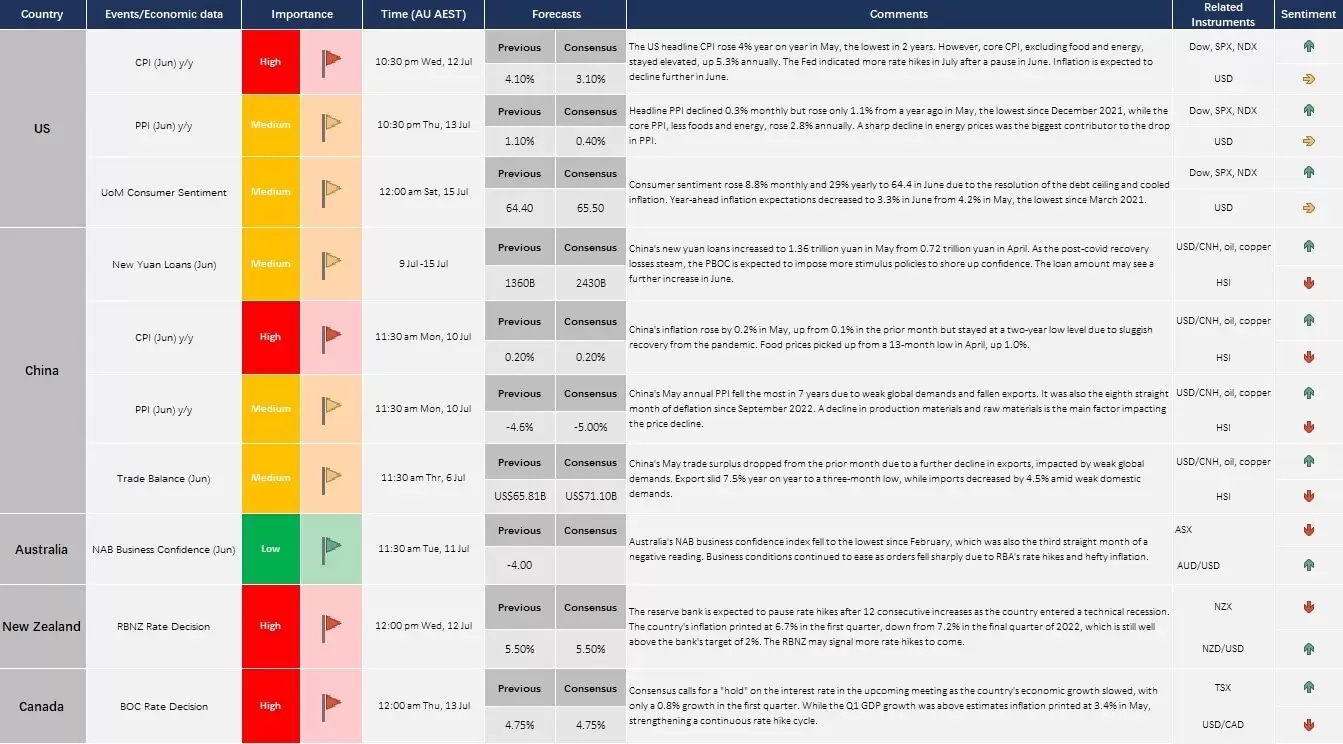

Wall Street finished the week lower to kick off July as improved US economic data strengthened odds for the Fed to hike rates further and sent jitters to the bond markets, which tightened up liquidity. With the US 2-year bond yield hitting a 16-month high, risk-off mounted across the global equity markets, which may have entered a period of correction ahead of the crucial earnings season. The big banks’ second-quarter performance will be a key gauge for the wider financial system’s health, with JPMorgan Chase, Citigroup, and Wells Fargo reporting their results later this week. On the economic front, the June CPI data will be critical to guide Fed’s policy path, steering market future trends.

In Asia, the selloff intensified in Chinese shares amid geopolitical uncertainties after the country implemented restrictions on major chip metals exports in the face of the US curbs on its technology advances. The ASX 200 has also been slashed by surging bond yields, finishing lower, down 2.24% for the week as big caps like mining and financial stocks were all in the red. Looking ahead, China’s slew of influential economic data, including CPI, PPI, and trade balance for June will continue to keep sentiment in check.

Elsewhere, two major central banks, including RBNZ and BOC are due to decide on their policy rates this week. Both of the banks are expected to pause their rate hike campaign, particularly the RBNZ, which may stop raising the OCR after 12 consecutive increases.

What are we watching?

- Bonds yields hit fresh highs: The global bond markets tumbled following US’s strong job data as yields soared on bets that the Fed will keep the interest rates higher for longer.

- Nasdaq retreats: The tech-heavy index may enter a correction period as the AI-powered rally loses steam, with sector rotation brewing into the new month. The index may have been overbought from a technical perspective.

- Apple hovers around an all-time high: The tech giant held above a 3 trillion market cap, hovering around a record high. Apple’s shares rose about 68% from the January low as the company beat earnings expectations in the last fiscal quarter.

- Crude oil consolidates: Oil markets rebounded from the week-low amid a larger-than-expected draw in the US inventory data. The OPEC + meeting will provide further clues on the supply front, where a further hint of output cut may take oil prices to reverse the downtrend.

- Gold consolidates: Gold price consolidated above pivotal support of about 1,900 as the US dollar slumped following Friday’s job data. Risk-off sentiment may continue to lift gold prices if the stock markets retreat further.

Economic Calendar (10 July – 14 July)