Last week, strong US labour markets and Fed officials’ hawkish guidance put Wall Street’s uptrend on hold as growth stocks were hammered by a rebound in rates. The rally in Chinese shares also took a breather, with Hang Seng Index down 2% for the week. The crucial economic data will be the US CPI this week and consensus calls for further cooling inflation following the last three consecutive sharp slowdowns.

What are we watching?

- US dollar rebounds: Amid a slew of hawkish Fed officials’ policy guidance, the US dollar index consolidated above key support of 100 last week, showing signs of strengthening towards a further resistance of above 105.

- The ChatGPT technology buying frenzy: ChatGPT becomes another popular concept akin “metaverse”, and the chatbot technology sparked a new wave of buying frenzy in tech shares, such as Microsoft, Alphabet, and Baidu before a sharp retreat later last week.

- Crude oil rebuilds strength: Undersupply becomes a major issue again and pushes oil markets to rebound last week, erasing most of the gains in the prior week. Russia announced to cut output by 500,000 barrels per day from March, while China’s reopening stretches the demand outlook, and OPEC+ indicates to stick to their production plan in the coming months.

- Gold retreats: The buying euphoria came to a pause in gold due to a rebound in the US dollar and a jump in the bond yields. The precious metal may take a further hit if the current market trends persist. The near-term technical support may be anchored around 1,840.

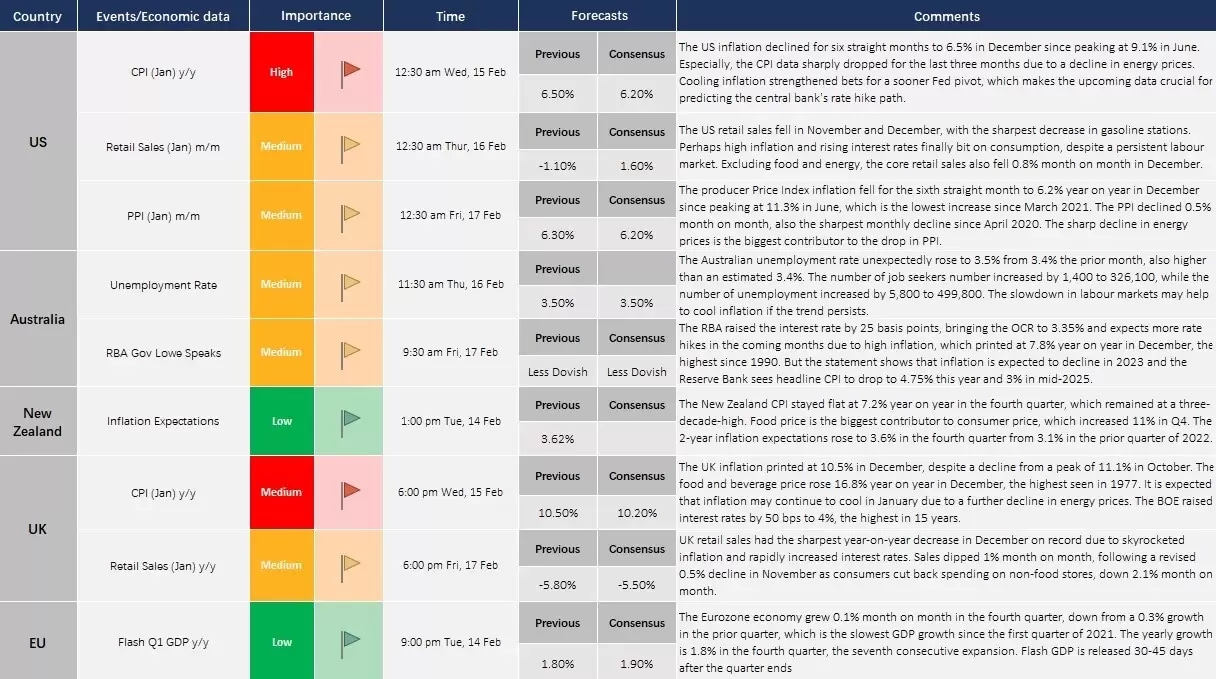

Economic Calendar (13 Feb – 17 Feb)