In contrast to Wall Street, the Australian stock markets experienced a relatively subdued year in 2023. The benchmark index, the ASX 200, increased about 3%; in comparison, its US peer, the S&P 500, recorded a 20% year-to-date performance increase. However, the rally in energy prices and the resilience of mining stocks mitigated the ASX’s slump in 2022. The ASX 200 only saw a 5% decline, while the S&P 500 slumped by 19% amid the global headwinds in the challenging year of 2022. Another contributing factor was the Reserve Bank of Australia (RBA), which was not as aggressive in its rate hikes as the Federal Reserve.

While the ASX 200 typically mirrors the movements of the S&P 500, the benchmark has displayed less volatility than its US counterparts in the last decade. This could be attributed to differences in component weights between the two indices. The ASX 200 is heavily weighted towards banking and mining, whereas the S&P 500 is dominated by the seven major US tech companies. Consequently, the tech-driven stock market rally did not propel the ASX 200 in the same manner as the US markets this year. Building upon this context, let's explore both micro and macro factors that may influence the ASX 200’s trends in 2024.

RBA’s Hiking Cycle Nearing an End

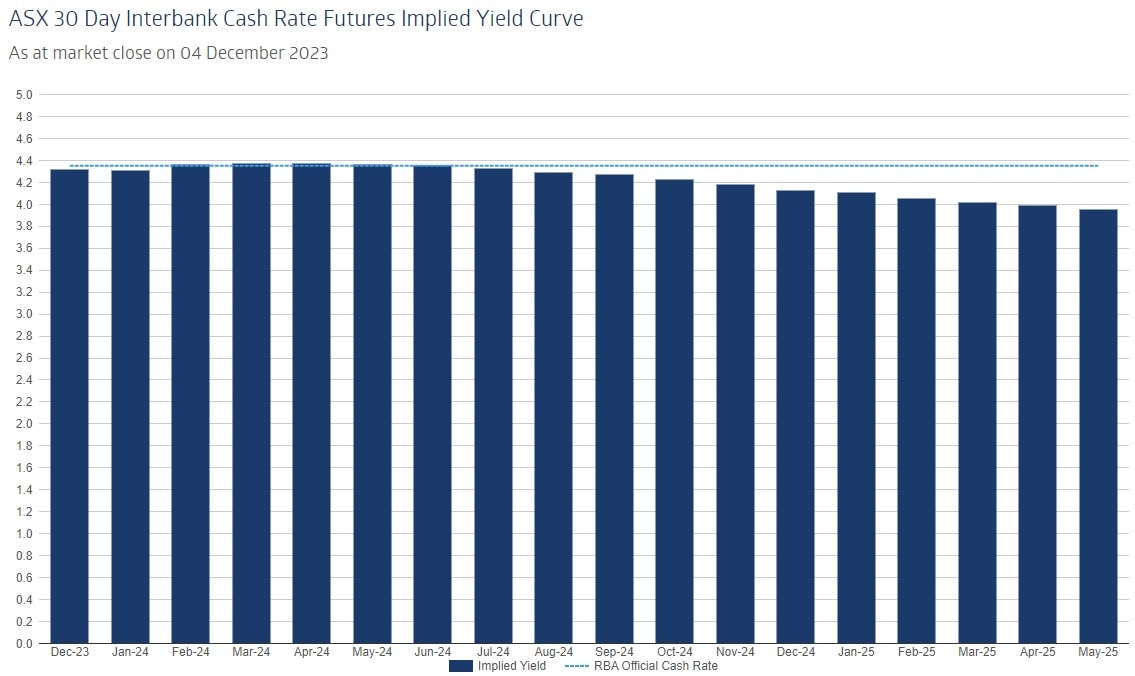

Despite inflation persisting above the target level, the RBA adopted a more cautious stance on rate hikes in the November meeting. Concerns about economic growth arose as third-quarter GDP figures fell below expectations, and China's economic slowdown continued to exert pressure on Australia's major exports. These factors significantly heightened expectations of an earlier rate cut, with the money market indicating a potential cut as early as August 2024.

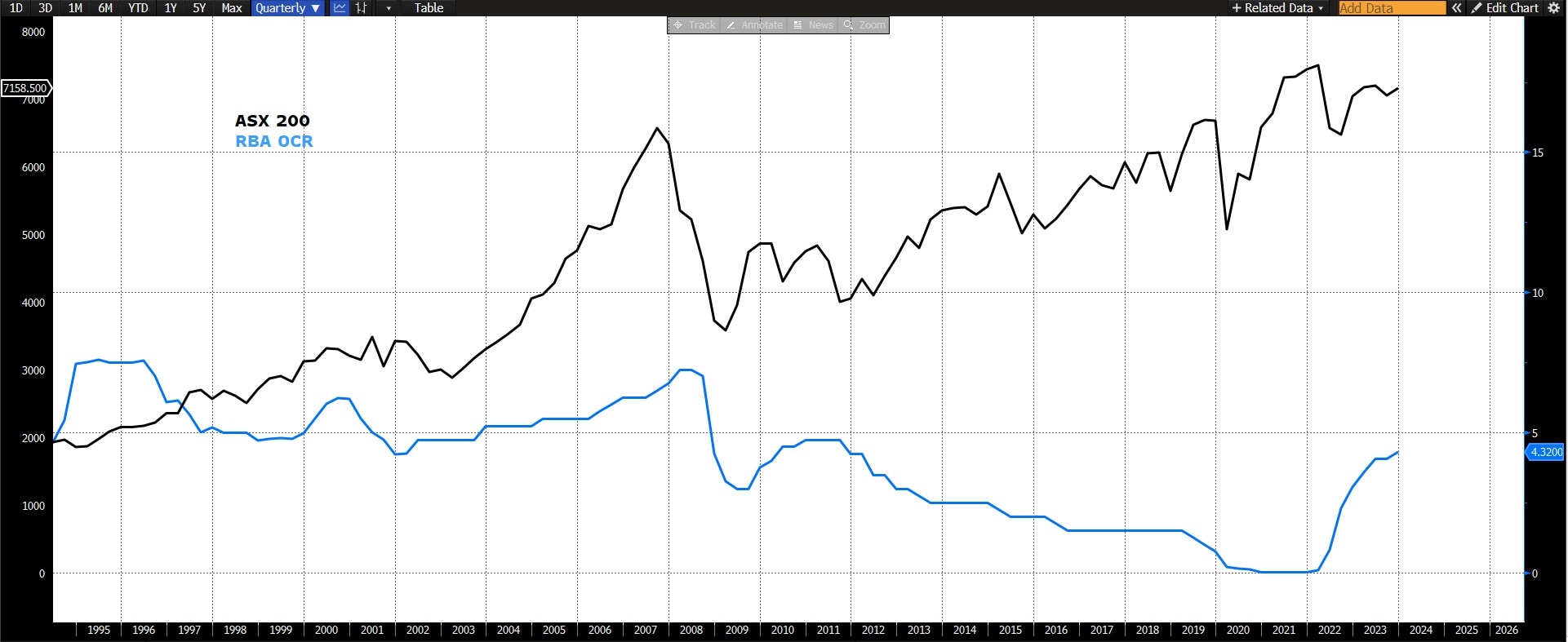

As illustrated in the chart below, the ASX 200 exhibits a negative correlation with the RBA’s Official Cash Rate (OCR). The index may experience further gains if the RBA concludes its rate hiking cycle and begins cutting interest rates in the second half of 2024.

However, there are potential risks of an economic crisis if the ongoing conflicts in the Middle East and Ukraine-Russia escalate. This could lead to a spike in energy prices and trigger a resurgence of inflation. Based on the current geopolitical landscape and economic developments, this scenario appears less concerning. Most major economies are depicting a "soft-landing" scenario, potentially paving the way for a rate-cutting cycle in the second half of 2024. While China's economic challenges may still pose hurdles for Australia, the government's stimulus measures could alleviate some pressure on the economy. Additionally, policy support in China's infrastructure and property sector could positively impact metal prices.

During a rate-cut cycle by the RBA, the ASX 200 has historically recorded an average gain of about 15% in 2019 and 2021. Assuming the bank initiates rate cuts in the second half of the next year, the index could rally by 7-8% in 2024.

Mining Stocks Set to Sustain Australian Markets in 2024

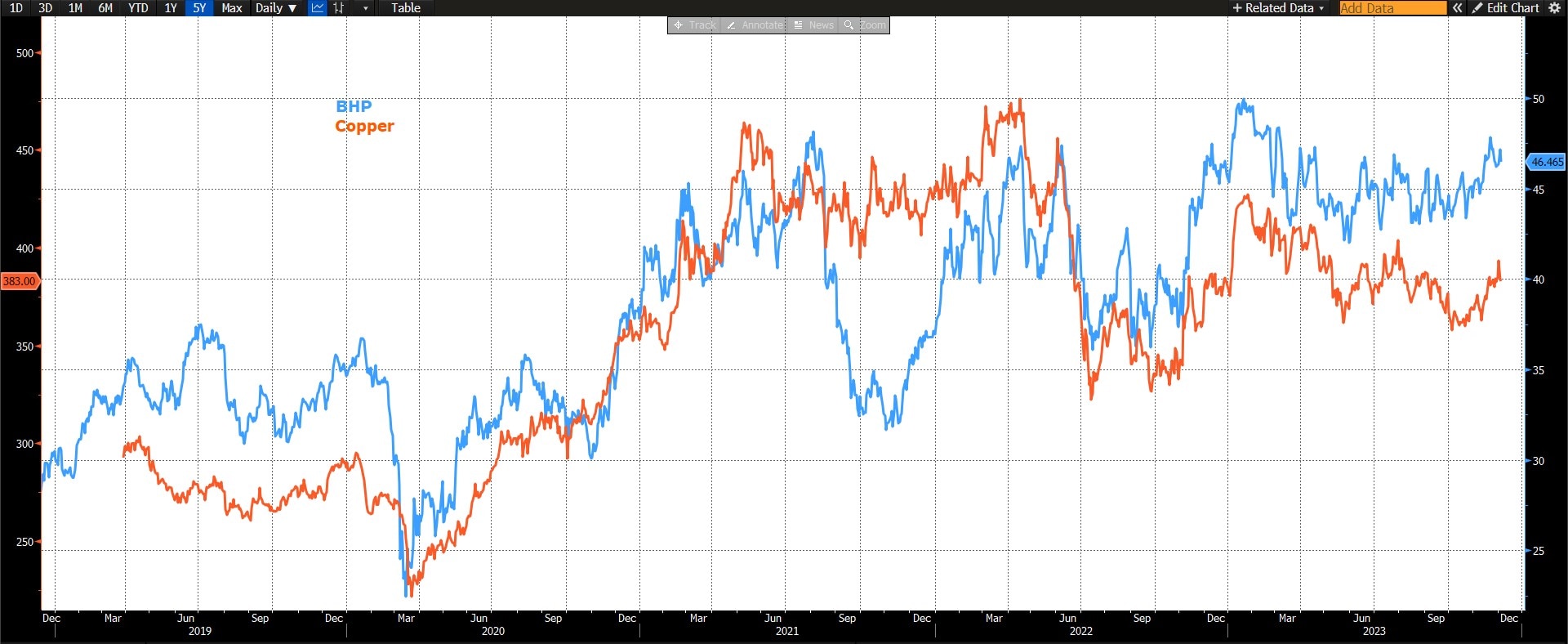

Major miners, including BHP, Rio Tinto, and Fortescue Metals, contribute approximately 14% to the market cap of the ASX 200. BHP alone holds a weight of 10.5% on the index. Historically, BHP tends to move in a positive correlation with the ASX 200, with its stock movements aligned with base metals such as copper and iron ore. These correlations underscore the significant impact of mineral prices on the Australian stock markets.

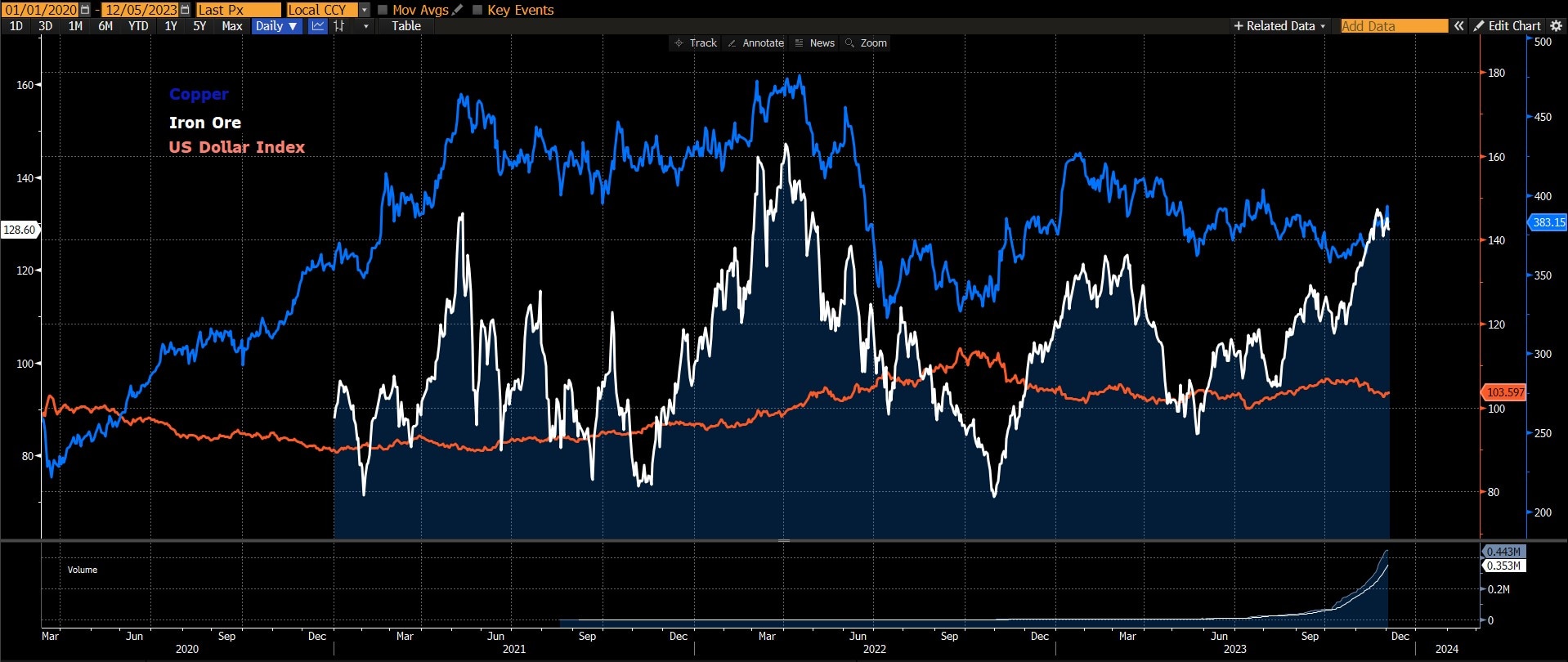

Amid growing expectations of a Fed pivot on interest rates, the US dollar has been in a downtrend since October this year, boosting metal prices in general. Signs of slowing down in the US labor markets and a promising cooling trajectory in inflation have led markets to price in a potential rate-cut cycle starting as early as May 2024 by the Federal Reserve. This is likely to result in further weakness in the USD, subsequently lifting Australia's major metal export prices, such as copper and iron ore. Consequently, the material sector, comprising major miners like BHP, Rio Tinto, and Fortescue Metal, could be the driving force behind the ASX 200's gains in the new year.

Big Four Banks Facing Challenges

The Australian Big Four banks, namely Commonwealth Bank of Australia (CBA), Westpac Banking Corporation (WBC), Australia and New Zealand Banking Group (ANZ), and National Australia Bank (NAB), collectively hold a significant weight of about 20% on the ASX 200. Consequently, the performance and trends of these banking stocks wield considerable influence as another major driving force in the Australian stock market.

The Australian Big Four banks enjoyed a record-profitable year in 2023, thanks to high-interest rates and robust loan growth. However, signs of earnings growth may moderate in 2024 as RBA rate hikes potentially impact household borrowing abilities and spending, thereby affecting bank profits. This moderation may be reflected in slowing mortgage and business credit growth, declining deposits, and peaking Net Interest Income. Nevertheless, the Big Four may seek to appease investors by increasing dividend payouts and share buybacks.

Additionally, during an RBA rate-cutting cycle, banking stocks tend to rally alongside broader markets.