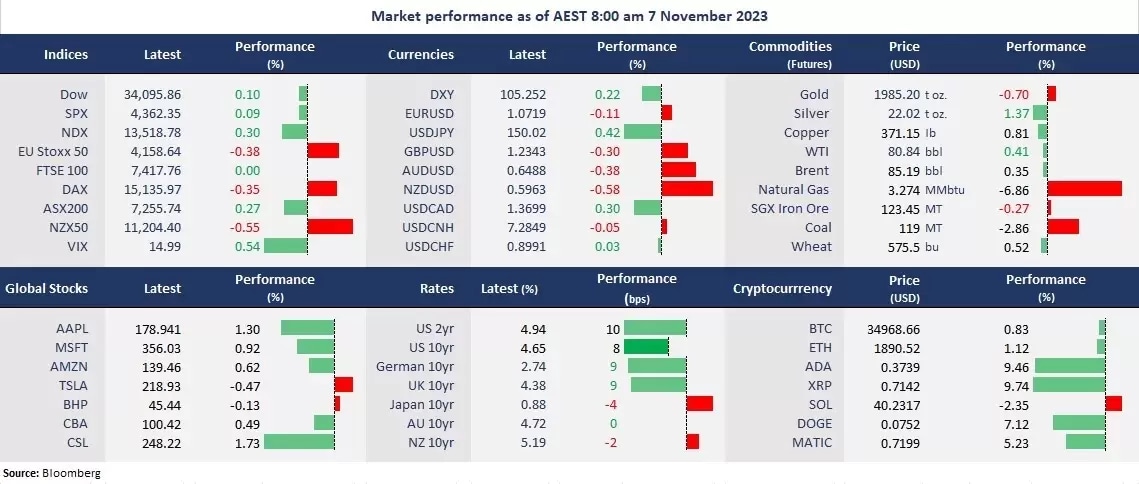

The US stock markets were marginally higher to kick off the week as investors reassessed the Fed policy path and the economic outlook. The US bond yields climbed, sending the US dollar higher and pressing commodity prices, including gold and oil. While technology stocks remained the upside momentum, the energy sector continued to slide. The sector rotation suggests that markets may still be positioning for peak rates. Notably, Apple and Nvidia outperformed other mega-cap tech stocks, leading to gains on Wall Street.

The RBA’s rate decision will be in the spotlight in today’s Asian session. The bank has paused rate hikes for the last four times in a row on economic concerns. However, the ASX 30-Day Interbank Cash Rate Futures priced a 50% chance for the bank to raise the OCR by 25 basis points to 4.35%. Elsewhere, China is due to release the trade balance data for October. Consensus calls for an improvement in both exports and imports of the country, which could further fuel the rebounding momentum in the regional stock markets.

Asian markets are set to open lower. ASX 200 futures were down 0.16%, Hang Seng Index futures fell 0.68%, and Nikkei 225 futures slid 0.33%.

Price Movers:

- 5 out of 11 sectors in the S&P 500 finished higher, with Technology leading gains, up 0.78%. Energy and Real Estate were the laggards, down 1.19% and 1.41%, respectively.

- OpenAI announced GPT-4 Turbo and cut prices for developers to use its software. The generative AI pioneer grew at an unprecedented pace, with about 100 million weekly active users. Despite rumours, CEO Sam Altman said the company would not go public anytime soon.

- USD/JPY rebounded, snapping a three-day losing streak after the BOJ governor, Kazuo Ueda, singnalled that the bank will unlikely end its negative rates by the year-end. The pair faced resistance of 150 and may continue its retreat as bearish divergence has been potentially formed. Potential near-term support can be found at the 50-day moving average of about 148.70.

- Brookfield’s shares slid 2.7% on the US markets amid its third-quarter earnings report. The Canadian multinational alternative investment management company raided US$26 billion and was on track for $150 billion in fresh capital this year.

- The New Zealand media corporation, NZME (ASX/NZX: NZM), amended its guidance for EBITDA to be between NZ$57 million and NZ$59 million for 2023. The company indicated that advertising revenue growth saw a slowdown amid economic headwinds.

Today’s agenda:

- RBA’s Cash Rate Decision

- China’s Trade Balance for October