon after by Governor Michael Barr, with markets expected to parse any comments that might be considered hawkish. Given recent experience however it seems that markets don’t seem to care that much and for now simply want to go higher.

EUR/USD – slipped to the 1.0670 area before rebounding to close above the 50-day SMA at 1.0690. A sustained move below this key support opens up the risk of a move back to the January lows at 1.0480. Resistance now comes in at the 1.0780 area, and 1.0820.

GBP/USD – bounced off the 200-day SMA at 1.1960 yesterday with the next key support at 1.1835. The pound needs to recover above the 1.2080 area and open up a move towards the 50-day SMA at 1.2180.

EUR/GBP – decent reversal off the 0.8980 area which suggests that we might see further falls towards the 0.8870 area.

USD/JPY – the inability to push through the 50-day SMA at 132.60 has seen the US dollar slide back sharply. A move below the 130.50 area and yesterday’s lows has the potential to retarget the 128.00 area.