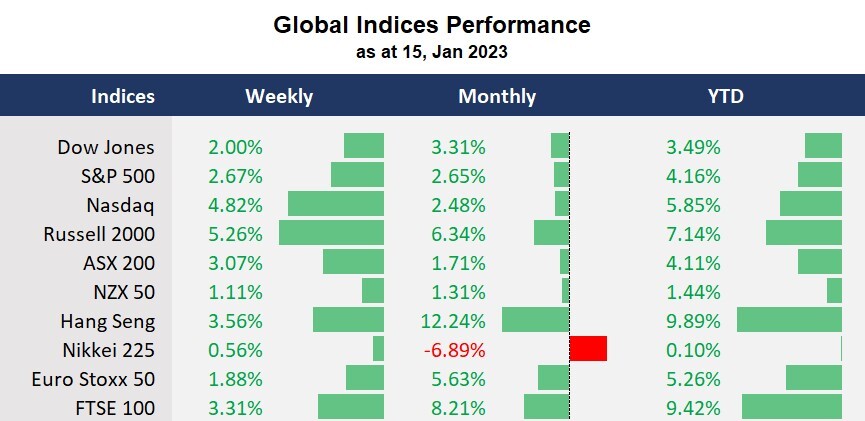

Global equity markets extended gains for the second week, thanks to a further cooling in US inflation, making a sooner-than-anticipated rate-pivot more by the US Federal Reserve more likely. Notably, high multiples have outperformed US equity markets, with the tech-heavy Nasdaq up nearly 4.8 %, and the small-cap index, Russell 2000, up 5.2% for the week.

At the same time, China’s reopening story is playing a major role in gauging the global economic trajectory, with a further jump in commodity prices at the back of an improved demand outlook.

Following a stronger-than-expected US banks' Q4 performance, US big tech earnings kicks off with Netflix, which may further steer current market bulls. The Bank of Japan’s policy meeting will be also a focus, since the central bank unveiled a policy twist in early December.

What are we watching?

- The US dollar weakens: Cooler inflation has sent the king dollar lower, with the dollar index dropping to the lowest seen in June 2022, supporting a sharp rebound in the other major currencies, especially in the Japanese yen and the Chinese yuan. Both USD/JPY and USD/CNH tumbled to the lowest since mid-2022.

- Gold surges: The decline in US bond yields and a softened USD continued to support the sharp rally in gold prices, with gold prices jumping above the key resistance of 1,900, to the highest seen in April 2022.

- Crude oil rebounds: Crude oil prices rose amid China’s reopening optimism and a softened US dollar. The recession fear-induced sell-off in oil faded as cooler inflation and bets for a sooner Fed pivot improved the demand outlook.

- Cryptocurrencies spike: The broad rally in risk assets has also boosted sentiment in cryptocurrencies, with bitcoin surging above 21,000 and ethereum jumping above 1,550, the highest since November 2022.

Economic calendar (16-20 January)