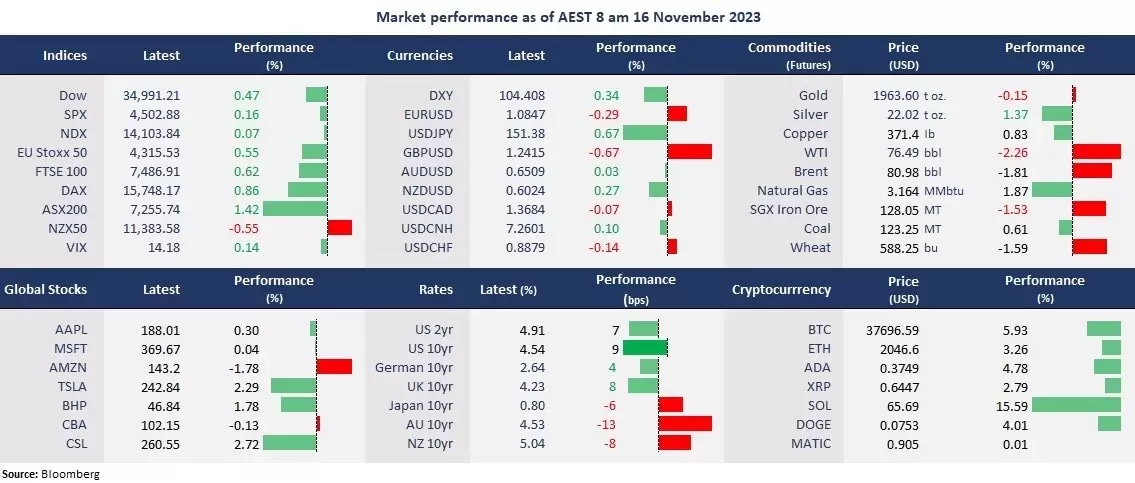

Macro Scenes:

- The US stock markets extended gains amid further encouraging inflation data. The US October Producer Price Index (PPI) declined 0.5% month on month, the deepest drop since April 2020. However, the retail sales data came to be slightly stronger than expected. The diverging indicator may point to the “soft-landing” scenario for the US economy.

- The US government shutdown risk receded as the House of Representatives passed a bill to fund the government until 18 January. The bill is sent to the Senate, which is expected to pass.

- The US Treasury yields moved higher after a sharp decline on Wednesday as positive retail data took “higher for longer rates” fears back on the table.

- The US dollar rebounded after Wednesday’s biggest one-day slump in more than one year. This pressed on the Eurodollar and the British Pound as the UK October CPI fell more than expected, down 4.6% year on year, the lowest in two years.

- Gold extended the second-straight day gains due to slumped bond yields and weakened USD. Spot gold rose above the key resistance of 1,945 again.

- Crude oil prices accelerated decline after the US reported higher-than-expected inventory data. The US crude production ramped up to a record of 13.2 million barrels per day.

- Chinese stock markets are set to open higher, buoyed by better-than-expected Chinese economic data and major Chinese tech companies’ positive earnings reports. The Hang Seng Index futures rose 1%. The ASX 200 futures were up 0.05%, pointing to a higher open following Wall Street’s rally.

Chart of the Day:

JD.com (NDX: JD ADR), daily

Company News:

- Microsoft (NDX: MSFT) was flat after it introduced an in-house AI chip, Maia 100, which could compete with Nvidia’s AI GPUs. It also unveiled a Cobalt 100 Arm chip for general computing tasks, which may compete with Intel processors. Nvidia’s shares fell 1.8% on the news.

- Tencent Holdings (HKG: 0700) rose 4.5% after the Chinese social media giant reported a profit that topped expectations. The biggest contributor to Tencent’s growth is gaming and advertising, lifting the overall revenue by 10% to 154.6 billion yuan in the third quarter.

- JD.com (HKG:9618, NDX: JD) jumped 6% on the Hong Kong Stock Exchange and 7.8% on the US stock markets amid better-than-expected third-quarter revenue. The Chinese e-commerce firm posted earnings per share of 3.7 Yuan on revenue of 247.7 billion Yuan, up 1.7% from a year ago. Both beat estimates.

Today’s Agenda:

- Australia’s October employment data

- US Unemployment Claims