Russia’s surprise invasion of Ukraine in February caused shortages of oil, natural gas and wheat, sending the global economy into a spin. The brunt of the war’s impact was felt in Europe, where nations’ efforts to reduce their dependency on Russian energy exacerbated inflation and increased the likelihood of a recession.

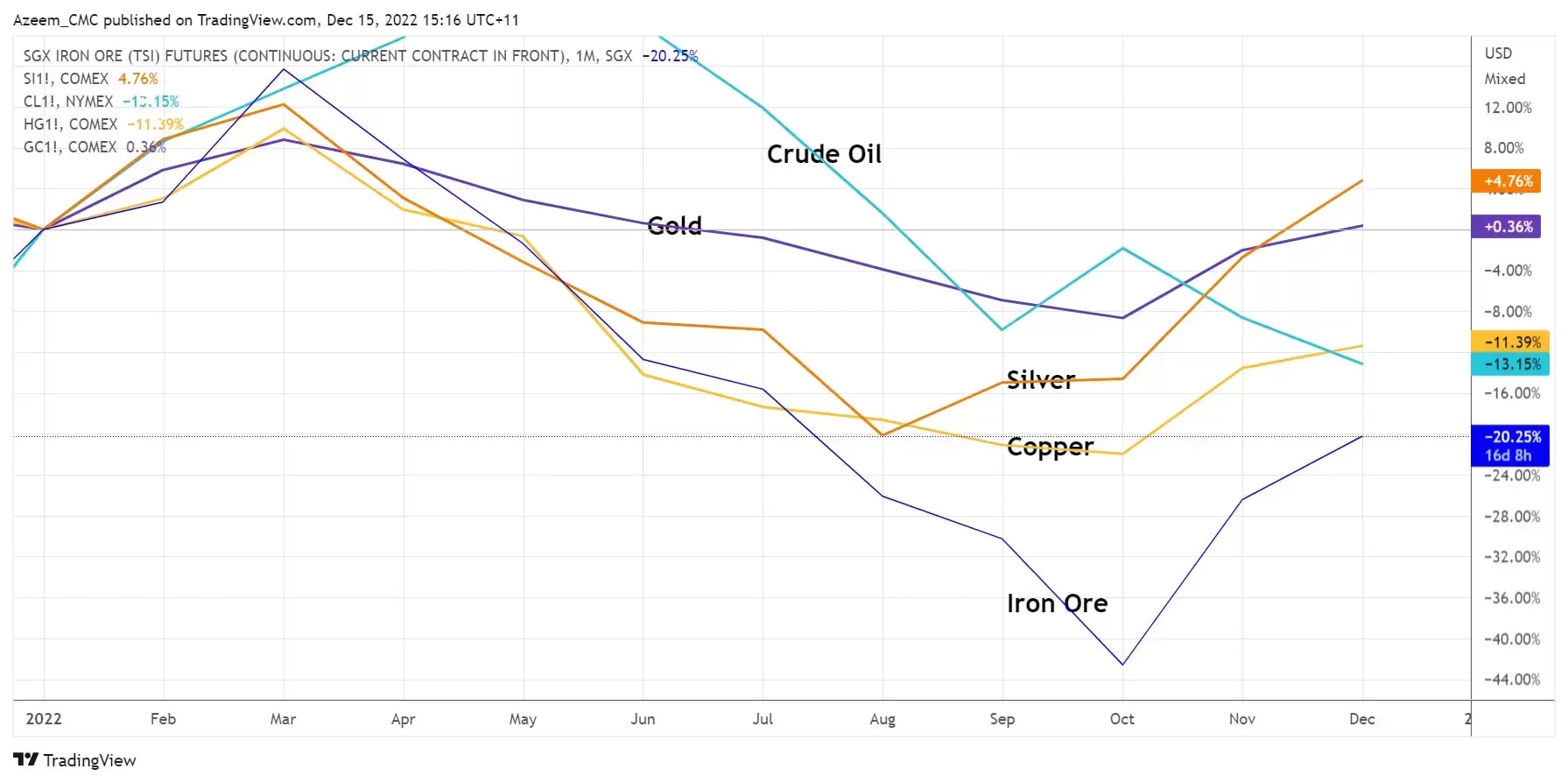

Performance of selected commodities, indices and stocks in 2022 (pricing as of 14 December, 10:30am, Sydney, Australia)

| Commodity | Price in USD (YTD) |

|---|---|

| Copper | 3.83 (-11.7%) |

| Gold | 1,810 (+0.6%) |

| Iron ore | 109.10 (-10.7%) |

| Lithium | 567,500 (+150%) |

| Oil (Brent) | 80.35 (+3.4%) |

| Asset (Ticker) | Price* (YTD) |

|---|---|

| ASX 200 Materials (XMJ.ASX) | $17,930 (+7.1%) |

| BHP Group Ltd (BHP.ASX) | $45.95 (+23.9%) |

| Rio Tinto Ltd (RIO.ASX) | $114.23 (+14%) |

| Antofagasta PLC (ANTO.LSE) | £1,483 (+10.3%) |

| Glencore PLC (GLEN.LSE) | £545 (+42.9%) |

*Prices in right-hand column of second table are in local currency: $ = AUD, £ = GBP

Commodity prices fluctuated in 2022

After a bumper 2021, base metal prices started to peak in Q2 this year, just before mining companies reported record earnings on higher profit margins. Most base metals peaked around March before descending. They then returned to a more neutral price setting as demand picked up and supply tightened.

Gold remained relatively stable compared to other commodities. However, the yellow metal’s function as an inflation hedge was called into question amid rising bond yields and US dollar strength.

Oil stood out as it reached $130 a barrel – a level not seen since the 2008 financial crisis. Higher prices this year stemmed from the Russia-Ukraine war, which impacted almost 30% of global oil supply. The conflict triggered alarm among OPEC+ members, who shuffled resources to meet soaring demand.

Iron ore had a stellar 2021, reaching an all-time high of $230 a tonne. This led to iron ore miners paying record dividends of more than 12% as profit margins widened. However, as 2022 progressed, demand for iron ore – which is used to make steel – fell significantly as Covid lockdowns in China forced factories and construction sites to close temporarily.

Glencore was top-performing mining stock

BHP Group and Rio Tinto paid record dividends during 2022, mainly thanks to extremely profitable free cash flows of around 9% yield from record profit margins.

But questions remain over whether such payouts are sustainable and whether the two mining giants paid out more than they should have, given that we were in a strong bear market for share retention. Short answers: no, they’re probably not sustainable, and yes, they overpaid.

That said, the strategy helped the miners’ stock market valuations. They didn’t want to see a significant fall in their stock prices, so to maintain positive investor sentiment they compensated investors with record dividends.

However, given that the spot price for metals has decreased, profit margins are likely to tighten. This will reduce the free cash flow available to pass onto shareholders.

The top performer, though, was Glencore. But what makes the FTSE 100 constituent – whose share price has climbed 43% this year, outperforming the other miners – so unique? One reason is that Glencore has asset quality and diversification. This strengthens its performance against competitors, as was evident in its latest trading results. Will we see similar outperformance from Glencore in 2023? Time will tell.

Mining and metals face challenging 2023 outlook

Global macroeconomic conditions are expected to continue to deteriorate in 2023. This could bring downside risks for the metals and mining industry as commodity prices may remain volatile, and demand for metals- and mining-related equities might weaken.

Mining companies may have to contend with narrowing profit margins, while the exploration sector is beginning to curtail activities amid tight financial conditions. Conditions may fluctuate throughout the year as central banks tackle inflation via their respective monetary tightening policies, potentially impacting commodity prices.

A drop in mining activity levels in 2023 could highlight the sector’s important role in the clean energy transition. Supply-side constraints will continue to permeate the industry, impacting commodity prices, while demand-side factors include the rise of electric vehicles (EVs) and the nickel-lithium batteries that power them, as well as the ongoing shift to renewable energy resources and technology.

With governments and companies around the world scrambling to secure critical resources, we expect the mining and materials sector to play a vital role in the near term as commodity prices stabilise and demand returns to pre-Covid levels.

War in Ukraine remains dominant macro factor

The macroeconomic backdrop has been pivotal in 2022, and is likely to remain so in 2023. The war between Russia and Ukraine, and China’s Covid response, have driven the narrative for global commodity markets this year. With a global recession now imminent, economic downturn could affect business fundamentals during 2023.

High inflation, driven by the fallout of the war in eastern Europe and post-lockdown supply chain issues, has created numerous challenges for many major economies. Their struggles with high prices for energy, electricity, oil, wheat and natural gas seem set to continue as the cost of these goods remains elevated heading into 2023.

Dr Copper to continue taking the pulse of the global economy

Copper has been at the forefront of the commodities industry for almost a decade, with much focus on copper exploration and production. Alongside lithium, copper is a key component in EV batteries. Demand for copper is expected to grow in 2023.

Mining companies have faced headwinds as demand for metals like copper and lithium has increased as part of the clean energy transition. Environmental, social and governance (ESG) concerns have become a massive issue. As many companies continue to dig new mines, they will face greater scrutiny. This could limit the number of new copper projects, potentially affecting global copper supply.

What about decarbonisation?

Decarbonisation has been another major talking point in the metals and mining sector. Efforts to decarbonise have seen countries ramp up renewable energy production, increasing demand for raw materials and introducing new challenges for the commodities sector. The pace of the rollout of renewable energy seems set to outstrip the mining sector’s ability to increase supply, which could create a gap in output during 2024.

Is demand for electric vehicles and battery tech waning?

The world has heard a lot about EVs and battery tech in recent years, but as we head into 2023 the chatter may start to die down. Production of EVs has been subdued amid reduced demand and supply.

China’s zero-Covid policy disrupted supply chains this year, but the country is expected to generate more EV batteries during 2023. However, we could start to see a shift in the narrative around passenger EVs from supply-capped to demand-constrained.

Tight financial conditions for exploration sector

As discussed above, macro headwinds were front and centre this year as we entered a period of global inflation and recessionary fears. The exploration sector has been hit particularly hard by this economic downturn.

As 2022 gives way to 2023, the global economy faces multiple issues, including stubbornly high inflation, monetary policy tightening, geopolitical instability and impending recession. These factors are set to continue to have a negative impact on exploration financing.

Exploration budgets are therefore likely to continue to focus on lower-risk sites. So far, this has contributed to a notable decline in new discoveries.

How will mining M&A play out in 2023?

Mergers and acquisitions activity in the mining industry was relatively subdued for most of 2022, partly due to the global macro backdrop. Still, mining majors have made some notable plays as they seek to consolidate market share amid rising commodity prices.

However, in 2023 the high inflationary and rates environment will likely create caution. Growing demand for energy-related metals might take centre stage in the green energy and electrification transition.

With copper a potential play in 2023, the world’s largest miner and Australia’s biggest company, BHP Group, in November bid AU$9.6bn (US$6.4bn) for Oz Minerals Ltd – Australia’s second-biggest copper miner after BHP. The proposed deal would position BHP to dominate the copper market.

The bid prompted Rio Tinto to announce in an investor seminar on 30 November that it, too, is looking at M&A opportunities, adding that it was “agnostic” about location. After receiving shareholder approval, the company completed its US$3.3bn acquisition of Canada’s Turquoise Hill on 10 December, giving it control of Mongolia’s Oyu Tolgoi copper mine. Back in March, Rio acquired the Rincon lithium mine in Argentina for AU$825m.

With two of the world’s biggest miners engaging in M&A, you can bet that a larger strategy is at play. We await further activity in the year ahead.