It seems that the hunt is on. The hunt for gold and silver, to be exact. The performance of the two precious metals over the past 18 months has probably been different from what most market observers expected.

Gold is popular with investors because it's traditionally used as a store of value and to hedge inflation. Astonishingly, despite the highest inflation rates in over 30 years, precious metal prices didn’t benefit. The war and chaos in Ukraine and the resulting geopolitical tensions and upheavals also didn’t help the precious metals to earn their name as a crisis currency.

Gold even went down by 22% at its peak. Silver was also unable to escape the downward pull, and even lost over 41% at its peak from its highs in the summer of 2020. Nevertheless, the still uncertain future for technology stocks, market fluctuations, and acute geopolitical risks have created a perfect breeding ground for precious metals.

Acutely bad sentiment

At the end of October 2022, the prices of gold and silver reached their lowest levels, and at the same time sentiment was at a peak. Some investors will have noticed that events in the markets and publications in certain financial media often point to a certain anecdotal indication as bullish or bearish. Often these headlines can intuitively be seen as a counter-indicator.

Examples include celebrities who advocate an asset class, the taxi driver who suddenly reports on the best investment opportunities without risks, or the covers of a magazine that proclaim a strong opinion about a particular asset. Basically, it can be assumed that when a mainstream journalist or editor finally dedicates a front page to a market trend, country, or person, the story or topic has been en vogue for some time, and will probably reach its peak soon. This can be observed, for example, with the following publication.

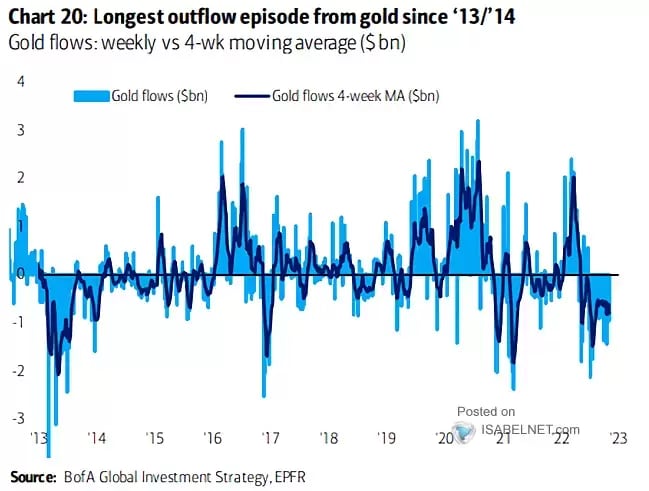

Outflows from investment funds, or other gold investment instruments, have been very negative up to this point. It was even the longest period of net outflows in almost 10 years. In the meantime, this situation has changed, and the market is recording its first net inflows in a long time.

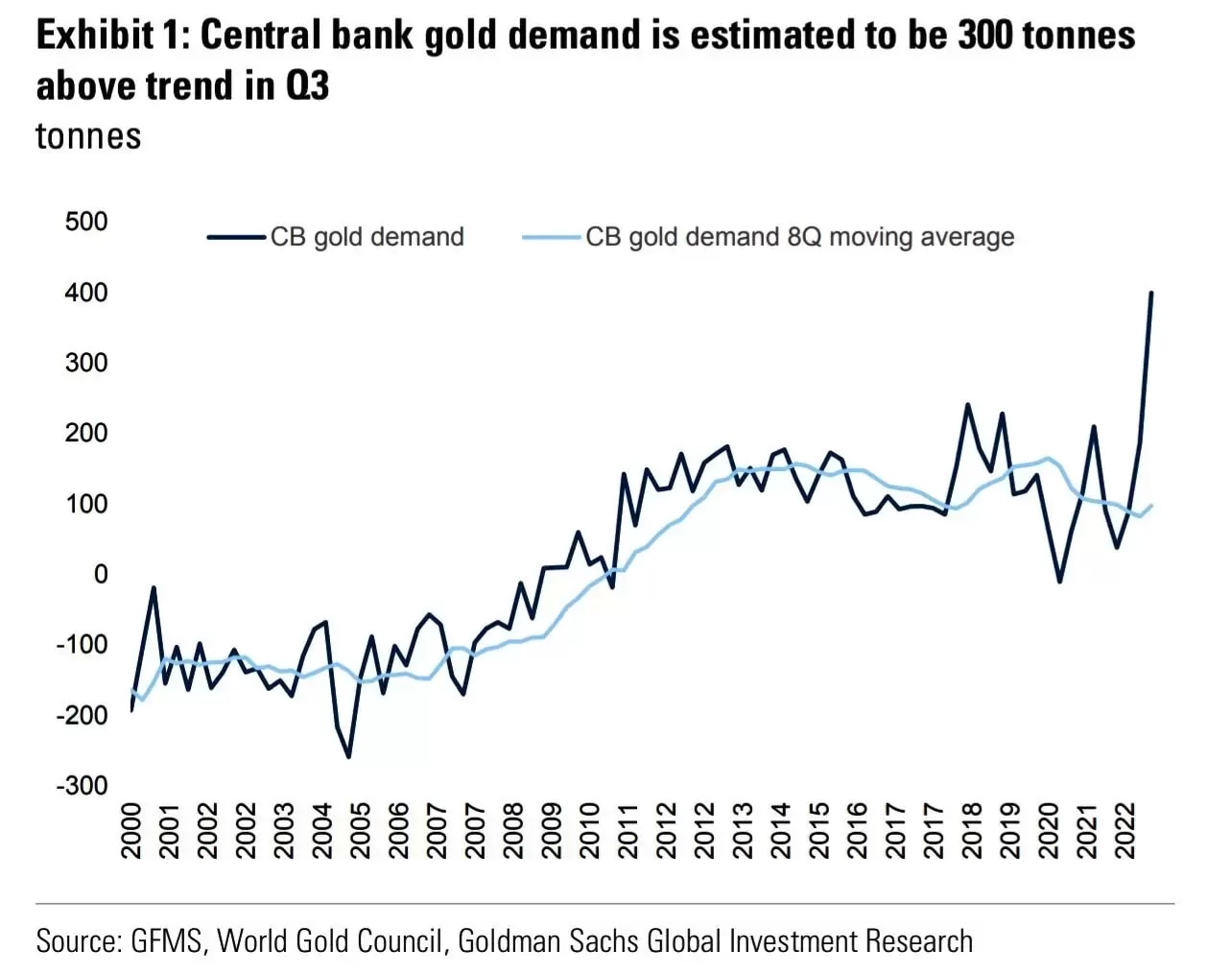

Central banks are buyers

But it's not just fear that supports gold. Central banks in emerging markets continue to buy gold to further diversify from the dollar. This time, however, it’s also the central banks of G7 countries that are among the buyers. At the same time, global debt has risen again, and the US trade deficit could also reach a new high next year.

Silver also looks like a bargain

A higher silver supply is also expected for the coming year, as the industry needs more silver. Indeed, industrial demand is expected to increase to 539 million ounces in 2023. Developments such as the progressive electrification of vehicles, the increasing adoption of 5G technology, and government commitments to more green infrastructure, means that industrial demand will more than outweigh macroeconomic headwinds and weaker demand for consumer electronics. Car manufacturers are using more silver as the amount of electronics in vehicles increases, but the sector accounts for only about 5% of total demand. Solar panels make up about 10% of silver demand.

Gold-silver ratio again close to record low

The gold-silver ratio is a measure that indicates the relationship between the price of gold and the price of silver. For this, the price of a troy ounce of gold is divided by the price of one troy ounce of silver. The gold-silver ratio could therefore provide the answer to the question of which of the two precious metals is currently overvalued or undervalued.

For investors, this ratio can therefore be helpful when analysing the weighting of gold and silver in their personal asset portfolio. The more pronounced an overvaluation or undervaluation is, the higher the probability that a corresponding price adjustment by the market could take place in the future.

The gold-silver ratio has climbed again close to the all-time high in August. The Covid-19-inspired crash led to a strong outperformance for silver against gold. Currently, it means that you need a little more than 82 ounces of silver to buy an ounce of gold. Simply put, silver has historically been significantly undervalued relative to gold. Should the environment for precious metals change, the silver price could again recover much more strongly than the gold price.

Source: Trading View, created by CMC Markets, weekly chart 29/11/22