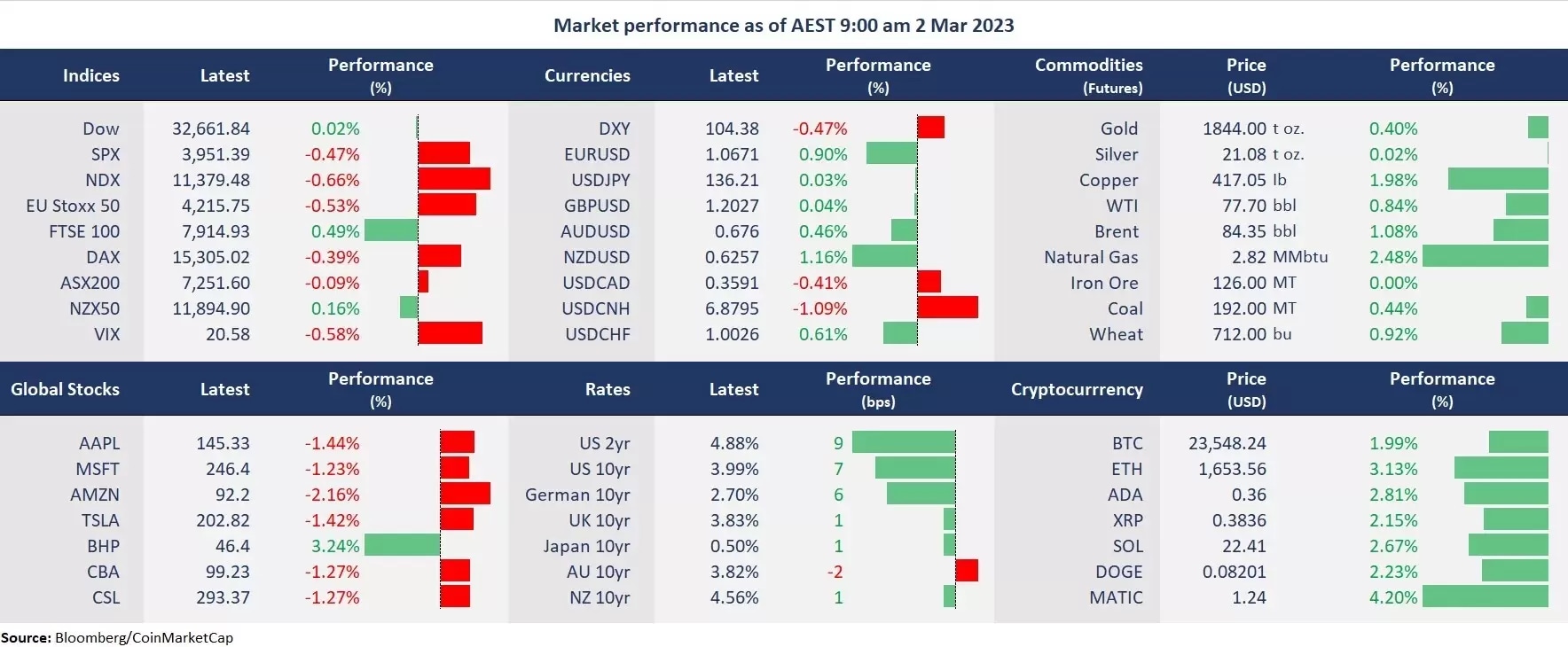

Wall Street started March on a back foot as rates jumped, with the US 10-year bond yield surging to 4% at a four-month high, while the yield on the 2-year notes surged to 4.89%, the highest seen in May 2007. Both S&P 500 and Nasdaq finished lower, while Dow eked out gains in the final hour. However, the spikes in rates did not lift the US dollar as Asian currencies strengthened following China’s strong PMI data for February, boosting broad sentiment in the APAC region, with Hang Seng Index up 4.2%. In the Eurozone, stubbornly high German CPI raised expectations for a higher peak in rates for the EU, pushing the Eurodollar higher.

Chinese positive economic data also buoyed commodity prices, outweighing recession fears. Both gold and oil were higher following the data on a softened US dollar. However, Asian markets are set to open lower following Wall Street’s slump. The ASX futures were flat. The Hang Seng Index futures slid 0.83% and Nikkei 225 fell 0.25%.

- 8 out of 11 sectors in the S&P 500 finished lower, with utility and real estate stocks leading losses, down 1.7% and 1.4% respectively. Energy stocks outperformed due to a rebound in oil prices, with Occidental Petroleum up 2%, and Exxon Mobil rising 1%. Most of the big tech shares were down 1-2%.

- The US ISM manufacturing PMI contracted for the fourth consecutive month in February, printing at 47.7, slightly higher than the prior month of 47.4, lower than an expected 47.9. Both new orders and production remained weak due to weakened demands and rising interest rates.

- NIO’s ADR shares slumped 5.7% on the US markets amid a widened loss in the fourth quarter and weak guidance for the first quarter. The Chinese EV maker lost 44 cents per share on revenue of $2.329 billion versus an estimated 26 cents loss per share on revenue of $2.462 billion. NIO’s guidance for the current quarter is a midpoint of $1.620 billion in revenue, far below an expectation of 2.5 billion.

- Chinese Yuan jumped to a one-week high amid strong Chinese economic data. USD/CNH tumbled 1% to 6.88, the lowest seen on 20 February, falling below the 200-day moving average. The greater-than-expected Chinese manufacturing and services PMIs have also lifted the APAC currencies in general, with the New Zealand dollar leading gains, up 1.16% against the US dollar.

- Gold rebounded for the second straight trading day on a softened US dollar. Gold futures found footing at 1,809 after surging to above 1,960 in early February. The precious metal may regain its momentum after a month-long drop amid signs of further softening in the USD.

- Crude oil moved higher for four days in the last five sessions amid China’s reopening optimism. China’s strong PMI data helped push the crude price higher on Wednesday, while the US inventory increased less an expected, which also buoyed oil markets.