Overall, the US mega tech earnings were certainly not rosy for this season, but two-straight weekly gains on Wall Street may suggest that a Fed pivot or at least a Fed slowdown on rate hikes is near, making the upcoming FOMC meeting a crucial event for the doubtable rebounding optimism. But will there be “buy the rumour and sell the news” trades if the Fed does meet expectations to soften its hawkish tone? Or the selloff may resume if the Fed keeps its aggressive tightening stance.

Plus, the US non-farm payroll will also offer clues about the labour markets’ trajectory, where a rise in the unemployment rate may not be avoided since companies have been slowing hiring and laying off workers.

What are we watching?

- VIX falls: The CBOE volatility index continued to slide last week, suggesting that investors’ risk appetite recovered, which may continue to support equity markets’ rebound ahead of the Fed meeting. See VIX's movements

- The US dollar pulls back: The US dollar index slid for the second straight week to just above 110, a four-week low. However, its upward trend is still intact from a technical perspective. Trade the USD now

- Gold futures set to test key resistance: Gold showed resilient moves in the last two weeks, approaching key resistance of 1,680. A bullish breakout of this level may take the precious metal to reverse its downtrend. Check on gold's charts

- Chinese shares tumble: Chinese stock markets were in turmoil amid uncertainties about the new leadership and re-ramp up in Covid curbs. The Hang Seng Index slashed 8%, tumbling to the lowest level seen in 2009. See Hang Seng Index's trend

- Cryptocurrencies pop: Both Bitcoin and Ethereum rose to a six-week high, and Dogecoin surged to the highest level seen in June amid Elon’s takeover of Twitter. Trade Bitcoin now

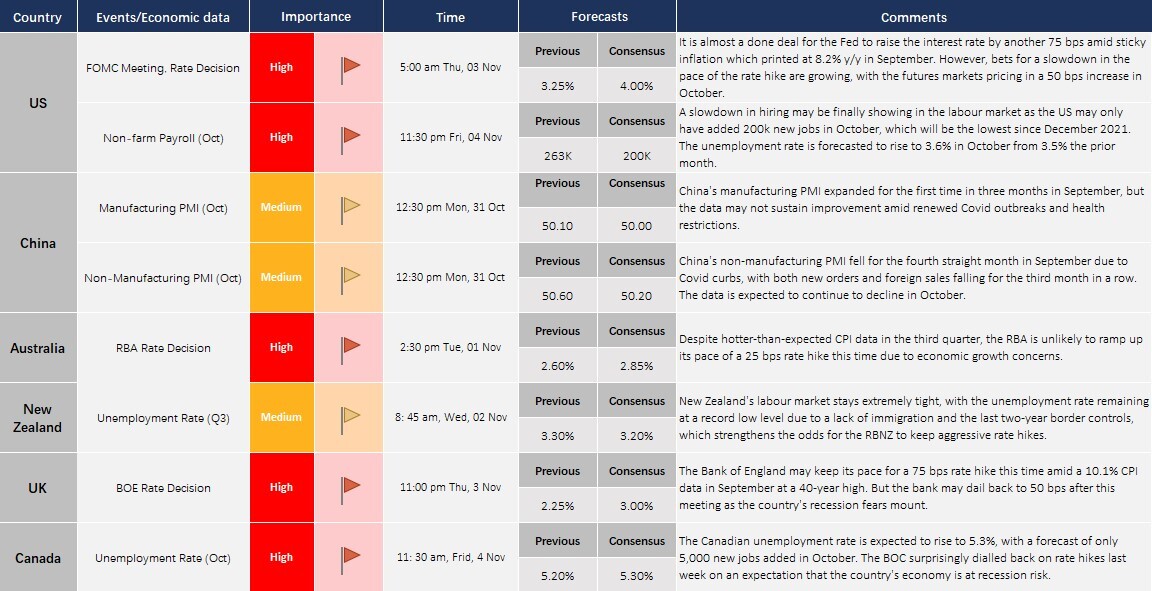

Economic Calendar (31 Oct – 04 Nov)

All the time is in Australian Eastern Standard Time (AEST)