The recent AI-powered tech rally on Wall Street suggests that investors or fund managers may see an opportunity to shrug off the economic doom by guiding the market’s attention to the fast-developing industry. Nvidia’s shares exploded and topped a $1 trillion market cap tech club after the chipmaker reported strong earnings and provided a positive outlook about its AI chip demand. This boosted other major industrial players’ stocks, such as Broadcom and AMD, which all jumped about 20% in one week. However, could the tech euphoria be disguising the wider market trajectory at the back of a stumbling economic outlook?

Too good to be true?

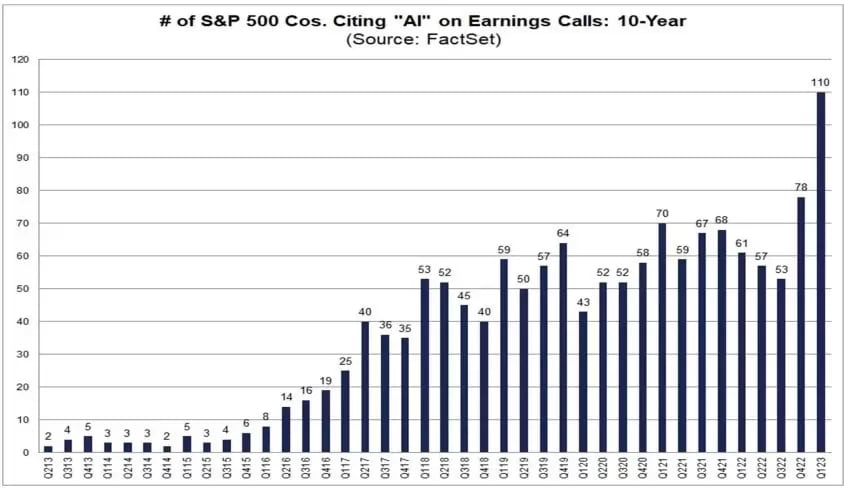

According to Factset, in the first quarter earnings calls, the number of companies in the S&P 500 that cited “AI” is the highest in over 10 years. At a sector level, 75% of communication services companies and 66% of information technology companies in the S&P 500 cited “AI” during the Q1 Earnings Season, representing the highest percentage among sectors.

Coincidently, the two sectors, information technology (XLK) and communication services (XLC), have been the top two performers in the S&P 500 during the past three months, suggesting that funds may have purely flown into those companies with AI development, but not really buying based on stock valuations. The below chart illustrates that information technology and communication services stocks have been in a divergent movement with all the other 9 sectors in the S&P 500 since May, sparking concern about how far this prevailing trend could sustain, with only a few big tech giants leading gains. At the same time, the economic front is not rosy, economic activities in manufacturing contracted for the sixth consecutive month in April, while consumer confidence weakened to the level that usually points to an economic recession in the next year, mirroring the downtrend movements in the energy, financials, and industrial sectors.

Another observation is that the AI-powered big tech rally started when Microsoft launched a new AI-powered search engine, Bing in early February, while the growth-sensitive index, the Dow Jones Industrial Index was in a sluggish movement during the same period and the selloff accelerated in May. This suggests that the AI euphoria has likely been driven by inflated expectations and excitement since the launch of ChatGPT, which implies a possible tech hype cycle.

Fed’s decision is at a critical point

Investors are hoping a rate hike pause will further boost risk sentiment to maintain the market bulls. However, history indicates that stock markets usually reach a peak when the reserve bank holds on to the interest rates at the end of the hiking cycle, which implies rising risks for an economic downturn.

Though most tech leaders’ earnings beat markets’ expectations in the first quarter, many showed a decline in revenue growth. Despite the AI boom, a majority of the tech giants had massive job cuts to save costs to win investors’ trust.

In addition, the regional bank’s crisis warns of mounting systemic risks after those big banks took over bankrupted small financial institutions. The only positive economic front is the strong labor market, but the Fed may intend to soften employment by continuous rate hikes to fight inflation. A rise in the unemployment rate may rapidly translate into household debt default and likely cause a credit crunch. Looking back, the AI buying frenzy has some similarities with the dot-com bubble in 2000.

Hence, the AI boom lacks the fundamentals to defend against an economic recession base on the above narratives. But it does not conclude that all AI-related stocks are facing an imminent pullback. Companies with strong AI infrastructure and healthy cash flows may still weather an economic storm as the AI innovative development is still at an early stage, just like the internet burst in early 2000. Investors need to take all these aspects into account when making their own investment decisions.