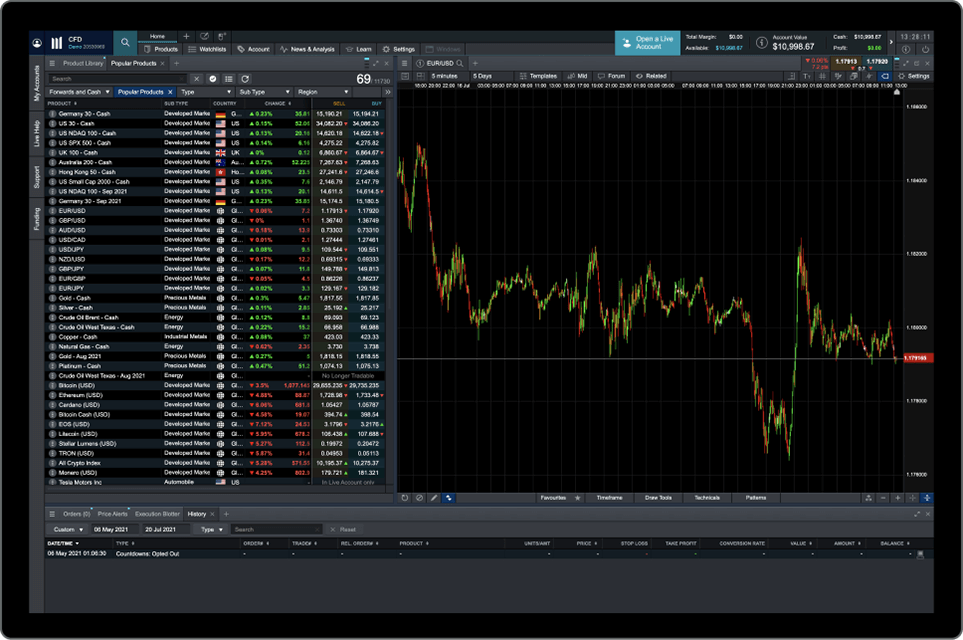

10,003 seconds CFD median trade execution time, 2022 CMC Markets financial year.

2Awarded No.1 Platform Technology, ForexBrokers.com Awards 2022; No.1 Web-Based Platform, ForexBrokers.com Awards 2021; Best Spread Betting Provider, The City of London Wealth

Management Awards 2021; Best Phone Customer Service & Best Email Customer Service, based on highest user satisfaction among spread betters, CFD and FX traders, Investment Trends 2020 UK

Leverage Trading Report.

3FSCS is an independent body that offers protection to customers of financial services firms that have failed. The compensation amount may be up to

£85,000 per eligible person, per firm.

Eligibility conditions apply. Please contact the FSCS for more information.

4Fill rate based on all FX trades placed in February 2020.

5Max discount in tier. Discounts are based on our tiered-volume discount scheme and are variable per product. Please check our tiers table on the

CMC Price+ T&Cs.

6T&Cs apply. 'FT' and 'Financial Times' are trademarks of The Financial Times Limited.

7308,644 active spread betting, CFD and stockbroking clients, CMC Markets plc annual report 2021. Active clients represent those individual clients who have traded with or held

CFD or spread bet positions or who traded on the stockbroking platform on at least one occasion during the financial year.