Tesla will report its first-quarter earnings after the US market close on 19 April (ET time). The popular stock has jumped more than 80% from its January low of $100, as investors hope for a strong delivery number after Elon Musk admitted a production ambition of 2 million cars in 2023.

However, its price cuts since the end of last year may have eaten up its profit margin, leading to a decline in earnings. With an already lowered expectation, a beat on the results may send its shares higher, but a miss could reverse some of its gains. So what key numbers may drive Tesla share’s price action amid the upcoming earnings?

Tesla’s car deliveries lose momentum

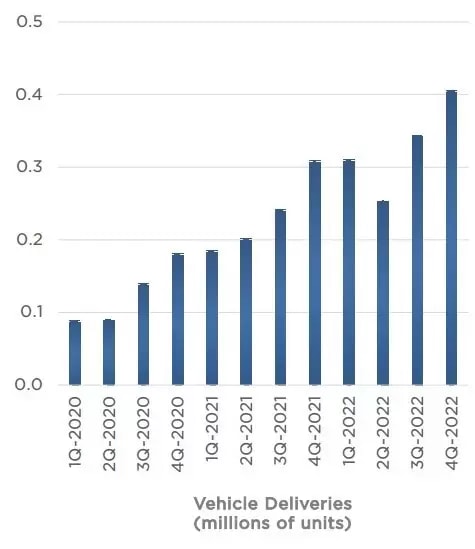

Tesla delivered a record 422,000 vehicles from a total production of 440,808 vehicles in the first quarter. The delivery number represented a 4% growth sequentially and a 36% increase from a year ago, but was shy of Wall Street’s expectation for 432,000 vehicles. However, the increase in car deliveries slowed down from 40% annual growth in 2022, suggesting that the EV maker is losing momentum in growing sales, despite its massive price cuts.

On a positive note, with Tesla expanding its manufacturers to more countries, production is expected to ramp up. CEO Elon Musk said the company was on target to produce 2 million cars and potentially achieve the same number of sales in 2023, which would be a 53% increase from 1.31 million deliveries in 2022. But the official guidance called for the production of 1.8 million, or a 37% increase annually.

Nonetheless, Tesla’s guidance on car sales is crucial for its stock’s valuation in the upcoming earnings. According to TechCrunch, China’s demands will be the most influential part of its sales number as the country may account for 50% of its first–quarter car deliveries (including both domestic and overseas sales). The long-awaited Cybertruck is expected to start production later this year, which could boost sales if it can be on track. However, increasing competition in the Chinese markets may threaten Tesla’s sales. The rapidly growing Chinese EV maker, BYD, sold 206,089 vehicles in March.

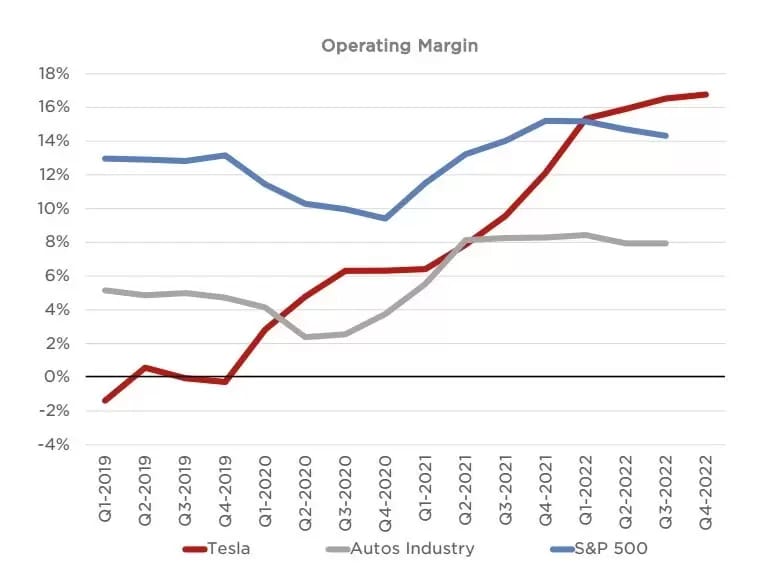

Tesla’s profit margin is on check

Despite a record car delivery number, Tesla’s profit margin may be squeezed by its price discounts starting late last year. In the fourth quarter of 2022, its automotive gross margins came in at 25.9%, the lowest in the last five years. Its cash flows from operating activities dropped 28.5% from a year ago. The figure suggests that Tesla’s earnings will dramatically decline if it cannot grow its sales as expected.

Tesla’s earnings per share are expected to be at $0.85, or a 20.6% drop year on year, and the revenue is forecasted at $23.56 billion, up 25.6% annually, but lower than a 37% growth in the final quarter of 2022.

Technical analysis

Tesla shares have been in a range-bound movement since the end of January. There is no standing-out technical signal for the short-term price action. The near-term support may be around 170 at the 100-day moving average. Further support could be at 144 to fill the price gap early in January. The pivotal resistance may be at 200 around the 200-day moving average. A bullish breakout of 200 may take Tesla’s shares to about 242, which is the 50% Fibonacci retracement.