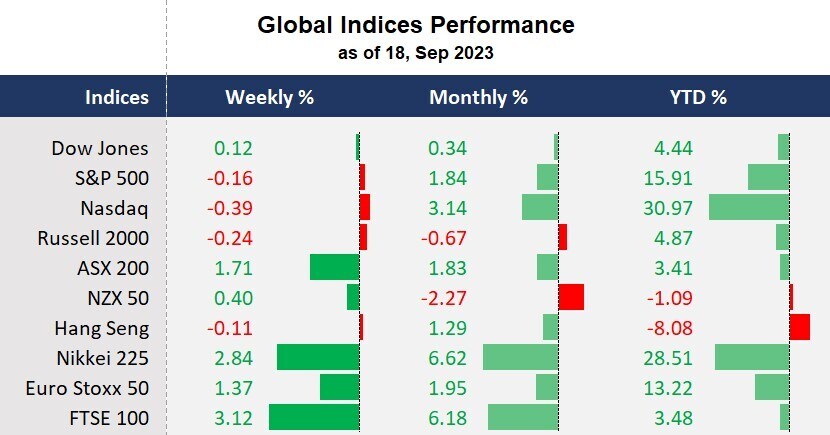

The US stock markets extended losses for the second straight week, with the S&P 500 finishing just below 4,500 and is in negative territory month-to-date. US inflation had another acceleration in August and potentially firmed the Fed’s hawkish stance. Equity markets were sold off on Friday after an Arm IPO-led rally, which flared up optimism in the AI stocks with a 25% surge on its debut day. Should the success keep pumping up liquidities, market bulls may continue to ride the AI wave at the back of a “soft-landing” economy. Notably, energy stocks have been outperforming since August on a rebound in crude oil prices. However, with inflation picking up again, central banks may delay their decisions to end the rate hiking cycle, which brings uncertainties to the global economic outlook.

It will be a big week for the financial markets, with four central banks, including the Fed, the BOJ, the SNB, and the BOE, set to decide on their policy rates. The Fed is expected to pause rate hikes this time but is likely to stay hawkish, which will be the most influential event to the financial markets. The Bank of Japan will likely keep the ultra-loss monetary policy despite hints of ending the negative deposit rate by the year-end from Governor Kazuo Ueda. However, any hawkish signal may cause a rebound in the Yen and press the king dollar.

China’s stimulus measures started taking effect on boosting its currency and the regional stock markets as the PBOC cut the Required Reserve Ratio by 25 basis points, which also boosted commodity prices, further lifting the crude oil and industrial metal prices. This led to a broad rally on ASX mining stocks, with the index finishing 1.7% higher for the week. The Australian banking stocks also benefited from rising bond yields and Arm IPO, which injected funds into the US big lenders. China’s Loan-Prime-Rate decision and the RBA’s meeting minutes are the focus of the APAC region. In addition, New Zealand’s second-quarter GDP will gather attention after two consecutive negative quarterly growth ahead of its election in mid-October.

What are we watching?

- Apple was under pressure: Apple’s shares slid for the second straight week since China imposed restrictions on iPhones in state-owned departments and agencies. Its new product launch event did not revive Apple’s shares from the downside movements. Apple’s shares found key support around 170 in the last five weeks.

- The US dollar may have reached a recent peak: The dollar index approaches 106, the highest level since 8 August, which could be a key technical resistance. The recent rebound in the Chinese Yuan may pressure the USD, in turn lifting other Asian currencies ahead of the BOJ meeting this week.

- Australian mining stocks surge: Big miner stocks, such as BHP, Rio Tinto, and FMG, soared amid China’s policy optimism after the country expanded its stimulus measures to aid the economy. Jumping commodity prices also added to these stocks’ upside momentum.

- Crude oil hits a 10-month high: Oil prices continued to climb, gaining for the third straight week, with the WTI futures rising above US$91 per barrel for the first time since November 2022. China’s stimulus policy, resilient US economic data, and OPEC+’s ongoing output cuts are the bullish factors that support the oil market’s upside movement.