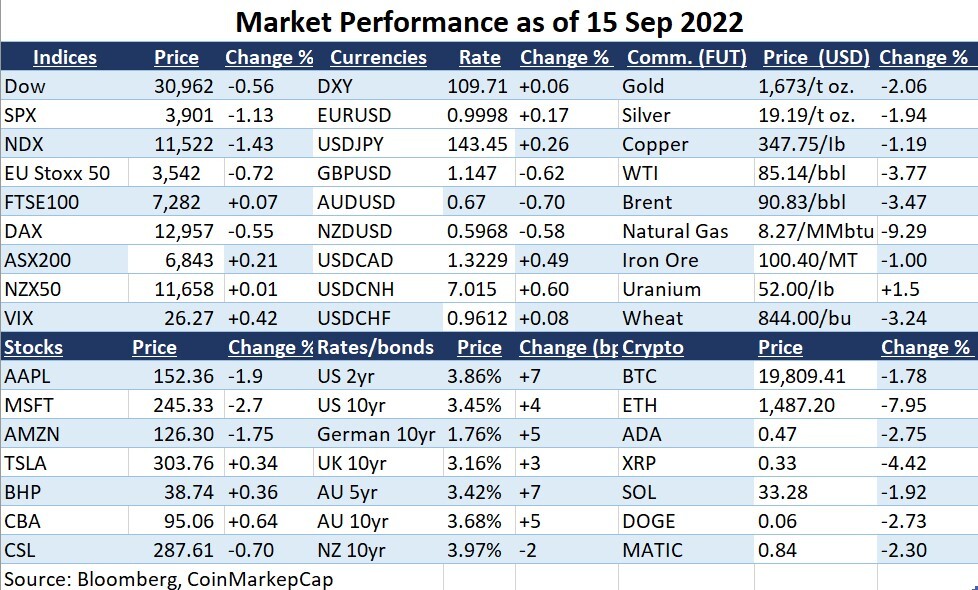

Wall Street finished at session lows as bond yields rose further amid strong economic data. The US retail sales unexpectedly rose 0.3% in August, well above an estimated 0.1% drop, while the jobless claims fell to 213,000 for the last week, the lowest in one month. The data strengthened bets that the Fed will stay hawkish on rate hikes next week. The US 2-year bond yield rose to 3.86%, a fresh 15-year high, while the US dollar strengthened, crashing major Asia-Pacific currencies, with Yuan falling above 7, a key psychological level. Both oil and gold prices slumped due to a strong dollar.

- Dow was down 0.54%, the S&P 500 fell 1.13%, and Nasdaq slipped 1.43%. 9 out of 11 sectors in the S&P 500 finished lower on a broad-based selloff. Energy stocks sank due to a slump in oil prices, while the financial and healthcare sectors closed higher. Most mega-cap companies’ shares finished lower, but Netflix jumped for the second day, up 5%, on positive outlooks for its new ad-supported program. Adobe shares plunged 17% on a deal to acquire Figma, a design software company, on a $20 billion bid, which will be the biggest takeover for Adobe.

- Yuan tumbled against the US dollar, shooting up above 7, for the first time since July 2020. USD/CNH reached a peak of above 7.19 in both August 2019 and July 2020. The pair rose to 7.013 this morning after major mainland banks cut deposit rates to boost lending demands. A slew of China’s influential economic data, including retail sales, industrial production, and the unemployment rate will be on watch in today’s session.

- Asian markets are set to open lower as broad government bond yields rose, pressing on risk assets. ASX futures slipped 0.73%. Nikkei225 futures were down 0.83% and Hang Seng Index futures declined 0.23%.

- Air New Zealand is reportedly in talks for a merger with Virgin Australia. The NZ flag carrier confirms that “it has not been approached, and is not in discussion with any parties, regarding the potential merger transaction”, according to NZX.

- Both crude oil and gold prices tumbled amid a strong US dollar, and a surge in bond yields. In fact, broad commodity markets were hit by the risk-off sentiment that was sparked by looming recession fears. A deepened US bond yield inversion warns of an inevitable economic recession sooner or later, a financial crisis like the 1970s crash.

- Ethereum completed a major blockchain merge that is seen to cut electricity use by 99%. The progress of the so-called “proof-of-stake” change has taken a few months, aiming to reduce costs for users and potentially generate around 5.2% yield. The Ether token, however, dropped 6.9% in the last 24 hours due to a slump in broad risk assets.